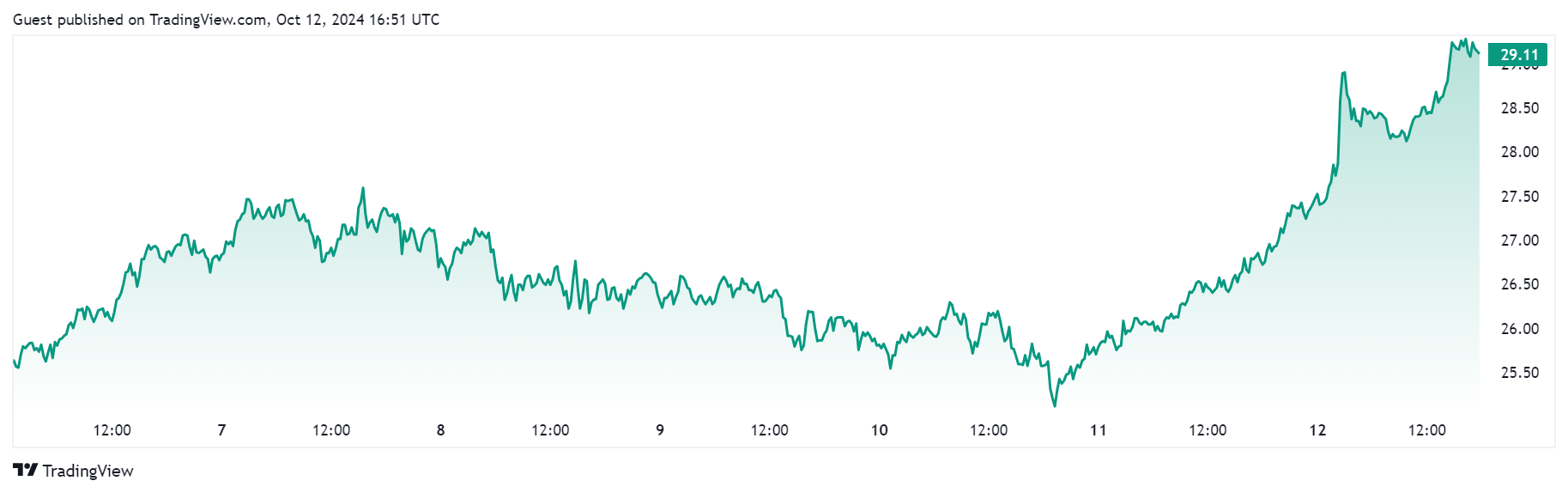

Since entering the 2024 halving year, Bitcoin has not managed to set a new record high yet, thereby spending more than 30 weeks in a lateral trend. This stagnation causes concerns among investors and analysts about the possibility of an upcoming bull market.

Ki Young Ju, the CEO of CryptoQuant, has also cautioned that if a bull market does not start within the next 14 days, it will be the longest period of sideways trading in a halving year.

Extended Stagnation in Bitcoin’s Market

Consequently, it has been longer than usual compared to the previous cycles for the stock prices to stay in the lateral zone. Historically, Bitcoin has formed a very strong upward momentum at this point of the halving cycle. It is usually followed by a very large price increase.

– Advertisement –

However, the current cycle looks significantly different; the cryptocurrency is unable to stoke similar growth. Such divergence creates doubts as to whether Bitcoin has the ability to start a strong bull run like it has in the previous instances.

Furthermore, Ki Young Ju notes that the price action of Bitcoin is still dormant below the 1.5x aggregated figure. That is quite far off from the nearly 4x by this time in the 2020 halving cycle.

Lack of range movement up during a bullish phase presents a signal of either changes in the market situation. Moreover, continuing in creating the speculation among traders and investors, Peter Brandt, the veteran trader, stated that the ongoing pattern could be the sign of coming market correction.

According to Brandt, based on historical data, it means a sharp decline. There has not been a new high in over 30 weeks. He warns that Bitcoin may experience a market decline of up to 75%. Moreover, he mentions that several following weeks will be incredibly decisive for the Bitcoin market.

Surge in Long Liquidations

Adding to the market woes, long liquidations hit a 28-month high in Bitcoin. The recent decline has witnessed massive selling, with $290 million in long liquidations between October 9th and 10th.

It is clear that this liquidation indicates bearish pressure which precipitates the downward movement and enhanced market fluctuation.

Evidently, much of the digital currency was sold at a loss; this is the strategy that most whale accounts embraced. This sell-off adds to the existing volatility within the market disrupting the slight recovery that some analysts had expected in October.

However, as the current negative signals suggest, the history offers some consolation because Bitcoin seldom holds red at the end of October. Most notably, marked increases are observed after the halving events of 2016 and 2020, indicating potential for recovery.

However, due to the particularities of the 2024 cycle, it is unknown whether Bitcoin will maintain this tradition. At the time of writing, Bitcoin (BTC) price had gone up significantly to $62,754, up by 4.72% in 24 hours.

This is coupled with a 13% increase in trading volumes to $32.60 billion as more players participate in the market. Market capitalizations have reached a total of about $1.24 trillion. Notably, there is more confidence in the market as BTC rises further in its range for the day.