EigenLayer, the innovative restaking protocol, is set to make a significant impact on the crypto market as it gets listed on major exchanges, including Binance, Bybit, and OKX.

Starting from October 1, 2024, Binance will open spot trading for EigenLayer (EIGEN) with trading pairs becoming available at 05:00 UTC. OKX has also announced plans to list EIGEN for spot trading, alongside pre-market futures, further enhancing its accessibility for traders.

The Role of EigenLayer in Ethereum’s Ecosystem

EigenLayer is a protocol designed to improve the security and utility of Ethereum by allowing users to “restake” their staked Ethereum (ETH). Through restaking, users can utilize their already staked ETH to secure additional applications and services built on top of Ethereum, expanding the reach and utility of their assets.

Key Features and Benefits of EigenLayer:

- Restaking: Users delegate their staked ETH to secure other protocols or applications, providing additional security beyond Ethereum’s base layer.

- Enhanced Security: EigenLayer uses the security of Ethereum’s proof-of-stake (PoS) mechanism to provide added protection for various decentralized applications.

- Increased Efficiency: By restaking ETH, users optimize the use of their staked assets, promoting a more efficient Ethereum ecosystem.

- New Opportunities: The protocol opens up possibilities for new applications and services that previously couldn’t leverage staked ETH.

How EigenLayer Works:

- Staking: As with traditional Ethereum staking, users stake their ETH on the Ethereum network.

- Restaking: This staked ETH can then be redeployed via EigenLayer to secure other decentralized applications or protocols.

- Security: EigenLayer’s system leverages the staked ETH to ensure the safety and reliability of these other applications, contributing an extra layer of defense.

- Rewards: Restakers earn rewards in addition to the standard staking rewards from the Ethereum network, incentivizing broader participation.

The Rise of Restaking: EigenLayer’s Dominance

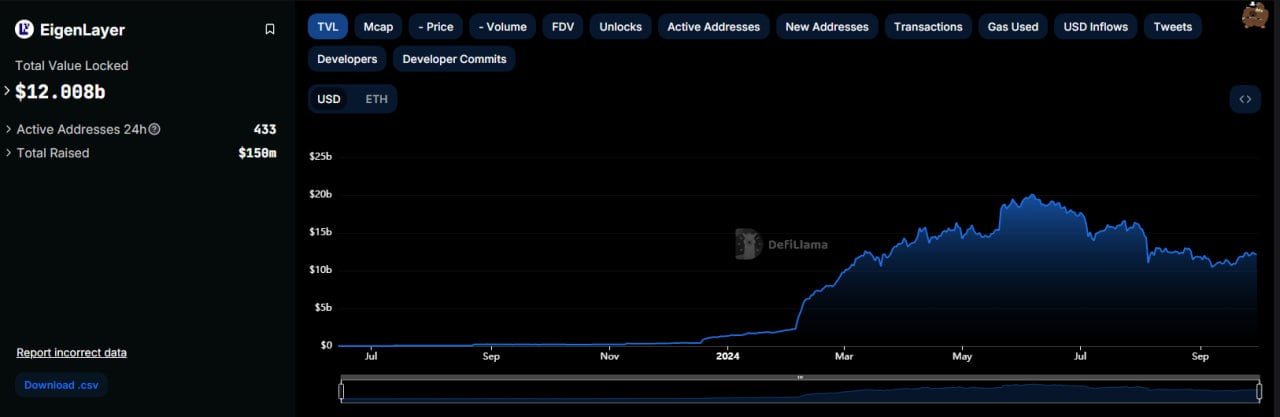

EigenLayer has quickly grown to become the largest restaking protocol in the space, with a total value locked (TVL) of $12 billion, which once peaked at $20 billion.

Restaking, as a concept, has surged in popularity with EigenLayer leading the way, holding $15 billion of the $16.6 billion TVL currently observed in the restaking sector. This dominance highlights the protocol’s significance in extending the utility of Ethereum’s PoS mechanism.

Potential Use Cases:

- Decentralized Finance (DeFi): EigenLayer could secure lending platforms, derivatives exchanges, and other DeFi services, enhancing their security and reliability.

- Gaming: It may play a role in securing in-game economies, reducing risks such as cheating and fraud.

- Supply Chain Management: By providing additional security layers, EigenLayer could protect supply chain data, ensuring authenticity and preventing tampering.