Bitcoin started the new week with a decline, while investors focused on Fed Chair Powell’s speech today and the employment data to be released on Friday.

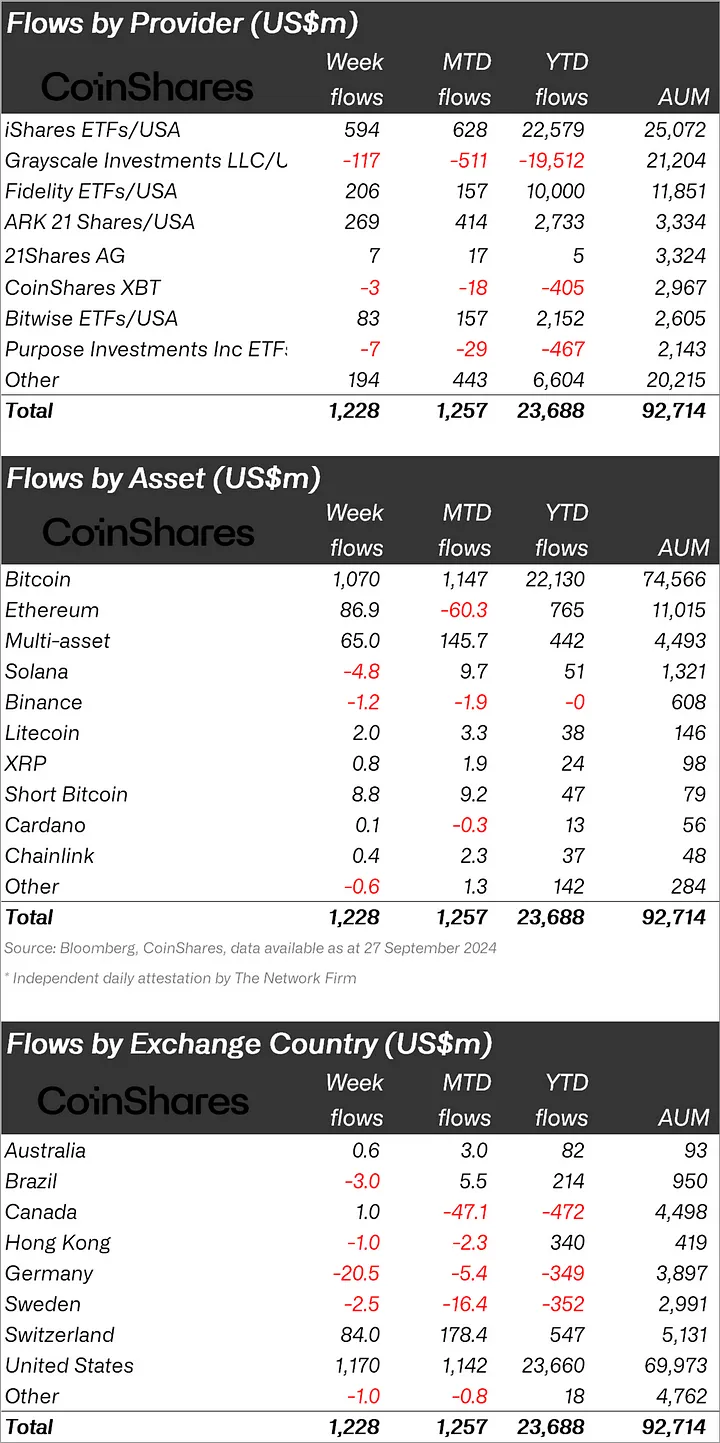

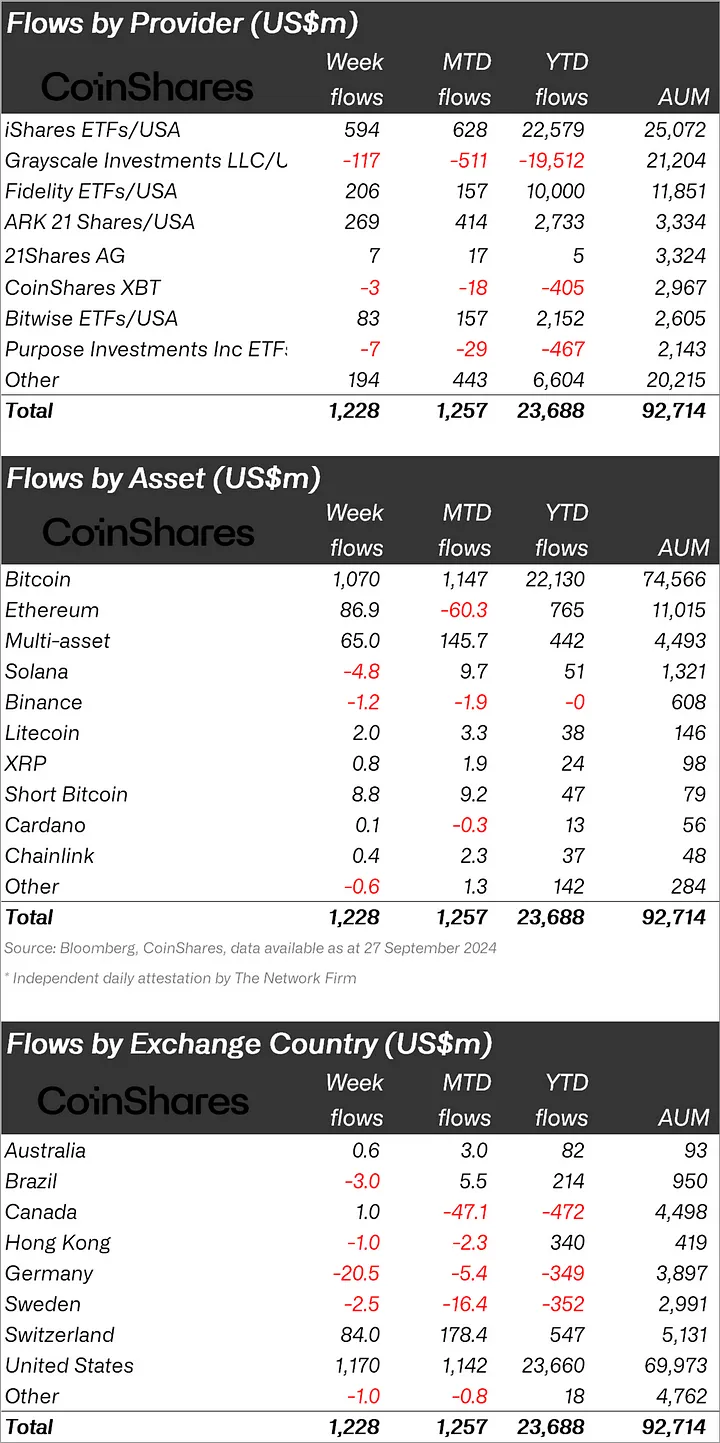

While Powell’s speech is expected in BTC today, CoinShares published its weekly cryptocurrency report and said that there was an inflow of $ 1.2 billion last week.

“There were $1.2 billion inflows into cryptocurrency investment products for the third week in a row. We believe this is a response to expectations of continued moderate monetary policy in the US.

“The approval of options on some US-based investment products may have boosted market sentiment, but there was no corresponding increase in trading volumes.”

Great Return from Ethereum!

When looking at crypto funds individually, it was seen that the fund inflows were in Bitcoin.

While BTC saw an inflow of $1 billion, Ethereum (ETH) saw an inflow of $86.9 million.

There was also an inflow of $8.8 million in the Bitcoin Short fund, which was indexed to the fall of BTC.

When we look at other altcoins, Litecoin (LTC) experienced an inflow of $2 million and XRP $0.8 million, while Solana (SOL) experienced an outflow of $4.8 million.

“There was a $1 billion inflow into Bitcoin, but that also led to another $8.8 million inflow into the short Bitcoin fund.

Ethereum broke its 5-week negative streak with $87 million in inflows, the first measurable inflows since early August.

Conversely, Solana saw $4.8 million in takeoffs.

Sentiment was mixed on altcoins, with Litecoin and XRP seeing inflows of $2 million and $0.8 million respectively.

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an inflow of 1.17 billion dollars.

Switzerland came in second after the United States with $84 million.

In the face of these inflows, Germany experienced an outflow of $20.5 million.

*This is not investment advice.