- Saylor plans to make MicroStrategy a Bitcoin bank.

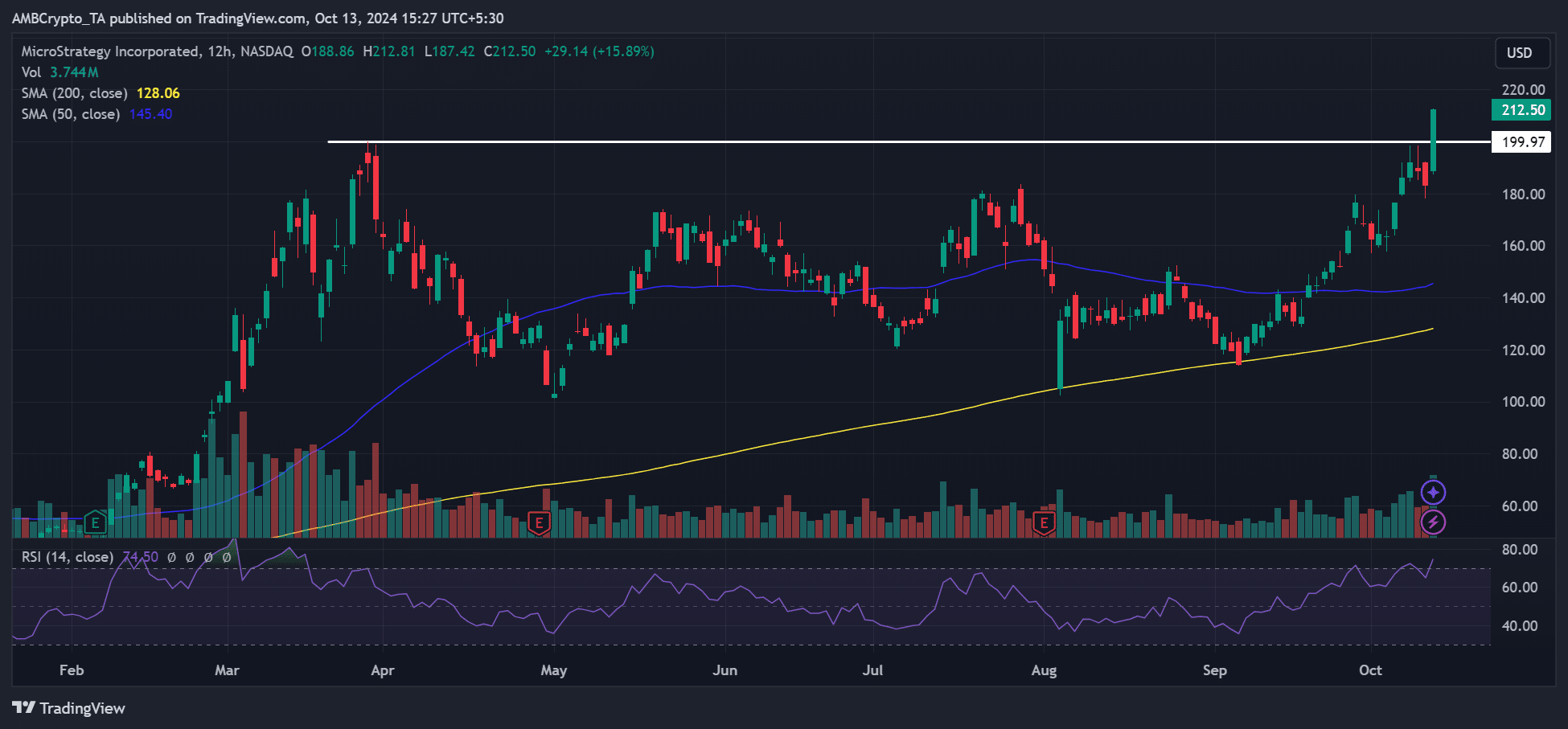

- MSTR rallied and hit an ATH after the revelation.

MicroStrategy’s MSTR stock hit ATH (all-time high) after the revelation of its end goal of becoming a trillion-dollar Bitcoin [BTC] bank.

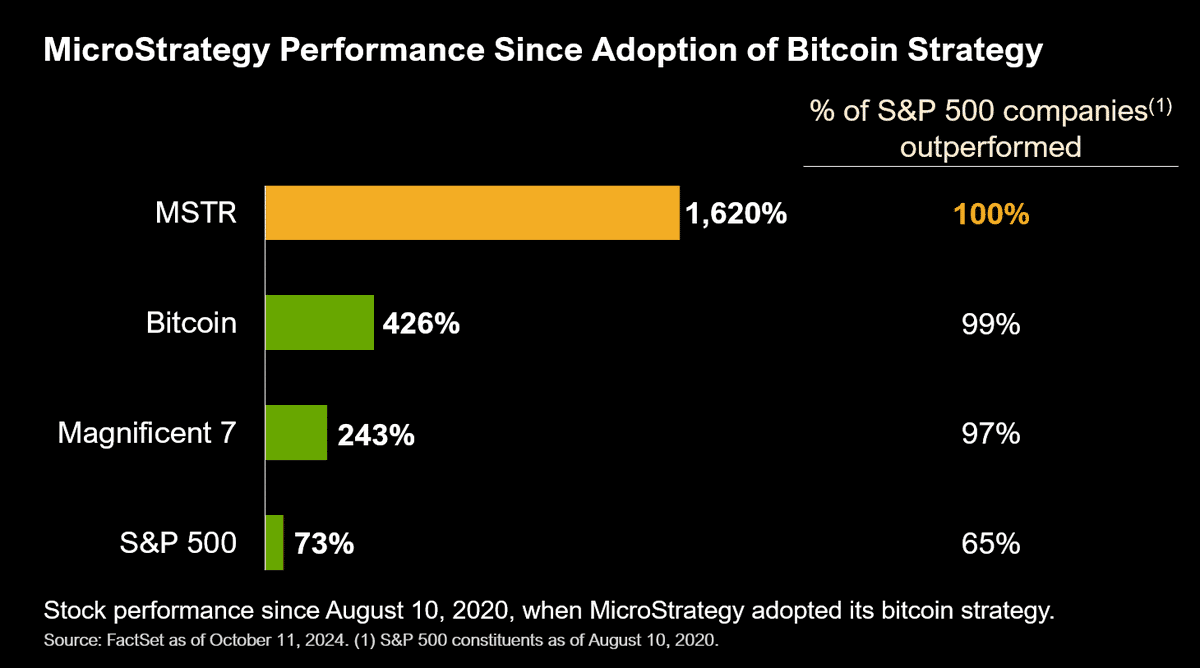

MicroStrategy’s founder, Michael Saylor, told Bernstein analysts his firm was eyeing a $1 trillion valuation as the largest BTC bank.

This would be partly aided by its aggressive accumulation of the world’s largest asset, as the analysts projected a price target of $290 for the stock.

Following the update, MSTR soared to a record high of $212.50, a 15% increase during the intra-day trading session on October 11th. It even smashed the $200 resistance.

Bitcoin bank end-game

Reacting to MSTR’s rally, Saylor noted that the only thing that performs better than BTC was more BTC.

“The only thing better than #Bitcoin is more Bitcoin.”

At press time, MicroStrategy held 252,220 BTC, worth about $15.8 billion per data from Bitcoin Treasuries. In most interviews, Saylor has never stated whether the firm will sell its BTC hoard or its end goal.

But the end-game was made clear last week.

So, what’s a Bitcoin bank?

According to Saylor, BTC bank would act like other asset classes and build financial entities built around them. Part of the Bernstein report stated,

“Michael believes MSTR is in the core business of creating Bitcoin capital market instruments across equity, convertibles, fixed income, and preferred shares etc.”

Saylor had previously projected that BTC could hit $3M-$49M by 2045 as the asset expands as part of global capital.

Thus, the executive projected that making money from creating BTC-based financial instruments like bonds or stocks would be easier than lending out coins held by MicroStrategy.

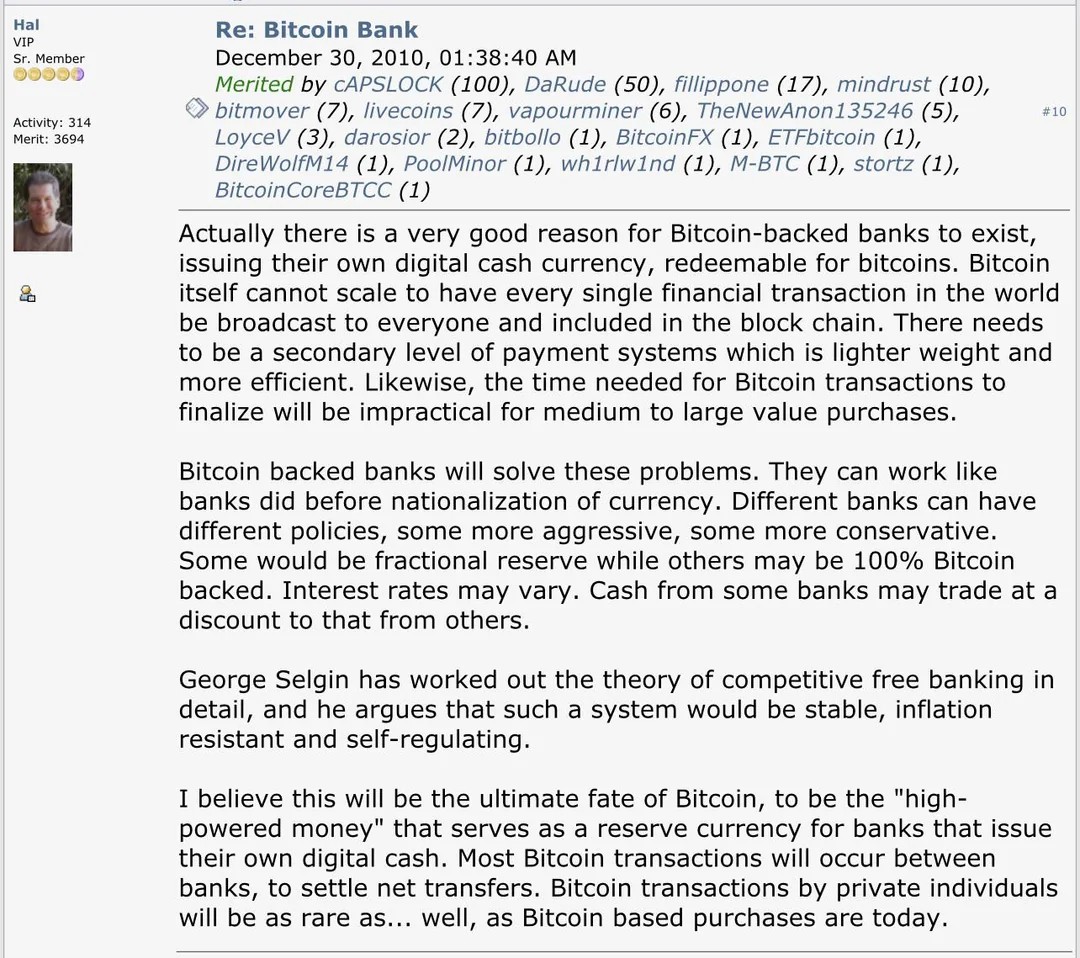

Interestingly, Hal Finney, one of the early BTC network contributors, floated a similar idea in 2010.

But some called for advanced self-custody technology to ensure such a system remains honest.

That said, some market pundits foresaw a strong BTC rally as a positive catalyst for MSTR’s value.

According to financial consultant Ben Franklin, based on MicroStrategy’s financial health and BTC appreciation, MSTR’s value could grow 6x-10x.

![Why Polygon [POL] bulls have been eyeing $0.43 of late](https://cryptosheadlines.com/wp-content/uploads/2024/10/Mapping-POLs-next-move-1000x600.webp-150x150.webp)