Key Points

- Aave protocol’s TVL recorded a new ATH at $22.24 billion.

- Despite a significant surge in AAVE’s price today, it still has to climb around 35% to reach its previous ATH.

Aave Protocol’s metrics have reached a new ATH, but its price is still down from its previous historical high recorded in 2021.

Aave TVL Reaches a New ATH

Aave’s total value locked (TVL) reached a new ATH at $22.24 billion on December 12, according to DeFiLlama data. Its previous ATH was recorded in October 2021 at around $19 billion.

The same data revealed that as of yesterday, AAVE’s price was still 50% down from its previous ATH recorded in May 2021, above $572.

AAVE Price Is Up By 35% today

At the moment of writing this article, AAVE is trading at around $375, up by approximately 31% today, after reaching $376 earlier. The coin has a market cap of $5.6 billion.

During its 2021 ATH, AAVE reached a market cap of around $7.3 billion while its TVL was lower compared to today’s numbers.

AAVE Potential Price Triggers

AAVE’s price could be pushed upward by more factors.

Aave Deposits

Aave’s deposits rose from $12 billion in January to over $32.5 billion by December, mirroring increased liquidity in DeFi. Only on December 5, the deposited volume in Aave surpassed $2 billion according to Dune data.

Revenue Growth

Aave revenue also experienced an increase this year at over $145 million, up by almost 70% compared to the previous year. Fees were over $865 million with a 66% increase compared to last year, Token Terminal data shows.

Revenue growth reflects increased engagement with the platform.

Aave’s Potential Compared to Other Banks

Aave’s valuation metrics highlight its high potential compared to traditional banks.

For instance, HDFC Bank in India held $300 billion in deposits a few days ago, trading at a valuation of $171 billion, and yielding a valuation-to-deposit ratio of 0.57. Aave’s valuation-to-deposit ratio was 0.13 as of December 9.

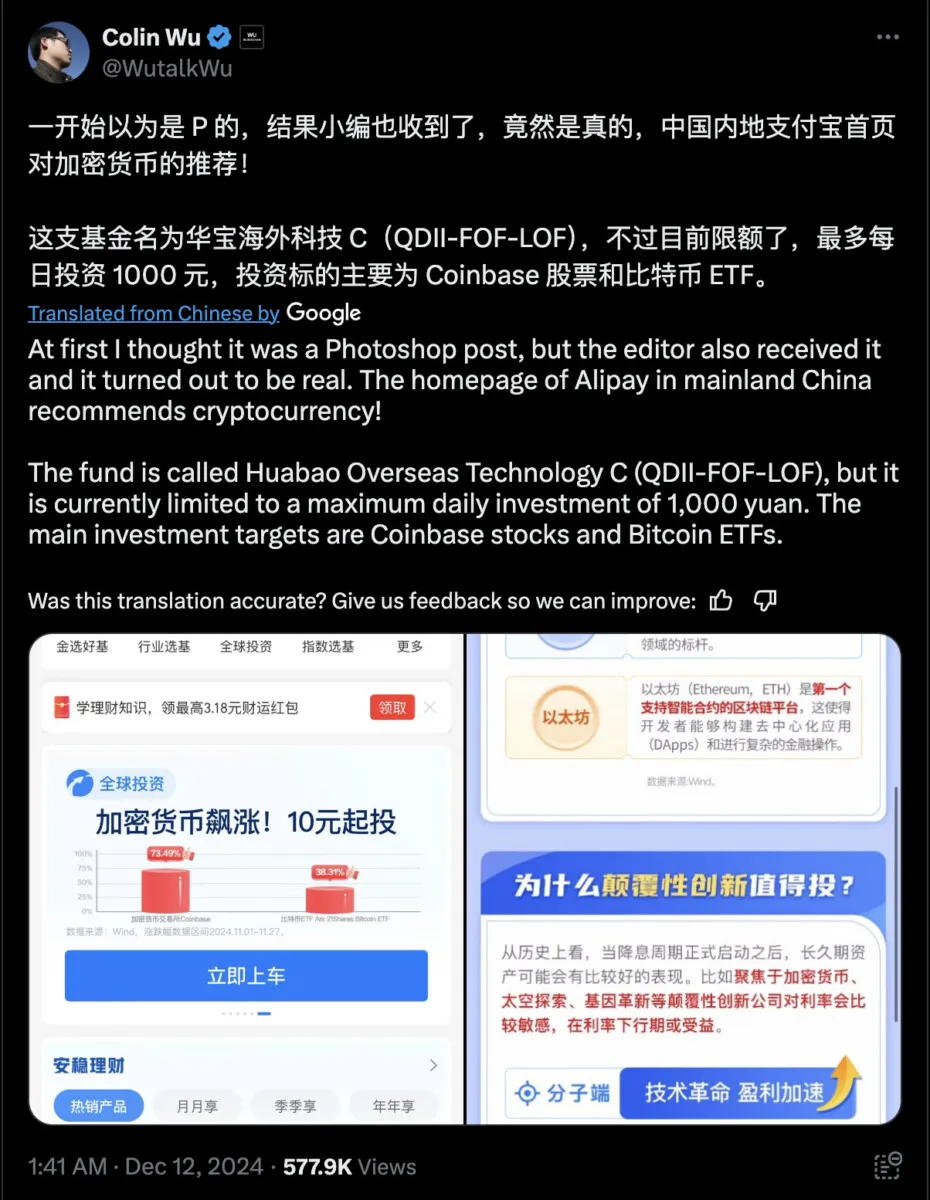

Trump Family Buys AAVE

Also, Lookonchain data revealed earlier today that the Trump family crypto project World Liberty Financial is buying ETH, LINK, and AAVE.

Earlier, Lookonchain revealed that their wallet spent 1 million USDC to buy 3,357 AAVE at $297.8 billion.

AAVE’s Price Expected to Surge to New ATHs

A rise in TVL for the Aave protocol and other indicators mentioned above should push the price higher. BlockBeats also mentioned that compared to 2021, the total supply of stablecoins is also significantly higher, which provides momentum for DeFi.

As of December 21, the total market cap of stablecoins was over $202 billion, DeFiLlama data shows. In 2021, it was around $187 billion, according to the same data.

All these metrics should push AAVE’s price higher to new ATHs, especially considering the favorable scenery for the overall crypto industry as well.

Also, the debut of the altcoin season a month ago could bring more liquidity to the crypto market as investors’ interest increases.

2025 will bring a new administration in the US with more crypto-friendly policies, another factor that will support the growing adoption of digital assets, and that already fuels bullish moves in the market.

Aave is a decentralized finance protocol that allows people to lend and borrow crypto.