- In the last 24 hours, AAVE has appreciated by 4.25%, signaling potential market momentum.

- However, analysis predicts that this recent uptick is temporary and expects a downturn.

Aave’s [AAVE] market performance has been outstanding recently. It has surged by 32.08% in the past month, outstripping many other tokens. This positive trend extends over the weekly timeframe as well, with a gain of 16.42%.

Despite these strong gains, emerging data suggest that AAVE’s rally will likely slow, potentially leading to a significant drop in its trading value.

AAVE’s recent market momentum appears to be temporary

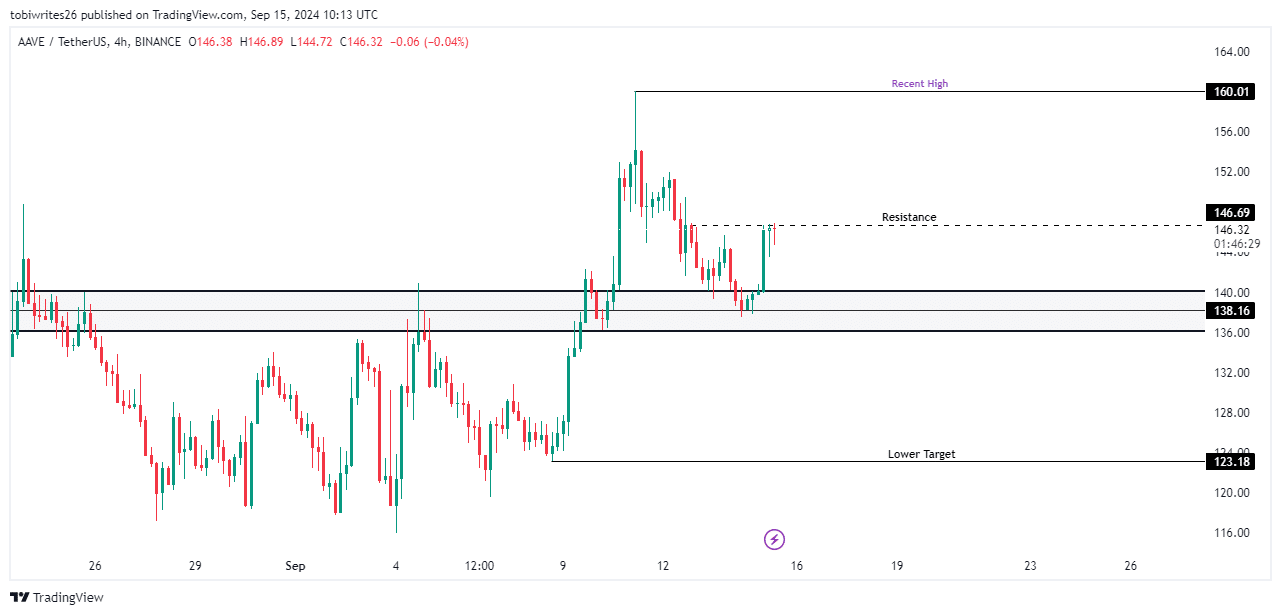

Tading at $145.80 at press time, AAVE was just $14.21 shy of its earlier high of $160.01. AMBCrypto’s analysis revealed that AAVE’s recent rally was triggered by its rebound from the midline of a major support level at $138.16.

However, AAVE has encountered a four-hour resistance level at $146.69, which coincides with a high selling pressure that could potentially drive the price lower, possibly back to or below the support range between $140.06 and $136.12.

Should the support level break, AAVE’s price could likely decline further, potentially falling as low as $123.18, especially with intensified selling pressure.

Rising supply could negatively impact AAVE

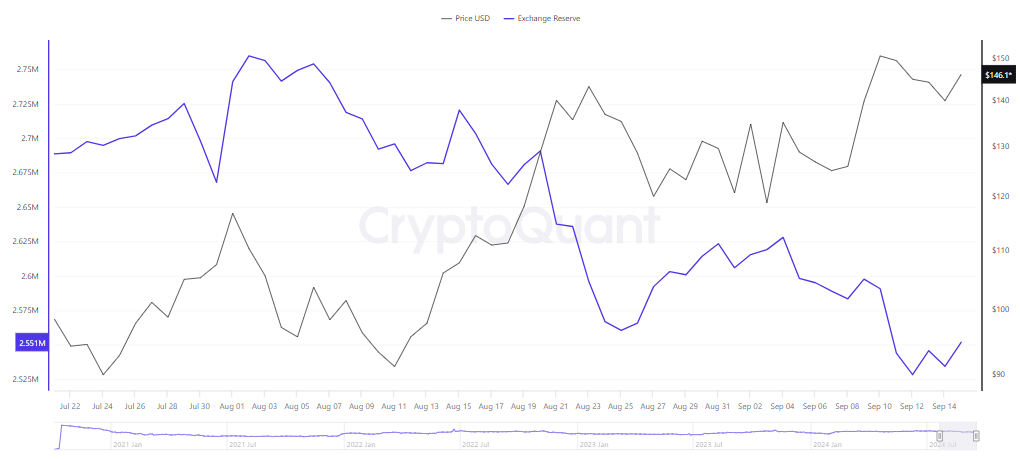

CryptoQuant data showed an increase in exchange supply over the last 24 hours, with 2.5 million AAVE now available across multiple cryptocurrency exchanges.

An increase in exchange supply suggests that market participants are listing their AAVE assets for sale, indicating a potential surplus.

This surge in supply coincided with a positive shift in Exchange Netflow, meaning investors are likely moving their AAVE to exchanges either to sell or swap for other tokens, resulting in a demand squeeze.

This uptick in supply and exchange flows has contributed to significant long liquidations, as reported by Coinglass. In the past 24 hours, $260.55k worth of AAVE long positions were forcibly closed as market conditions turned unfavorable.

Market conditions signal challenges for bulls

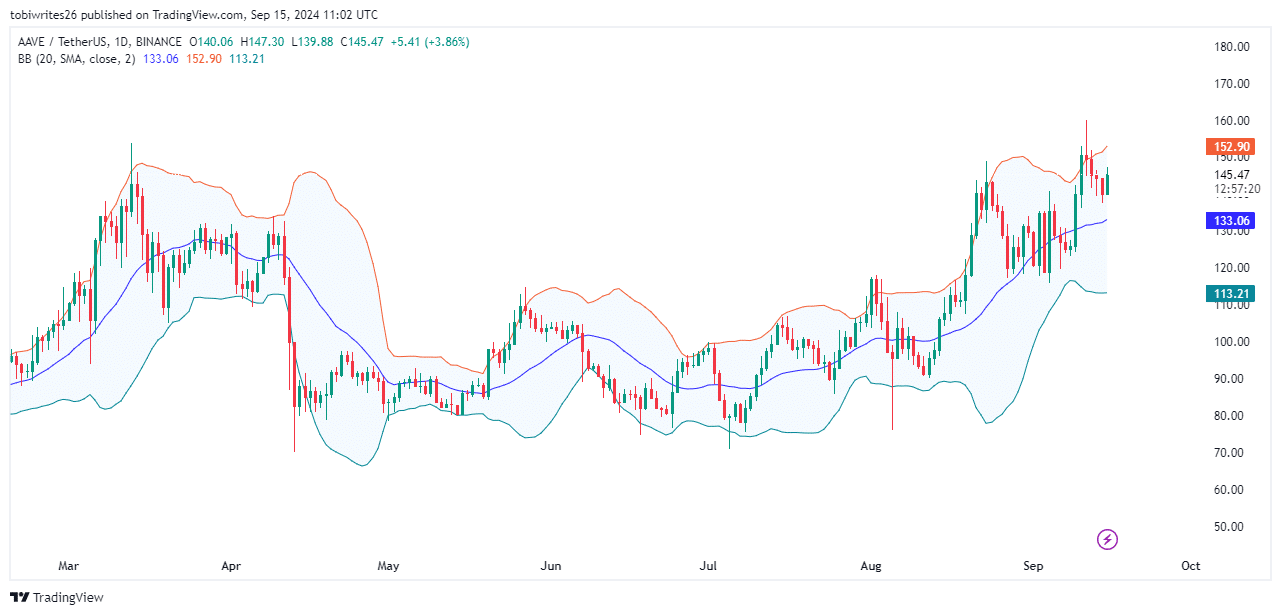

The Bollinger Bands, which measure market volatility and identify overbought or oversold conditions, indicate that AAVE has crossed into the overbought zone and is expected to trend lower as it seeks recovery.

The bands are typically interpreted as follows: crossing the upper band (red line) suggests an overbought condition, the lower band (green line) indicates oversold conditions, and the middle band (blue line) is considered neutral.

Furthermore, the bearish sentiment is reflected by a decline in open interest, which tracks the volume of unsettled derivative transactions.

Open interest in AAVE has decreased to $164.56 million from $214.71 million as of September 11, signaling reduced liquidity inflow into the market and a potential further decrease in asset prices, possibly reaching $140.06 or lower.