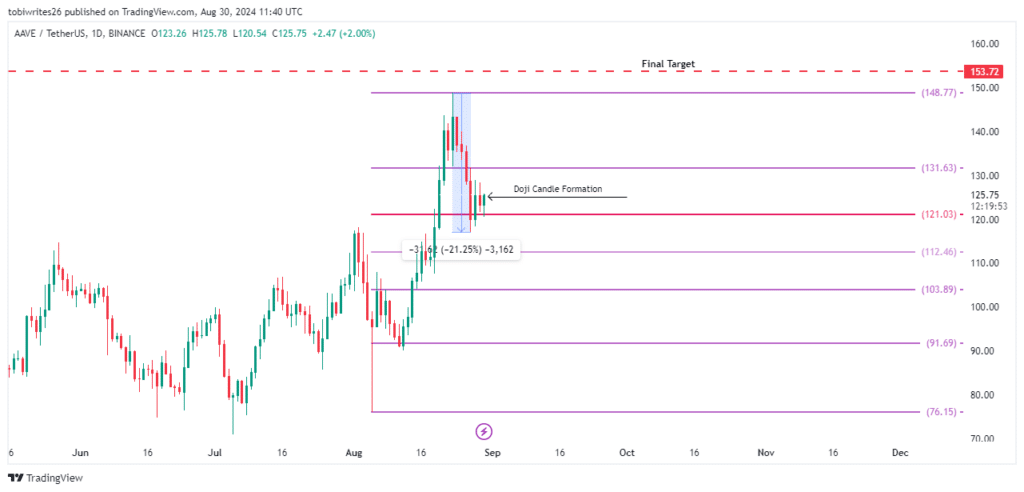

- AAVE’s pause may be a retracement, setting the stage for a higher low before a potential rally to $153.

- The altcoin was backed by a strong investor base in the $121 support region at press time.

After a remarkable ascent past $148, Aave [AAVE] has caught the attention of numerous investors.

A previous analysis by AMBCrypto correctly predicted that AAVE would hit $121, a benchmark it exceeded. However, it has now become a major support level.

To trade into this support level, AAVE saw a 21.25% decline. However, as of now, the $121 level has become a vital support that needs to hold for AAVE to advance further.

AAVE’s rally hinges on 121 support level

Utilizing a Fibonacci Retracement line by marking the highest high and lowest low within a trend, AAVE has been identified as trading at a critical support level of $121.03.

Should this level hold, AAVE is set to reach $153.

A detailed examination of the price action reveals that AAVE has approached this support level, with significant buying pressure evident.

Also, the daily candlestick is forming a Doji candle, which, if fully formed, signals strong buying interest.

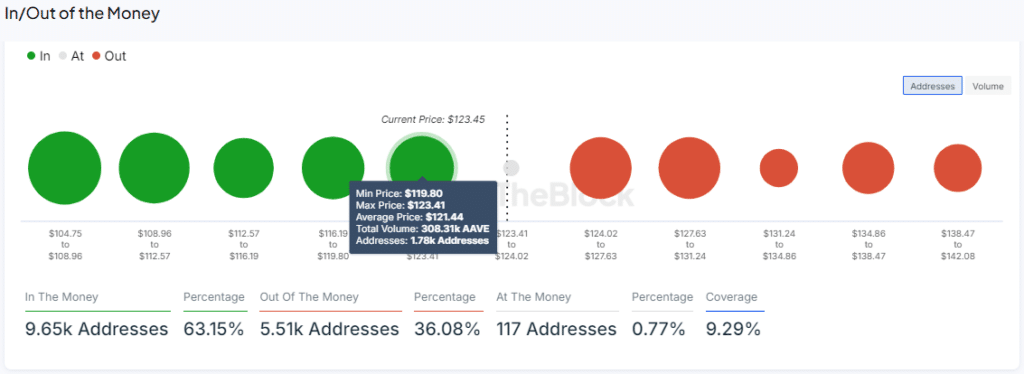

Further analysis by AMBCrypto has shed light on why the buying pressure around this price level appears to intensify.

Bulls charge ahead

The In/Out of the Money Around Price (IOMAP) analysis according to IntoTheBlock indicated substantial buying pressure around the $121 region, specifically at $121.44.

Over 1,780 addresses hold AAVE ‘in the money’ at a combined value of approximately $308,310. This level aligns closely with the Fibonacci retracement marker at $121.03.

IOMAP helps identify critical support and resistance zones by showing the distribution of addresses holding an asset at specific price levels.

It highlighted areas where a large number of addresses are “In the Money,” suggesting potential support levels as holders may be reluctant to sell.

Further insights from the Chaikin Money Flow (CMF), an indicator that assesses the accumulation and distribution of an asset by comparing price and volume, revealed a positive shift.

The CMF indicated a significant inflow of funds into AAVE, suggesting a potential rise in its price.

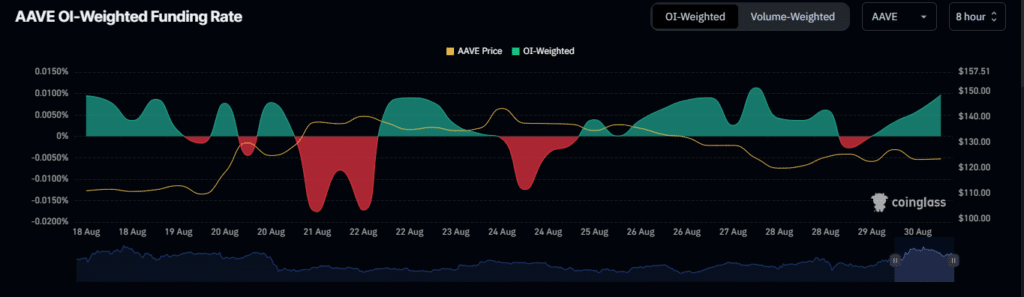

Bullish narrative gains momentum

According to Coinglass, both the Funding Rate and the Open Interest Weighted Funding Rate were positive, suggesting that bulls are gradually gearing up for a rally.

The positive Funding Rate is a fee that balances the prices of perpetual futures with the spot market by requiring longs to pay shorts.

Read Aave’s [AAVE] Price Prediction 2024–2025

This outlook is further supported by the OI-Weighted Funding Rate, which refines the standard Funding Rate by offering a more accurate gauge of the market’s overall conditions.

Its positive status shows the likelihood of a bull market.