- Bitcoin dominance continues to struggle at key resistance.

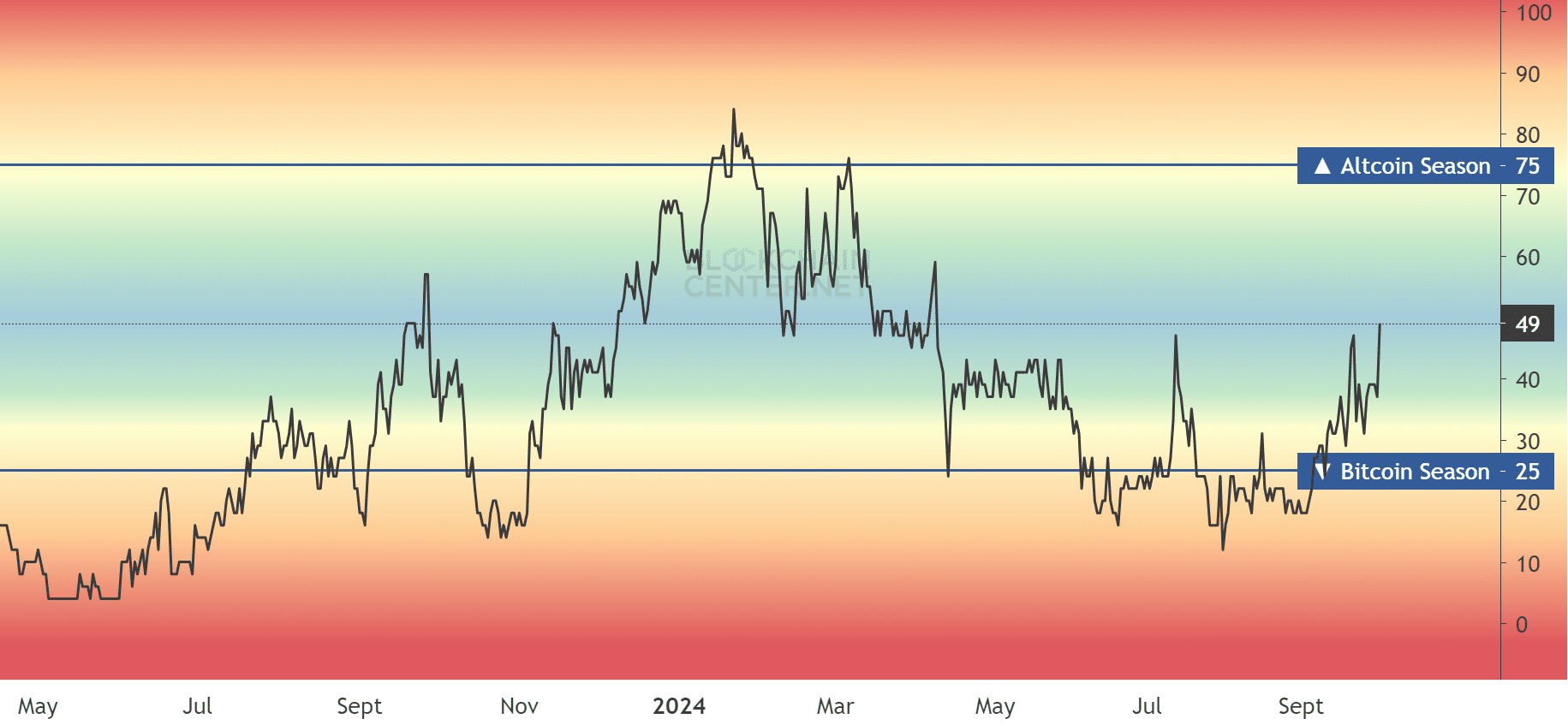

- The altcoin season index reached its highest level in six months.

Bitcoin [BTC] dominance has struggled at a key resistance level of 58%, raising market optimism of a stronger altcoin season if its market share decline compounded.

Historically, altcoins exploded when BTC dominance declined.

Since 2023, BTC dominance (BTC.D) has increased from 40% to a recent high of 58%.

However, the 58% level doubles as a resistance level, which, if not breached, would drag BTC dominance lower. Most market observers believe such a drop could accelerate the altcoin rally.

Altcoin season hits 6-month high

One of the metrics used to gauge the health of altcoin sectors is the ETH/BTC ratio. It gauges ETH’s value relative to BTC.

Additionally, since ETH is the largest altcoin, the ETH/BTC ratio also evaluates the overall altcoin sector performance.

Since the Fed pivot on the 18th of September, ETH has outperformed BTC. This suggested improved altcoin performance over the same period, which saw BTC dominance drop by 2.5%.

Last week, memecoins showed a massive bounce and led the market recovery, with Shiba Inu [SHIB] taking the lead.

On the monthly charts, Sui network [SUI], Bittensor [TAO], and Popcat [POPCAT] dominated the top September best performers with double and triple-digit gains.

At press time, the Altcoin Season Index reading was 49, near neutral, the highest level since March. This underscored last month’s remarkable altcoin performance.

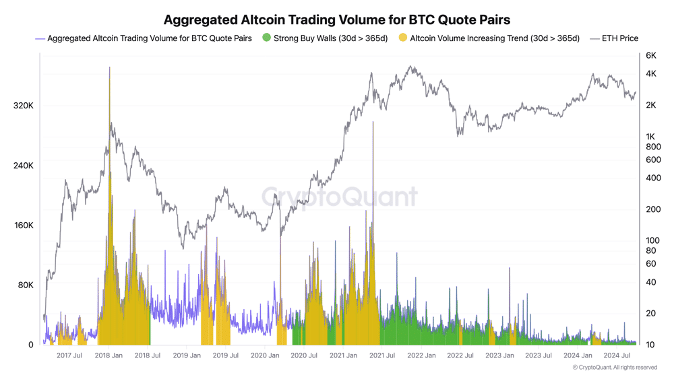

Despite the strong investor interest in altcoins, CryptoQuant’s founder noted that massive capital rotation from BTC to altcoins was yet to begin.

“Asset rotation from #Bitcoin to altcoins hasn’t started, but buy walls are getting stronger overall. I like the calm before the storm.”

Put differently, altcoin season was gaining momentum and presented upside potential for those who had exposure. Ergo, BTC dips could be great opportunities to grab more ‘cheap’ altcoins with massive potential.