America’s economy is playing a weird game right now, where it looks like it’s slowing down, but the chances of a full-blown recession are getting slimmer.

The Conference Board said that while things are still slowing down, we’re probably not crashing into a recession anytime soon. For those holding onto risky assets like crypto, this is a bit of good news.

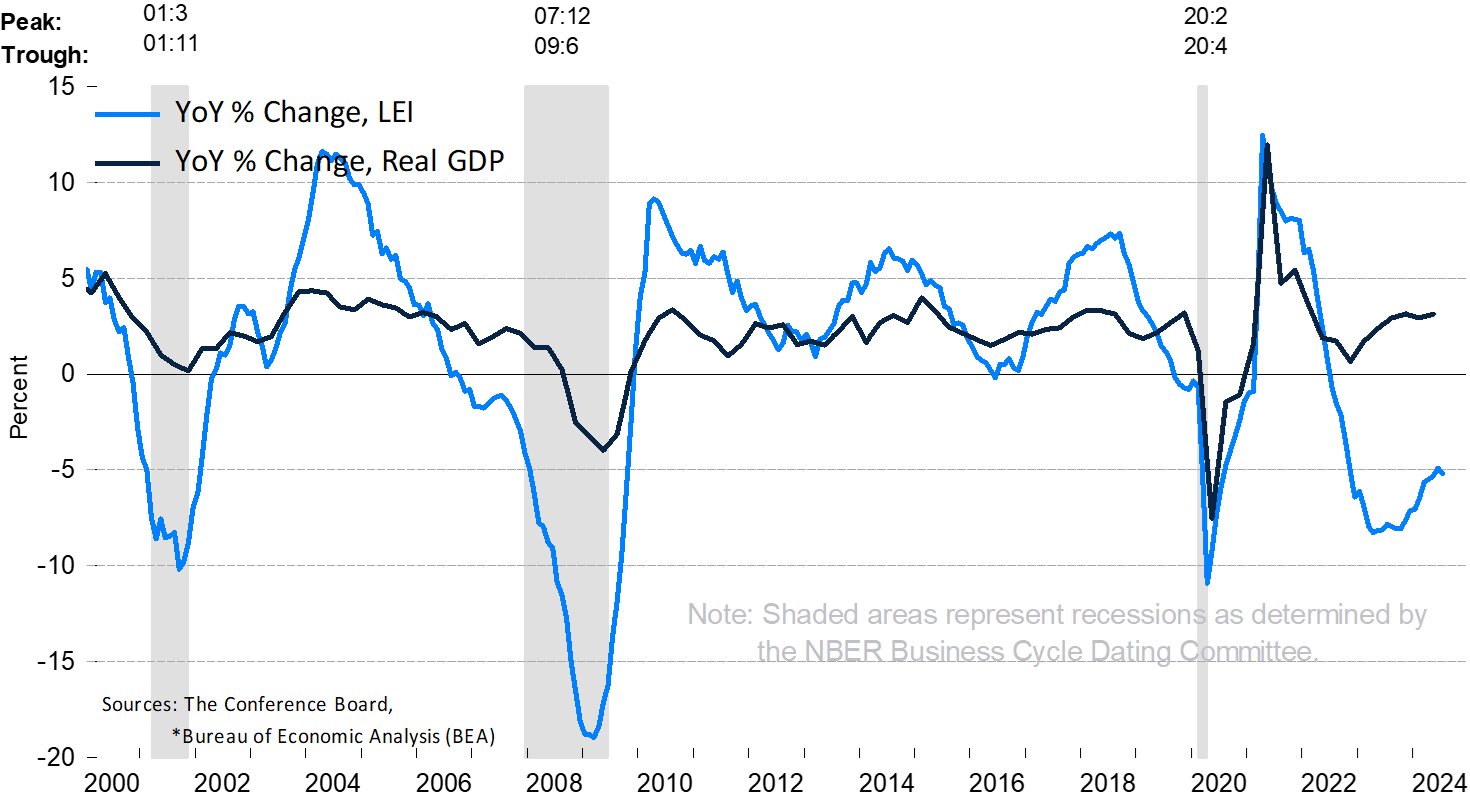

So, what exactly did the Conference Board say? Their Leading Economic Indicators (LEI), which is basically a bunch of different economic factors thrown together, dropped by 0.6% in July.

Now, this might sound bad, but it’s actually a little better than June, which only saw a 0.2% dip. The LEI has been on a downhill slide since it hit its peak in the second quarter of 2022.

But even though it’s still falling, the pace is slowing down, which means the economy isn’t heading straight into a wall just yet.

What’s really going on?

The LEI is made up of things that usually tell you where the economy is headed. We’re talking about stuff like the average hours people work in manufacturing, the number of people filing for unemployment, new orders in the manufacturing sector, stock prices, and credit conditions.

When you put all these together, you get a pretty good idea of whether the economy is about to take a dive or not. Traditionally, when these indicators start pointing down for two quarters in a row, that’s a sign that a recession is on its way.

But here’s the deal. Even though the LEI is still in decline, the drop isn’t as steep as it was before. The six-month annualized change in the LEI narrowed to -2.1% in July, compared to -3.1% in June.

This is probably making some of those risk asset bulls breathe a little easier. With stocks and cryptocurrencies recently taking a beating, this latest data might just be the reassurance they were looking for.

Sure, the market’s been in a slump, but if the worst is behind us, maybe it’s time to start looking up again.

The insanity of this market cycle

Earlier this month, things got shaky when the U.S. nonfarm payrolls data showed that job creation in July wasn’t looking too hot. People started freaking out, thinking a recession was around the corner.

The Treasury yield curve, which is a fancy way of saying the difference between short-term and long-term interest rates, started showing signs of a possible recession too.

This, combined with what’s known as Sahm’s Rule (another indicator that screams recession when things look bad), made the market really nervous.

And let’s not forget the yen carry trade unwinding—yeah, that didn’t help either. Basically, when people borrow yen at low interest rates to invest in higher-yielding assets and then suddenly bail out, it can cause a big mess in the financial markets.

This is exactly what happened, and the result? Stocks tumbled, and Bitcoin didn’t escape the carnage either, tumbling from $70,000 to $50,000.

But as if to prove just how resilient or just plain stubborn the crypto market can be, Bitcoin clawed its way back up to over $60,000. Still, the chaos is far from over, especially with all the uncertainties hanging over the economy.