- The Dencun upgrade allowed multiple L2s to grow substantially.

- ETH’s price action turned bullish in the last 24 hours.

After the Decun upgrade, Ethereum [ETH] witnessed major changes in the ecosystem. As a result, ETH’s fees hit an all-time low. This also had a major impact on the token’s deflationary characteristic.

But will ETH’s price see any impact?

Is Ethereum changing?

IntoTheBlock recently posted a tweet that revealed quite a few important updates. Post Dencun, Ethereum Mainnet fees hit an all-time low as L2 transactions surged. EIP-4844 slashed L2 costs by 10x, driving record activity.

This heavily helped L2s as their number of transactions and usage surged in the recent past. However, there was more to the story. With fewer fees burned, ETH has turned inflationary, reversing its recent deflationary trend.

Generally, deflationary characteristics are considered to be optimistic. This is the case, as whenever supply drops, it increases the chances of the asset’s price rising.

Since the opposite was true for ETH on this occasion, AMBCrypto planned to dig deeper into its current state.

What to expect from Ethereum?

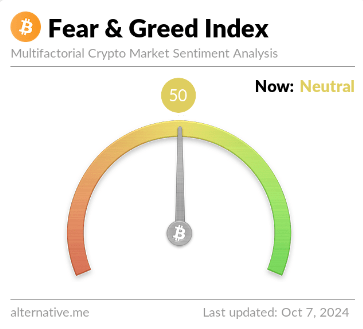

According to CoinMarketCap, after a week of price drops, ETH bulls gained control of the market as its value increased by over 2% in the past 24 hours.

At the time of writing, ETH was trading at $2,476.41, with a market capitalization of over $298 billion.

After the price uptick, more than 9 million Ethereum addresses were in profit, which accounted for over 50% of the total number of ETH addresses.

We then checked the token’s on-chain data to better understand whether the change in characteristic would affect the king of altcoin’s price in the coming days.

As per our analysis of CryptoQuant’s data, ETH’s exchange reserve was dropping. This meant that buying pressure on the token was rising, which can be inferred as a bullish signal.

Apart from that, our look revealed a few more bullish metrics. For instance, ETH’s total number of coins transferred has increased by 158.76% in the last 24 hours.

The total number of active wallets used to send and receive coins has also increased by 19.01% compared to yesterday.

Since most metrics looked optimistic, AMBCrypto checked Ethereum’s daily chart to find out more about what market indicators hunted at.

Read Ethereum’s [ETH] Price Prediction 2024–2025

As per our analysis, Ethereum was testing its 20-day simple moving average (SMA) resistance.

A successful breakout could result in ETH touching $3.5k in the coming days. However, the MACD displayed a bearish advantage in the market, which hinted at a plummet to $2.2k.