- BONK has secured key support in October.

- Can bulls use it to enter the market with a 25% gain at stake?

Bonk [BONK] has been defending crucial support in October, raising prospects of a likely upside for the memecoin.

After an aggressive recovery in September, netting nearly 65% gains, BONK cooled off in the first half of October.

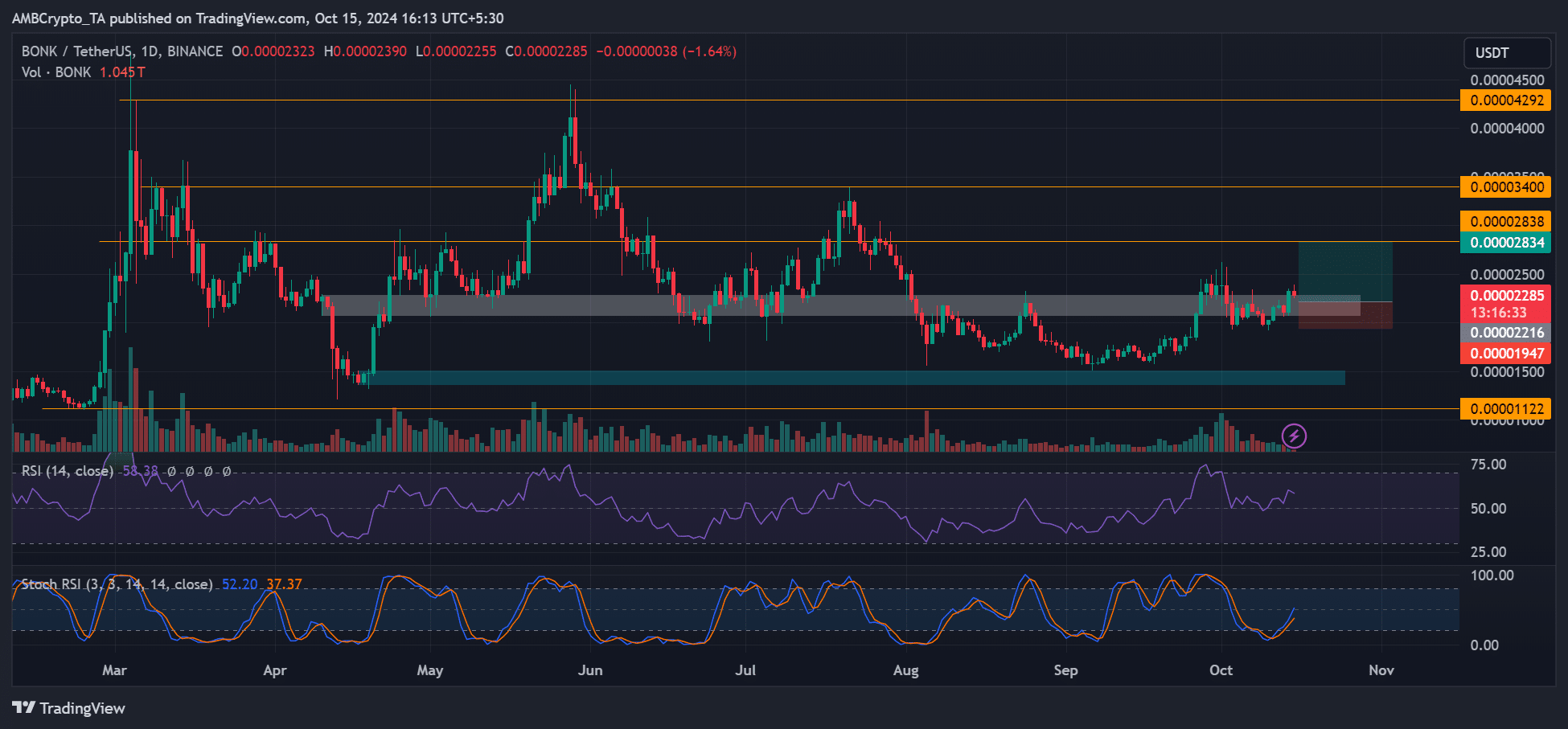

But the pullback stayed above $0.000022, a key support in Q2/Q3 (marked white). Could bulls tap extra profit from the memecoin in the short-term?

BONK’s 25% potential gains at stake

On the daily charts, the immediate bullish target was at $0.000028. With the religious defense of the previous $0.000022 support, BONK could aim at the immediate target.

If so, a 25% gain could be netted, offering a great risk-reward of 2.4.

Should the recovery extend to the next target at $0.0000034, 54% gains could be feasible. The chart indicators supported the bullish thesis.

Notably, the stochastic RSI fronted a reversal from the oversold zone while the RSI stayed above the neutral level. It suggested that a bullish reversal was underway, and above-average demand could support the upside move.

But a decline below $0.000022 support would invalidate the bullish thesis. Such a drop could drag BONK to $0.000015.

Smart traders long BONK

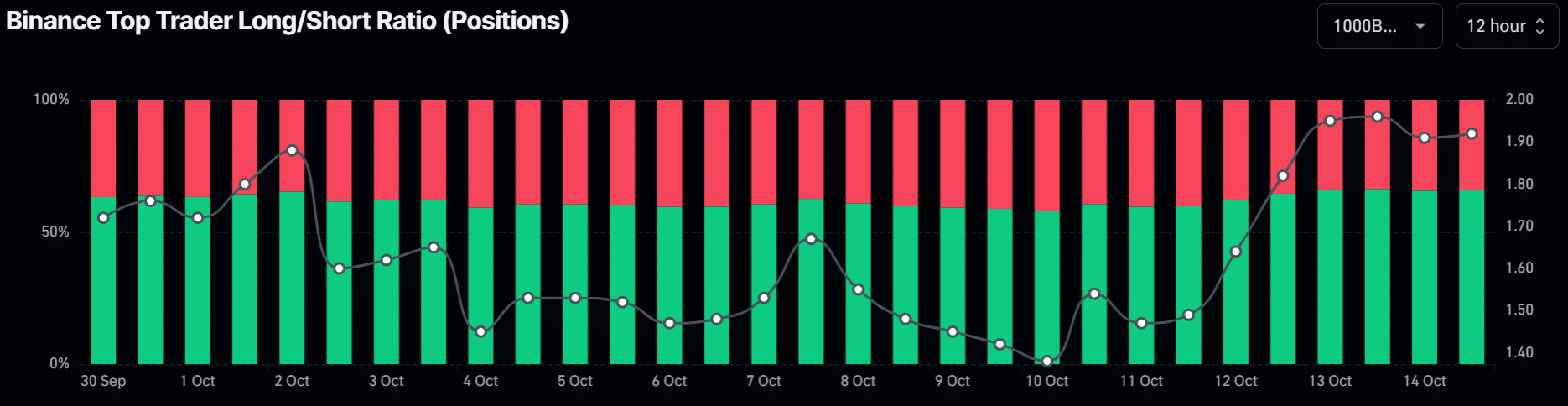

Smart traders on Binance exchange were net long on the memecoin, further underscoring wild expectations of upside price reversal.

Per the Top Trader Long/Short ratio, which gauges smart money on the platform, 68% of all positions were betting on BONK’s upswing. That’s an overwhelmingly bullish sentiment in the futures market.

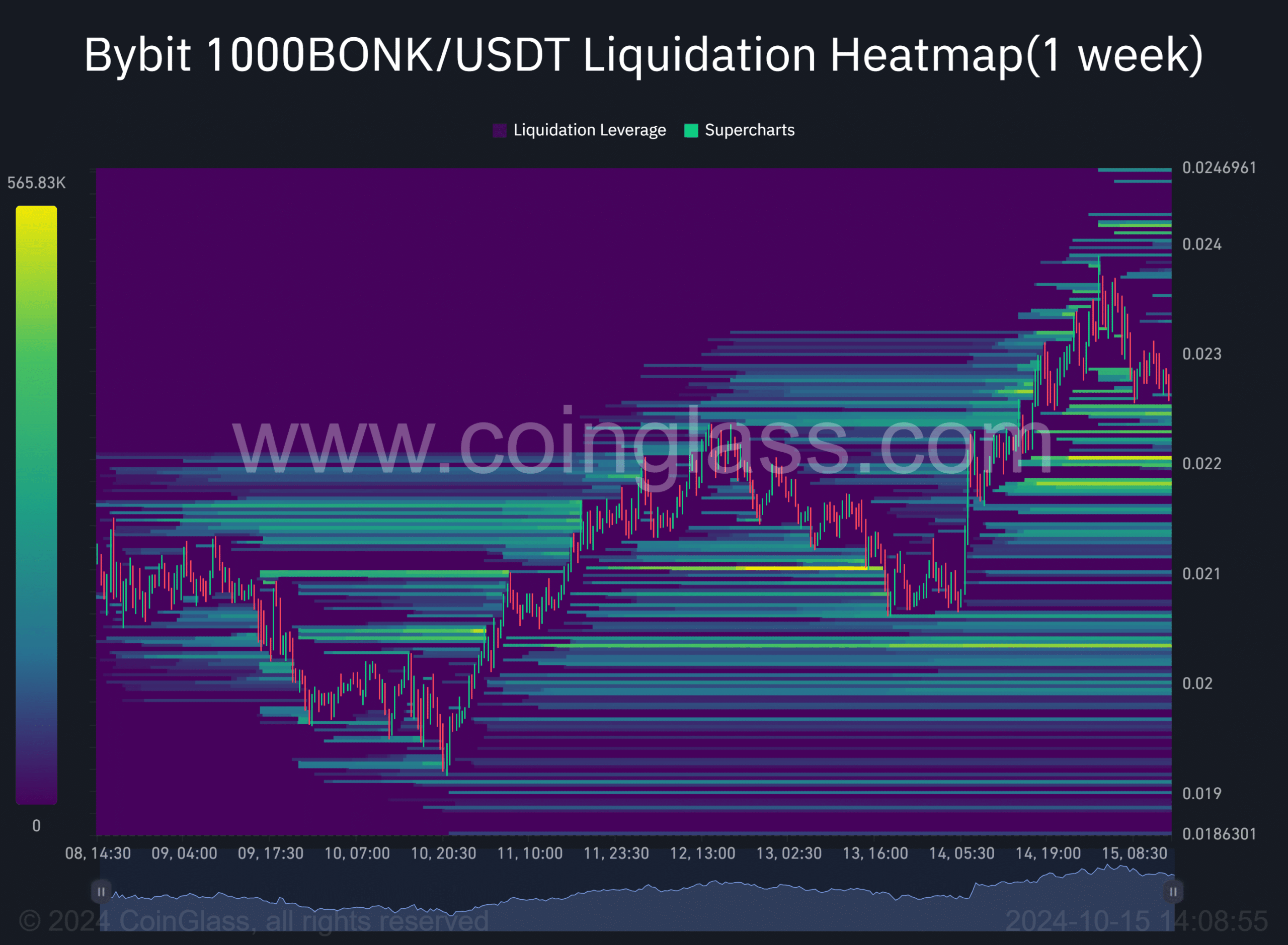

Besides, the liquidation heatmap marked $0.000022 as a key liquidity area with a massive build-up of leveraged long positions.

Read Bonk Price Prediction 2024 -2025

This reinforced the level as a key support zone, as the price could retrace to it before rallying.

Therefore, BONK’s set-up still had a great risk-reward ratio, especially for long positions if the memecoin stayed above $0.000022. But a decline below the support would invalidate the bullish projection.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion