Dtravel has announced a strategic partnership with Fetch.ai, a decentralized network for emerging peer-to-peer economies. The Fetch.ai AI agent marketplace now includes the AI-driven vacation rental discovery agent that Dtravel is now officially part of.

This is a nice fit with Fetch.ai’s mission to help get AI agent technology adopted. Dtravel’s AI agent is directly consumable by the ecosystem of developers. This advancement will usher in a widespread revolution for the travel sector by providing a new wave of innovative, decentralized, personalized vacation rental experiences.

Developers can use Dtravel’s agent to add booking functionality to applications, deliver tailored booking options, and create true end-to-end travel solutions. Maria Minaricova, Director of Business Development at Fetch.ai, highlighted the importance of this collaboration.

– Advertisement –

According to her, this is how they bring the travel industry one step closer to a completely decentralized, ‘AI-powered’ future. The integration is designed to speed the adoption of AI in travel and advance a more generalized decentralized ecosystem.

FET Still 2.66% Down in 24 Hours

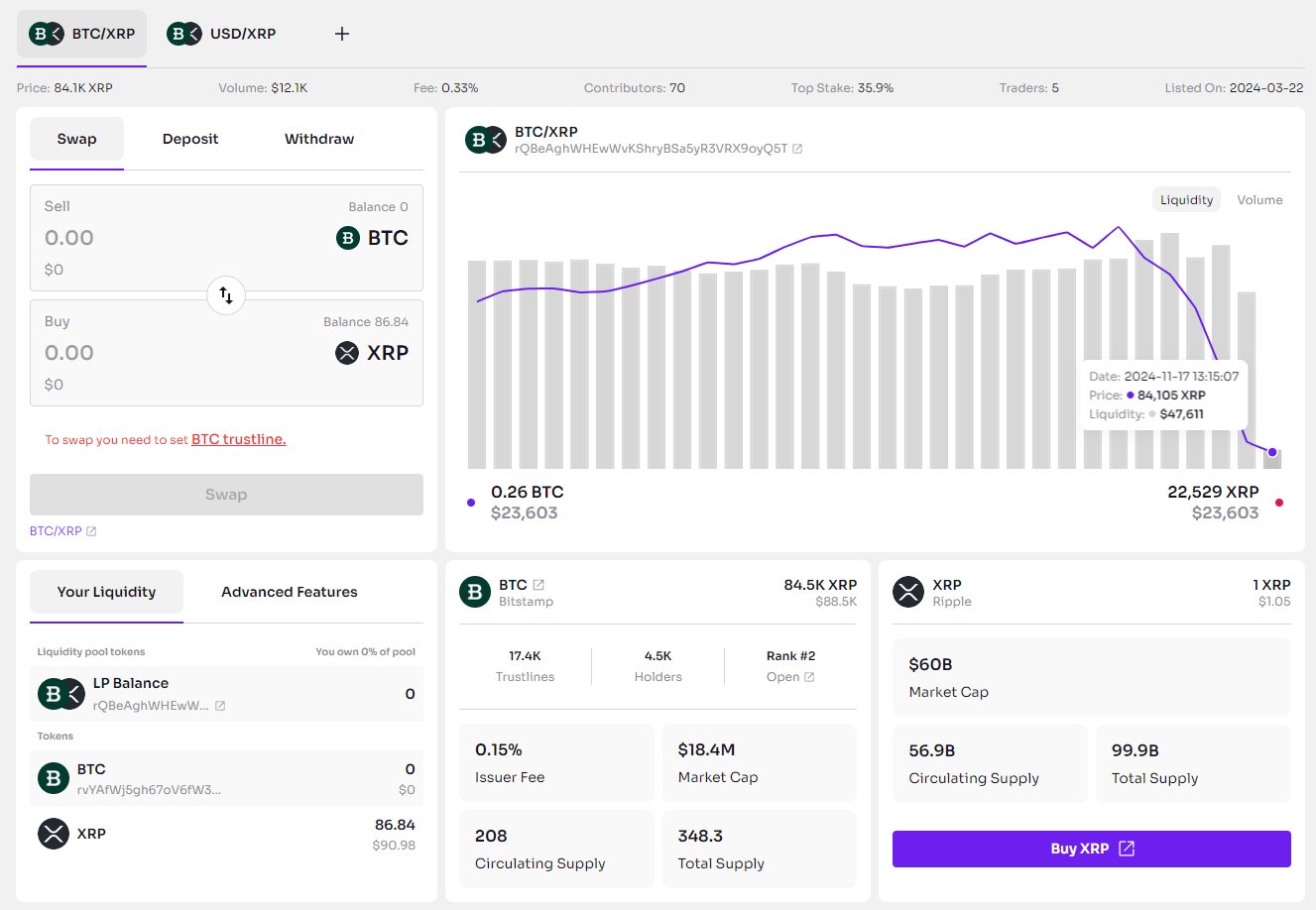

Despite the buzz around the partnership, Fetch.ai’s token, FET, has experienced downward momentum in current trading. On October 18, 2024, the price of the token was around $1.40, a decrease of 0.63% in 24 hours (according to market data, see chart).

While this value is declining, it’s happening amid general market volatility. However, the future outlook for FET is looking bright, particularly since the new partnership is in effect. With a market cap of $3.52 billion and a circulating supply of 2.52 billion FET tokens, Fetch.ai is ranked 30.

The bearish immediate price action is a good sign. Market analysts reckon the Fetch.ai partnership with Dtravel may hold for something more if it results in wider adoption of Fetch.ai’s decentralized AI agents within the travel industry.

FET Technical Analysis: Rising Wedge Pattern

From a technical standpoint, the rising wedge pattern that FET has recently seen on the 4-hour chart suggests possible downside risk. This was a breakdown pattern, which is frequently a precursor to price corrections.

The price now trades at its current level of $1.40, with immediate resistance at $1.45 and support around the $1.35 level.

The bearish crossover shows the Moving Average Convergence Divergence (MACD) has been worth a sell. The decline momentum may endure at least in the near term. Analysts have set a target close to $1.25 on the wedge formation, which agrees with the broader market sentiment.

The technical indicators hint at short-term bearishness. Yet, the long-term fundamentals surrounding Fetch.ai, especially with this new partnership, look like they could see a recovery, especially when tied to the wide-scale adoption of Fetch.ai in the travel sector.

Working with Dtravel is an audacious step in enabling AI technology and the travel industry. FET’s price has taken a hit in the short term. But there is still a lot of long-term potential behind their partnership.

Continuing its bull run, FET price action will be closely monitored by analysts to find whether the technical downturn is significant and will persist or if the fundamentals of this new partnership will help push the token into another bullish phase.