Key Points

- Amazon’s shareholders requested that the Board conduct an assessment to add Bitcoin to its treasury.

- In October, Microsoft’s Board of Directors revealed they were also considering a Bitcoin proposal.

Amazon’s shareholders submitted a proposal that the company adopt Bitcoin as a treasury reserve asset. This comes after Microsoft’s Board of Directors said that they were also considering the idea two months ago.

Amazon Could Adopt Bitcoin as a Treasury Reserve

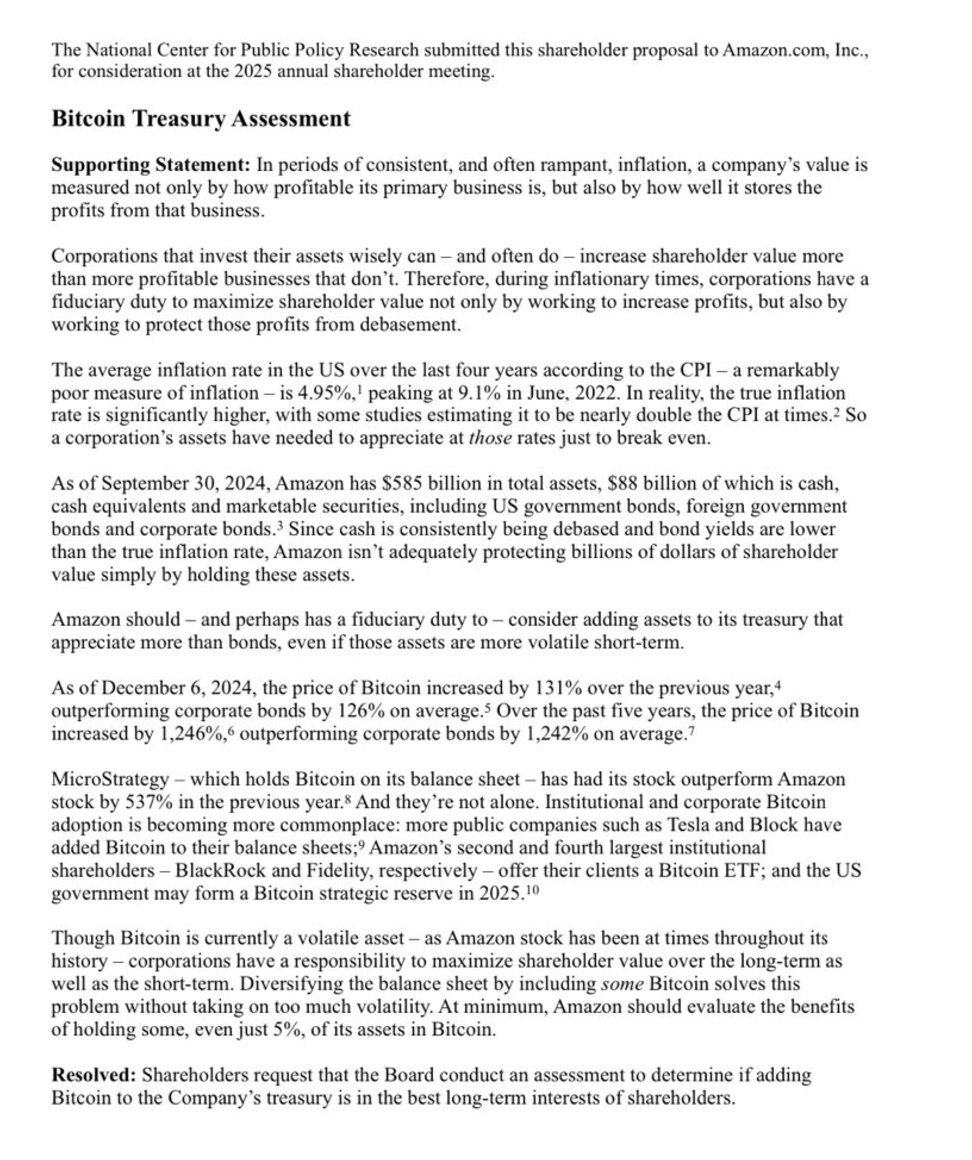

The National Center for Public Policy Research, Amazon’s shareholder, submitted a proposal for Amazon to adopt Bitcoin as a treasury reserve asset. This is a communications and research foundation, supporting national defense, in the US founded in 1982 by Amy Ridenour.

In the official proposal notes, the company addressed a supporting statement for a Bitcoin Treasury, highlighting that in times of high inflation, a company’s value is measured not only by how profitable its primary business is, but also by how well it stores its profits.

They also mentioned that corporations that invest their assets wisely, increase shareholder value more, and during inflationary times, maximizing shareholder value can be achieved by working to increase profits but also by working to protect them from debasement.

The notes revealed that the US inflation peaked in June 2022, at over 9%, while the average inflation rate in the country over the four years was 4.95%, according to the CPI – yet, the numbers are higher in reality.

As of September 30, 2024, Amazon had $585 billion in total assets, of which $88 billion in cash, cash equivalents, and marketable securities. The proposal also notes that Amazon is not adequately protecting these billions of dollars of shareholder value by simply holding the assets.

Therefore, the company should consider adding assets to a treasury that can appreciate more than bonds.

Benefits of an Amazon BTC Treasury Reserve

The notes highlighted some of the advantages of implementing a Bitcoin reserve for the company:

Bitcoin’s Strong Price Performance

The proposal also mentioned that as of December 6, 2024, Bitcoin’s price surged by 131% YoY, outperforming corporate bonds by 126% on average, and over the past five years, BTC’s price rose by 1,246%, outperforming corporate bonds by an average of 1,242%.

Other Companies’ Success Amidst BTC Global Adoption

The proposal also brought up MicroStrategy, the company that has been buying BTC since 2020, and which had its stock outperform Amazon’s stock by 537% in the previous year.

They also mentioned Tesla and Block which also added BTC to their balance sheets, amidst high institutional and corporate BTC adoption.

More than that, Amazon’s second and fourth largest institutional shareholders, BlackRock and Fidelity, also offer their clients Bitcoin ETFs, while the US government itself could create a Strategic Bitcoin Reserve, as we’ve previously reported.

The notes conclude by saying that even though Bitcoin is a volatile asset, corporations have the responsibility of maximizing shareholder value over the long-term and short-term, and Amazon should consider investing at least 5% of its assets in Bitcoin.

At the moment, Amazon ranks 5th in the top of the largest assets by market cap in the world with a $2.38 trillion market cap, while Bitcoin is in the 7th position with almost $1.95 trillion in market cap.

Amazon’s shareholders’ proposal comes after Microsoft revealed that the company is considering doing the same thing, according to recent notes in October.

These bullish moves come amidst increased institutional Bitcoin adoption reflected by the successful BTC ETFs in the US which amassed over $33 billion in total flows since their January launch and plans to create US Strategic Bitcoin Reserves in more states, and in other countries as well.

Also, the US is preparing to enter a new era that will bring friendlier crypto policies and supportive names for the industry, including Paul Atkins (potential new SEC Chair) and David Sachs, (Trump’s pick for AI and crypto sectors) among others.