Advanced Micro Devices, Inc. (Nasdaq: AMD) has surged nearly 63% in a year. The returns have been steady, but the decline in August stunted its price, leading to a gradual slowdown. AMD stock is currently trading at the $156 mark and surged by close to 1.85% on Friday’s closing bell.

Also Read: Local Currency That Challenged the US Dollar Fails, Dips 40%

All eyes are now on the Q3 2024 earnings report published on October 29. The earnings call has sparked high anticipation among stock investors as a positive report will push AMD to the green. The next few days might make or break the leading semiconductor giant as investors’ reaction will be strong.

Also Read: META Stock Price Target for 2030: Should You Buy Now?

AMD Stock: What to Expect After Q3 Earnings Results?

AMD commands a diverse portfolio of CPUs, GPUs, and adaptive processors that are in high demand in the global markets. The firm has also expanded its business into the Artificial Intelligence (AI) and datacenter markets for an upbeat growth catalyst. Its recent launch of the MI300X accelerator chip piqued the interest of top cloud providers generating significant business and expanding its revenue streams. If the firm delivers better-than-expected Q3 earnings reports, AMD stock could gain massively in the charts.

Also Read: BRICS: 85% Trade Settled in Local Currencies, Not US Dollar

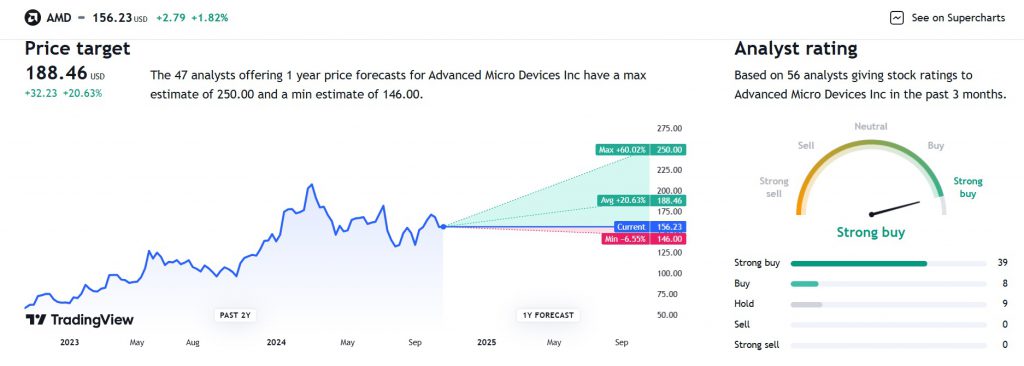

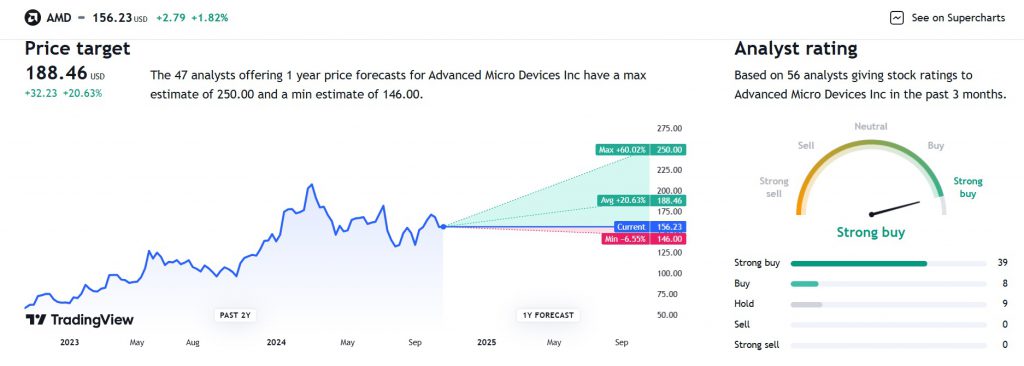

According to a recent price prediction on TradingView, AMD stock could reach a high of $186 if the Q3 earnings results turn out better than expected. That’s an uptick and return on investment (ROI) of approximately 20% from its current price of $156. Around 47 analysts from Wall Street have given the stock a ‘strong buy’ call as the earnings call could be positive.

Also Read: Would You Quit Your Job For Shiba Inu? 55% of Investors Will at $0.01

In addition, the 1-year forecast for AMD stock is even more bullish with a price target of $250. That’s a massive surge of another 60% in the next 12 months and could replicate its 2022-2023 performance. On the flip side, if the markets experience turbulence, the downturn could pull its price to the $140 level. In conclusion, buying AMD stock could be a good chance to make profits before the Q3 earnings call.