Ethereum layer-2 network Base recorded 6 million daily transactions on October 12, shattering its record for most transactions in a single day set only a few weeks ago.

The network’s creator, Jesse Pollack shared the milestone on X, showing that the network recorded 6.1 million daily transactions, with an average of 5.42 million for the whole week.

The milestone continues the trend of impressive performances for the Base network as it improves scalability and adoption. With its continuous increase in activity on the network, its growth trajectory puts it above every other layer-2 network in almost every metric, even though it has been around for a shorter period.

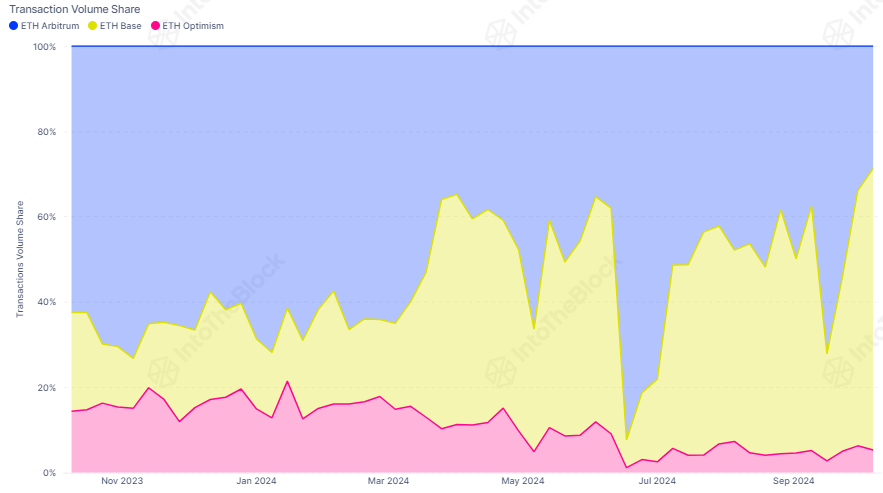

Meanwhile, Base transactions now account for 40 – 60% of transactions among the top three L2 networks, including Arbitrum and Optimism.

According to data from IntoTheBlock, Optimism appears to be the most affected by Base’s dominance, as it lost market share significantly between November 2023 and now. Ironically, Base was built using the OP stack.

Base flips Arbitrum in TVL on Defillama

Meanwhile, Base’s growth has seen the network overtake Arbitrum in total value locked on Defilllama. According to the platform’s data, it now has $2.367 billion in TVL, while Arbitrum has $2.363 billion.

However, the data on another aggregator, L2Beats, says something different. L2Beats reports $13.32 billion as TVL for Arbitrum, while Base has $7.50 billion. The disparity has raised several questions among observers, but Pollack recently clarified it.

According to him, Defillama TVL is the value of all assets locked in protocols on the network. At the same time, L2Beat TVL is actually the AOP, which is the value of all assets on each network, including native and bridged assets. This means that it already has more value locked in its protocol than Arbitrum.

Pollak described both metrics as important for determining the growth of the network.

He said:

“we think about AOP as a measure of latent capital and TVL as a measure of productive capital. both useful for measuring different things!”

Meanwhile, many expect Base to become one of the largest single chains by the end of its second year. One X user, Alexander, noted that the network’s success is remarkable given that the network never had an airdrop and has even ruled out the possibility of one, showing that its growth is purely organic.

Ethereum L2s hit 32 million active addresses in September

While Base might be taking most of the accolades regarding L2 performance, the general trend among L2 networks has been positive in the past few months. Data from Growthepie shows that L2s saw 32 million active addresses in September, an all-time high in activity.

Unsurprisingly, Base alone accounts for almost 70% of all the addresses, as the network recorded 22.3 million active addresses in the month. The closest network to it was Arbitrum, with 3.09 million, while Mantle and OP Mainnet had 1.22 million and 1.97 million, respectively.

Experts believe the impressive numbers of active addresses, along with other metrics on Ethereum, is proof that the network is scaling, and L2s are responsible for this. Not only is the DeFi activity booming, but the stablecoin market on L2s is gradually rising and is set to pass $10 billion soon, according to a MilkRoadDaily report.

Despite all the positive performance for L2s, most networks have seen their tokens struggle recently, likely because Base is taking market share.

Arbitrum’s ARB is down almost 3% in the past week, while Optimism’s OP fell 2.78% today. However, Ethereum has seen minor gains over the past few days, even though it has been down 26% in the past three months.