Unlocking events can heavily influence altcoin prices, often leading to supply pressure and potential losses in April. Investors must carefully assess token economics when crafting long-term strategies.

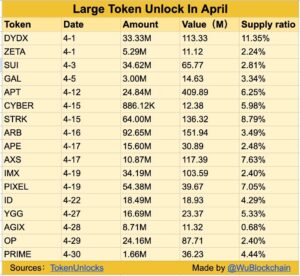

Unlocking events for altcoins can seriously impact their prices, as we’ve observed multiple times. In April, unlocking events totaling hundreds of millions of dollars might result in substantial losses for certain altcoins. Investors need to know which altcoins will undergo unlocking and the corresponding amounts and dates in April.

Cryptocurrency Supply Dynamics and Price Movements

Cryptocurrencies enter the market with two distinct supply metrics: maximum supply and circulating supply. Initially, when an altcoin begins trading on exchanges, it may release only a fraction, such as 1%, of its total supply, often in the billions. This limited circulation can trigger significant price surges as investors overlook the majority of the supply that remains locked, creating an artificial sense of scarcity and driving a rally fueled by heightened interest.

As time progresses and more of the cryptocurrency’s supply enters circulation, the magnitude of price fluctuations tends to diminish. Many altcoins that debuted with a relatively low circulating supply have experienced record-high prices during bullish periods, which are often difficult to replicate.

For instance, consider DYDX, which only released a small portion of its supply during the previous bull market, resulting in prices soaring above $20. However, the circulating supply has now surpassed 460 million tokens. Achieving a price above $20 again would necessitate reaching a staggering market value of $9.2 billion. Given its current market value of $1.58 billion, this presents a considerable challenge.

Long-Term Investment Strategies and Token Economics

When formulating long-term investment strategies, it’s crucial to scrutinize the token economy of the relevant cryptocurrency. Investing solely based on hype can lead to increased losses as the supply dynamics normalize over time. However, projects that can significantly enhance token utility and generate demand exceeding inflation can present a contrasting scenario for their investors.

Source: WuBlockchain/TokenUnlocks

Notable examples include DYDX, STRK, AXS, and PIXEL. These altcoins, expected to unlock a substantial amount compared to their circulating supply, might encounter selling pressure from investors anticipating a market downturn. The postponement of DYDX’s unlocking event left many investors awaiting short-selling opportunities in futures markets disappointed. Any updates to the unlocking schedule for these altcoins could potentially trigger price movements contrary to market expectations.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News