- AAVE soared this week, outpacing top altcoins after a dip

- However, despite strong technical indicators, concerns have been starting to surface

With its weekly gains surpassing some of the market’s leading altcoins, AAVE has gained significant traction in this bullish cycle. Especially since its 24-hour trading volume rose by nearly 12% to $180 million.

This rebound followed a recent plunge, as noted by another AMBCrypto report. Interestingly, with the RSI dipping into oversold territory at press time, the altcoin’s current price offers ample opportunity for traders to view it as a “dip,” before a massive parabolic surge. Especially with the bullish MACD crossover.

Priced at $150 at the time of writing, can AAVE maintain its recovery and break through the critical resistance level at $200? With two recent failed attempts, it would be interesting to see if AAVE can finally make its move.

Technical indicators support this scenario

With AAVE valued at around $150, the potential for a rally to $200 is firmly on the table, especially with several positive technical indicators in play.

However, this cycle tells a different story. Back in March, when BTC hit its ATH of $73k, AAVE enjoyed a sustained bull rally that lasted over a month, ultimately closing near its press time price.

On the contrary, with BTC approaching a similar peak this time, AAVE has encountered some notable pullbacks. Since late September, its price has been consolidating, with four failed attempts to break through the $150 resistance level.

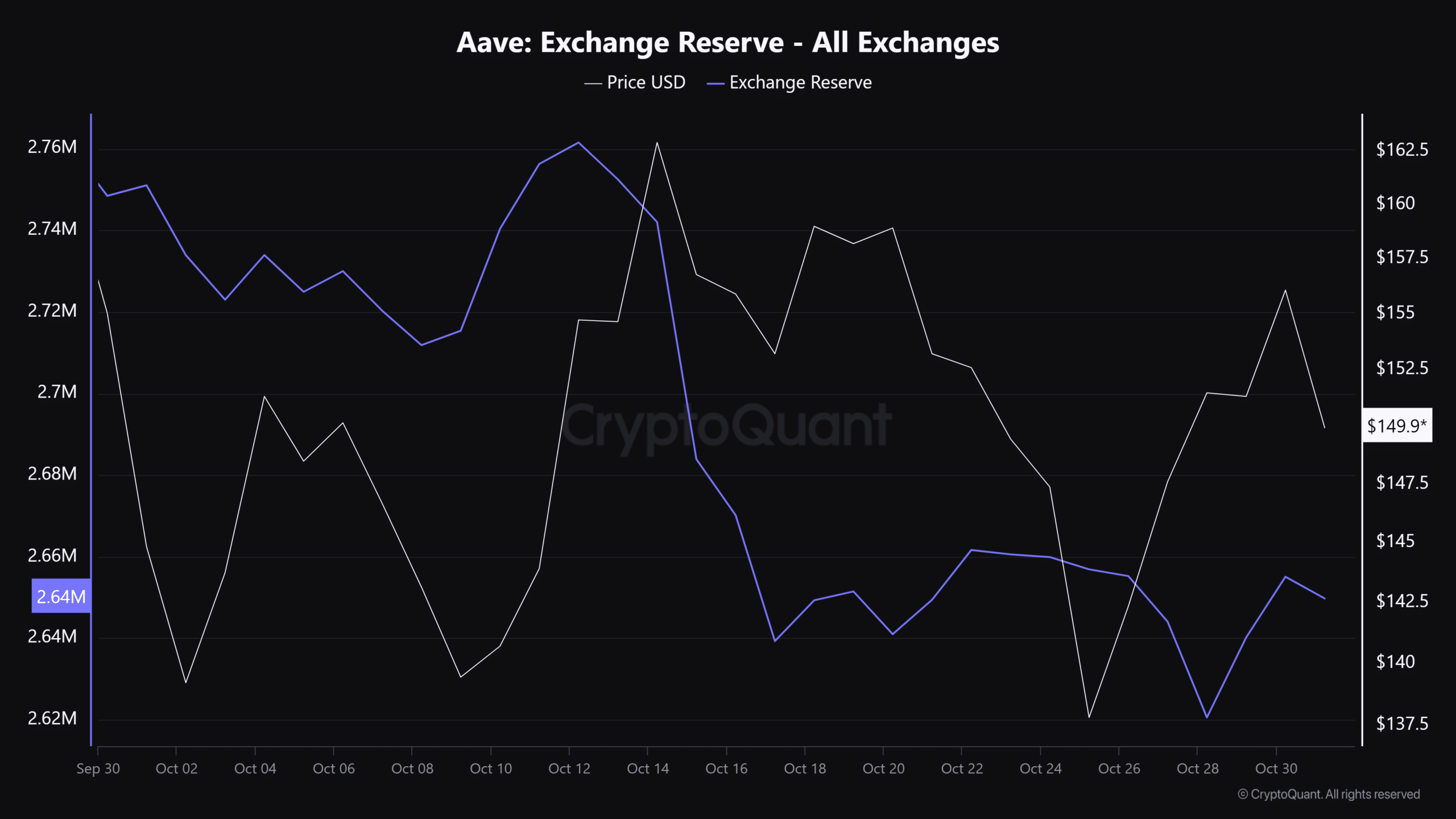

Amid growing volatility driven by the upcoming elections, Bitcoin is likely to attract most of the liquidity. This could divert interest away from lower-cap altcoins.

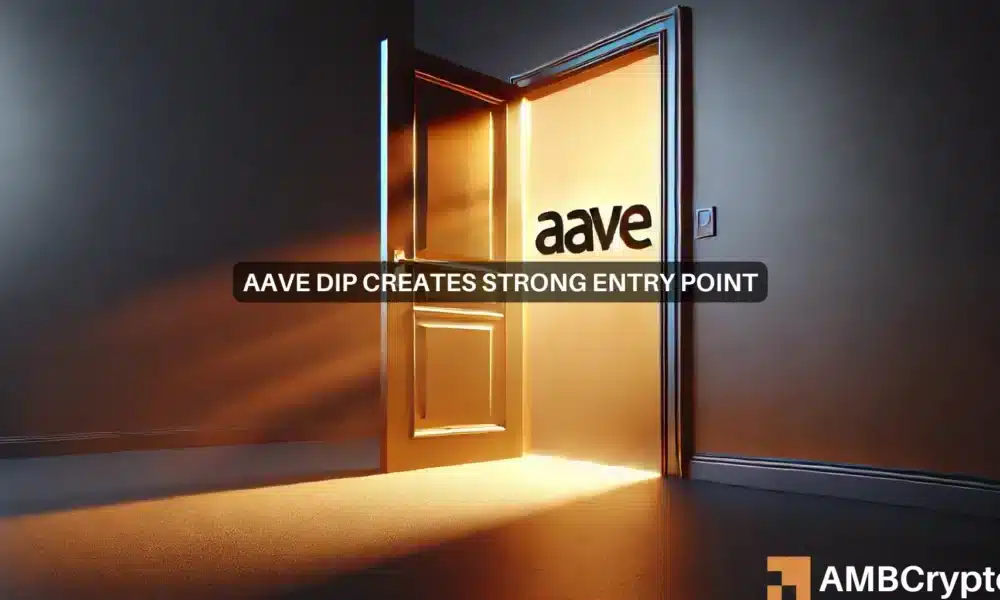

Additionally, there has been a significant hike in short positions within the derivatives market – A trend that makes sense given the current conditions.

If this narrative doesn’t reverse itself, AAVE may face a downtrend and it could drop to $140. This might present an attractive entry point for new investors, even as technical indicators signal a bullish outlook.

Short-term gains for AAVE seem more likely

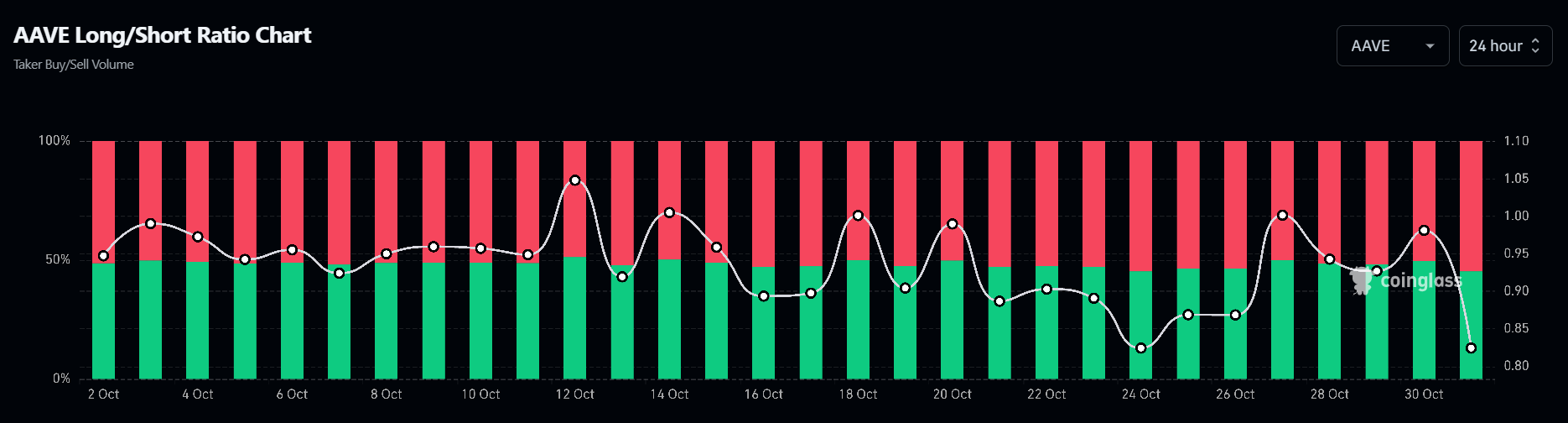

Over the past two days, investors withdrew over 20,000 AAVE tokens from exchanges, suggesting that the altcoin’s price represented a solid dip. However, this moment of optimism quickly faded as investors began offloading their holdings.

The reasoning is straightforward – t The market is currently volatile. Until stability returns, investors are likely to view Bitcoin as a safe haven, alongside assets like gold, silver, and bonds.

Read Aave’s [AAVE] Price Prediction 2024–2025

While AAVE’s current price may seem attractive for accumulation , it’s difficult to confirm if a bull rally is on the horizon. Short-term gains are likely to keep AAVE around $150 for now, especially if BTC maintains its bullish trajectory.

However, a retracement to $140 seems more probable. Until pre-election uncertainty subsides, it may be difficult for whales to break AAVE out of consolidation, even as they target the dip.