- ETH could reach the $2,900 level if it closes a daily candle above the $2,700 level.

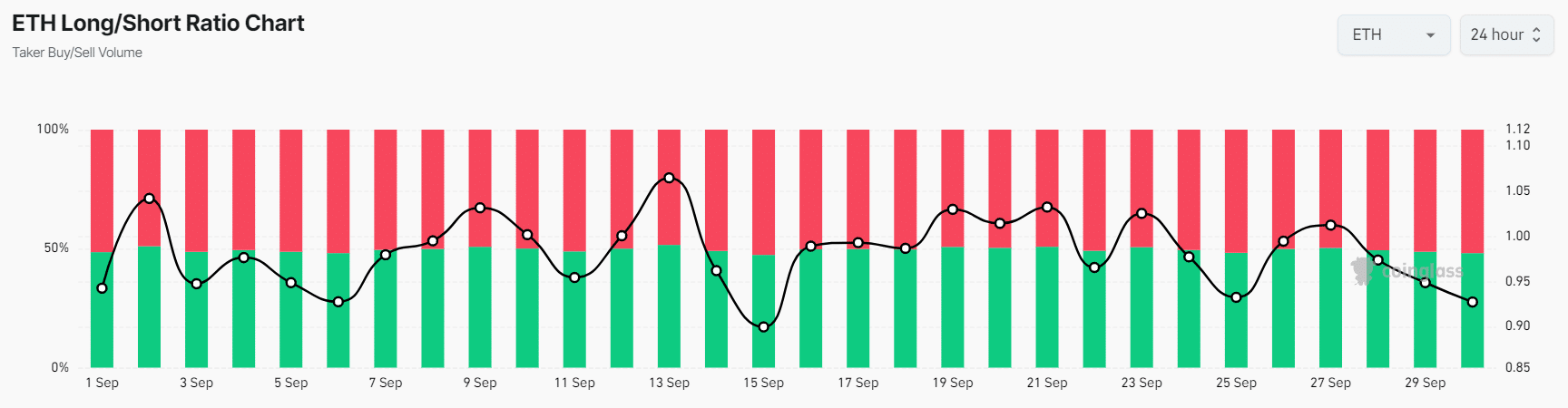

- ETH’s Long/Short Ratio stood at 0.927, indicating bearish sentiment among traders.

In the ongoing struggling cryptocurrency market, a wallet linked to Vitalik Buterin, the co-founder of Ethereum [ETH] dumped a significant amount of ETH.

According to the on-chain analytic firm Spotonchain, on the 29th of September, wallet address “0x556” linked to Buterin deposited 649 ETH worth $1.72 million to Paxos.

Wallet-linked to Buterin dump $1.72M of ETH

The firm also noted that, over the past 11 days, the wallet had deposited a substantial 1,300 ETH worth $3.35 million at an average price of $2,581.

Additionally, the firm added that this wallet received 1,300 ETH on the 19th of September, from another wallet that was funded by Vitalik Buterin in 2022.

This massive deposit of ETH has the potential to shift the market sentiment to a bearish side.

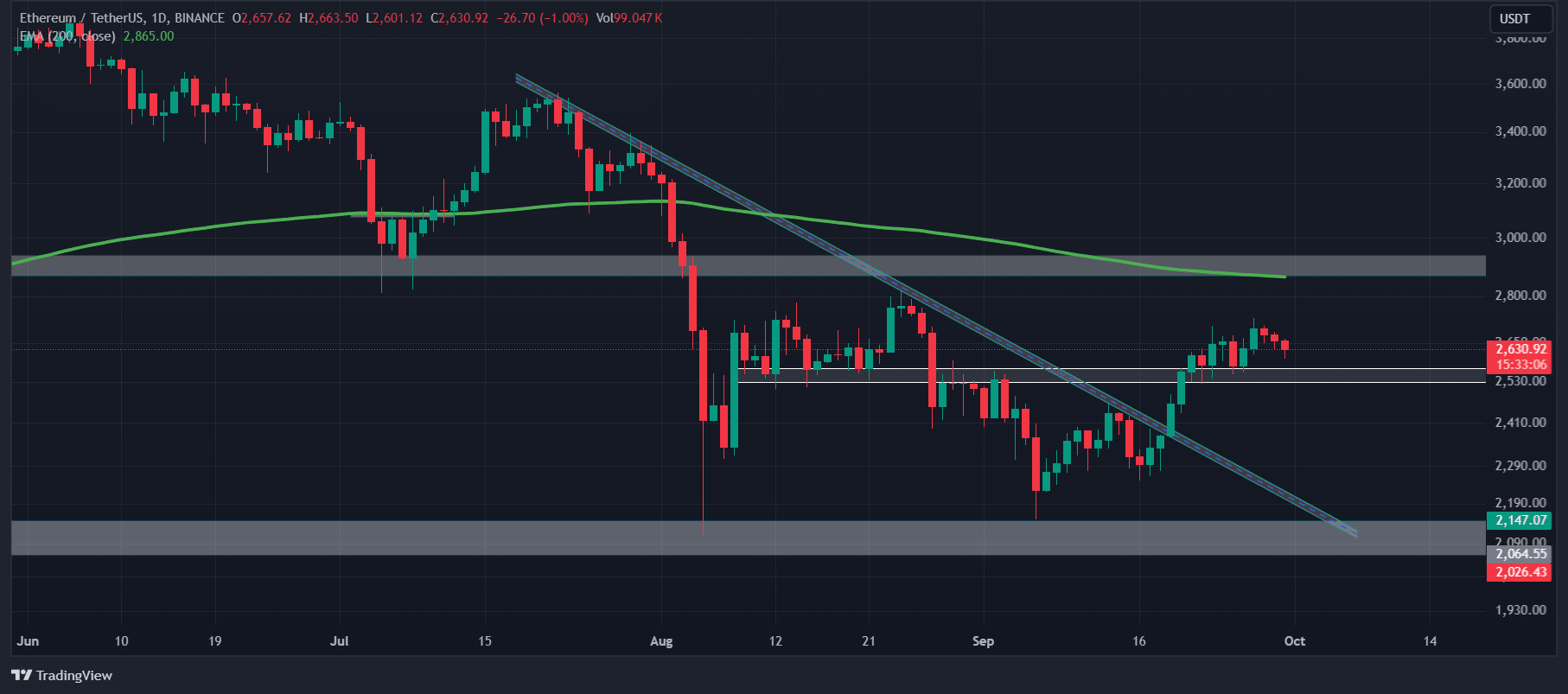

Ethereum technical analysis and key levels

According to AMBCrypto’s technical analysis, ETH is consolidating in a tight range following the breakout of a crucial resistance level of $2,590 level.

If the asset’s price soars and closes its daily candle above the $2,700 level, there is a strong possibility that ETH could reach the $2,900 level in the coming days.

As of now, ETH is trading below the 200 Exponential Moving Average (EMA) on a daily time frame, indicating a downtrend.

The 200 EMA is a technical indicator that traders and investors use to determine whether an asset is in an uptrend or downtrend.

Mixed-sentiment by on-chain metrics

In addition to the technical analysis, on-chain metrics signal mixed sentiment.

According to the on-chain analytics firm Coinglass, ETH’s Long/Short Ratio was at 0.927, indicating bearish sentiment among traders.

Additionally, its Futures Open Interest has remained unchanged in the past 24 hours, indicating traders are still holding their positions, while new traders are hesitating in building new ones.

Read Ethereum’s [ETH] Price Prediction 2024-25

51.89% of top traders hold short positions, while 48.11% hold long positions. At press time, ETH was trading near $2,635 and has remained unchanged over the past 24 hours.

During the same period, its trading volume jumped by 22%, indicating higher participation from traders and investors amid ongoing consolidation, which is potentially a positive signal for ETH.