The recently trending AI16Z fund ended up with two ELIZA tokens, after another team went for a Pump.fun launch. The fund aimed to turn ELIZA into one of its agentic AI traders, tying its performance to another token.

The AI16Z AI agent fund, mimicking the legitimate crypto fund a16Z, ended up with another case of token confusion. Initially, AI16Z aimed to create several trading profiles, and a new agent with a token attached, ELIZA. However, launching a token is an extremely fast event – and another team front ran AI16Z through Pump.fun.

Jupiter DEX decided to verify both tokens – the one launched by the AI agent, and the one belonging to the alternative team.

Over the last 24 hours, there are now 2 Eliza tokens with significant marketcaps and volume, similar to the Neiro situation.

In that case, we verified both in order to avoid taking sides – what would be a good situation here? pic.twitter.com/8IFXbGivvx

— meow (@weremeow) November 20, 2024

Currently, Solscan tags the tokens as AI16ZEliza with 15,474 holders, and Eliza (ELIZA) with 12,956 holders as of November 20. The two tokens have not decided a clear winner, though they are starting to show price disparity. The AI16Z version trades at $0.028, while the community-generated ELIZA is at $0.035.

The two tokens also show the formation of whale wallet clusters, with some wallets holding upward of 10% of the supply. At this stage, the tokens remain risky, with high trading volumes yet relatively low liquidity.

Both tokens depend on early-stage Raydium pairs, with a similar amount of liquidity locked. The AI16Z token version has a slight advantage in terms of trading volumes and liquidity, but the next few days will show which token would gain more traction. The situation recalls the NEIRO token, where ticker confusion led to significant losses for those that chose the wrong asset.

Since AI16Z is a high-profile AI agent, it sparked expectations of a big exchange listing. However, the double token confusion is splitting the community and causing skepticism about the project.

The Eliza framework was one of the main developments for AI16Z, in addition to the original fund. The original team wanted to build up the Elizaverse, which is a platform to launch community-based AI agents. At a later stage, the platform was supposed to be tokenized.

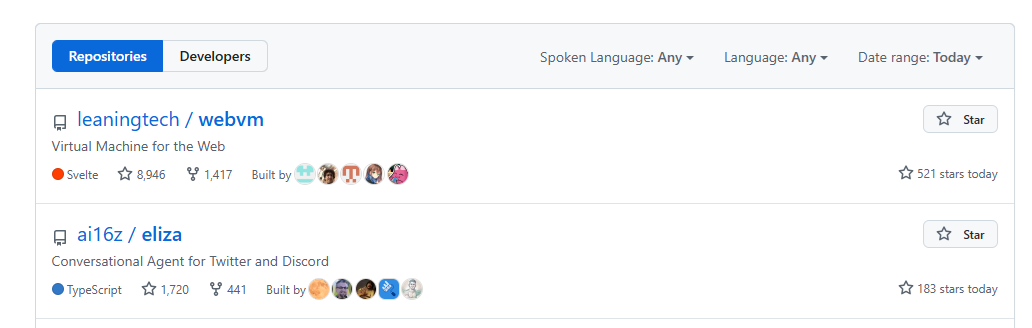

Despite the double token challenge, the Eliza framework is now in the second spot among trending GitHub repositories.

ELIZA and the AI16Z trend may face challenges as more AI agents proliferate. The AI agent projects have been flying under the radar for a few months, tapping available Web3 technologies to propose a new way of risk-taking and investment. At the current stage, hype may surpass utility, as traders will look for trending assets and the most liquid AI agent platforms.

Eliza opens up market for user-generated AI agents

Eliza taps a new trend, where anyone can launch an AI agent and open up for liquidity from risky traders. The activity starts to resemble that of meme tokens, and some of the AI agents are tied to previous memes and communities.

The Milady NFT community has joined the AI agent trend in droves, with more platforms and agents popping up every day. Just like meme tokens, only a small part may succeed. Most of the AI models are still small and hold less than $10K. Even the top AI agent, Sydney Sweeney AI, only has a $9.3K in tributes.

In comparison, the original AI agent fund, AI16Z, still retains a valuation above $211M. The agent is expected to trade until October 25, 2025, and does not guarantee returns to its backers. After the double token scandal, the fund’s native token also nuked, sliding to $0.26.

The value locked in the fund was more than $359M at one point, crashing just days after the launch. AI agents may prove to be as risky and volatile as memes, moving on hype rather than their real trading capabilities.

AI agents appeared just weeks after the first AI personalities on social media launched their tokens. Now, a proliferation of new assets and projects will test the real demand for AI agents. So far, the agents still have limited trading abilities, and are yet to show performance statistics. This did not prevent a gold rush and inflow of liquidity into the new projects.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap