- As the number of active addresses spiked, AAVE’s total value locked (TVL) dropped

- On the contrary, technical analysis suggested a potential rally for AAVE

Over the past 24 hours, there has been an aggressive 11.27% sell-off in AAVE’s market. However, this recent downturn might not end anytime soon, with other market developments indicating a sustained decline on the charts.

And yet, technical analysis pointed to a possible reversal, showing AAVE at a crossroads. Hence, AMBCrypto analyzed AAVE’s potential future movements, in light of these conflicting indicators.

Investor withdrawal drives AAVE’s decline

According to DeFiLlama, there has been a notable fall in the Total Value Locked (TVL) in AAVE. What this means is that investors are withdrawing from the protocol.

In fact, at press time, AAVE’s TVL had fallen to $11.941 billion. If these trends persist, AAVE is likely to face further declines.

Here, TVL measures the aggregate value of assets deposited within decentralized finance (DeFi) protocols. Figures for the same often represent overall market participation and capital commitment.

This trend of investor withdrawal can be underlined by a hike in the number of active addresses. At press time, it had surged by 6.85% to over 1,020, signaling heightened activity, predominantly sell-offs, as AAVE’s price dropped on the charts.

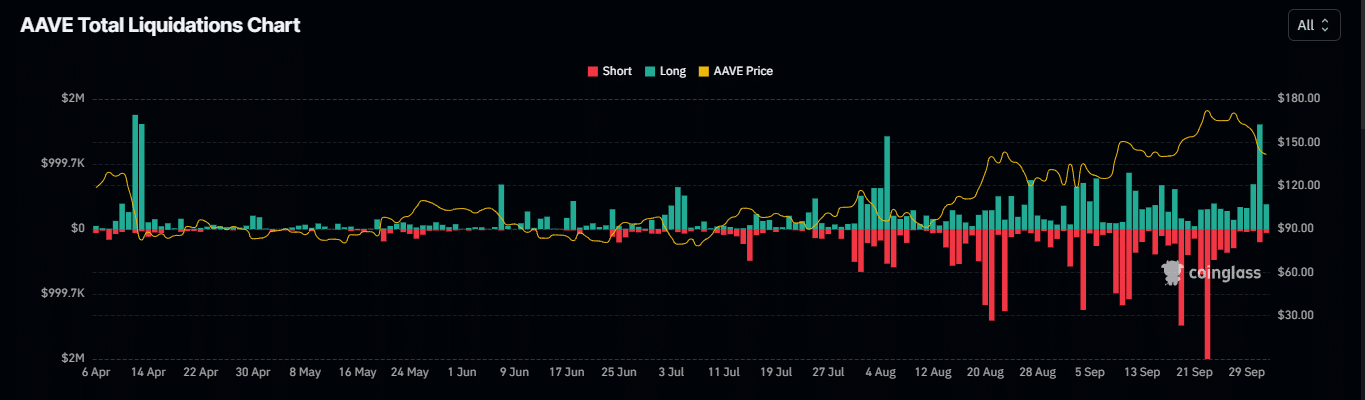

Major losses for long traders on AAVE

Traders who bet on a sustained upward trajectory for AAVE have faced substantial losses as the market turned against them.

According to Coinglass, $1.91 million have been wiped out after traders bet on AAVE’s rise on the charts.

Moreover, there seemed to be an imbalance between long and short positions, with there being a significant skew towards losses on long positions.

Here, the negative sentiment was further mirrored by the Open Interest. A drastic fall of 20.23% in Open Interest was recorded on the charts, suggesting a potential continuation of the sell-off by AAVE holders.

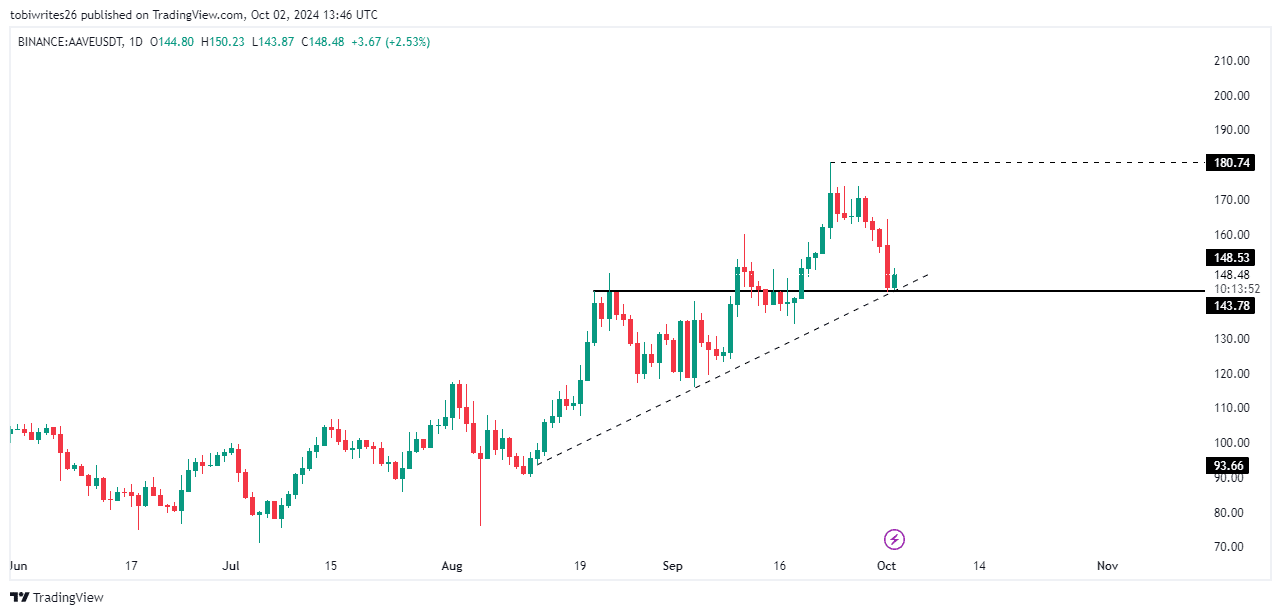

Technical analysis points to potential reversal for AAVE

Technical indicators on the chart suggested that AAVE may be positioned for an upward move. Especially since it has reached key confluences that could drive its price higher.

AAVE reached a critical juncture on the chart, one where a horizontal resistance line meets a diagonal resistance line. AAVE responded positively to the same, showing signs of an upward trend. If this resistance level holds, AAVE could rally to $180.74.

Conversely, if this resistance level does not hold, AAVE could fall, potentially reaching as low as $119.