Amazon is the leading retail behemoth that continues to take the market by storm. The giant is gearing up to report its Q3 earnings on October 31, compelling investors to develop new forecasts and predictions. However, one noteworthy expert has shared potential reasons Amazon can breach its stock price to breach the $240 mark.

Also Read: Here’s How High Bitcoin (BTC) May Soar This Weekend After Acing $70K

Amazon Web Services Is The Breakout Key For Amazon

Amazon is leaving no stone unturned to ramp up its retail proceedings. The retail behemoth has recently dove head-deep into AI. It has reportedly launched Rufus, its AI shopping assistant, on the Amazon app so that customers can make the most out of their shopping experience. The service has been launched in beta mode across Europe, allowing customers to explore high-end shopping experiences.

Evercore ISI senior manager, director, and head of internet research Mark Mahaney recently shared his insights on how Amazon can soar past the $240 stock price mark. Mahaney interestingly shared how Amazon Web Services are the key part of Amazon’s success and could deliver stellar gains for the firm if it continues revamping its proceedings. Mahaney shared how AWS is a high-margin business for Amazon, with two massive addressable markets.

“Two years ago, the narrative was they were losing share to Microsoft (MSFT). If that narrative change. And it would change if they continue to show accelerating revenue growth—I think that takes the stock higher.” Mahaney shared.

Mahaney later shared that Amazon’s stock can soar if the firm’s retail sales growth metrics spike by 10% and stay consistent over a long period. He also shared how, alongside metrics, retail margins should continue to grow for the stock to breach predicted price pedestals. Amazon is also reportedly exploring the satellite spectrum domain. The firm has invested in Kuiper to boost Satcom services, adding a new arena for the company to dominate and ace.

“Investors are going to want to know what’s happening to the core retail margin trends, e.g., Kuiper. If they can show those to be steadily, consistently, solidly rising. I think if you put those two or three elements together, the stock goes higher,” Mahaney later added.

Also Read: Walmart: WMT Gets $90 Target Upgrade Despite One Key Concern

The Stock’s TipRanks Forecast

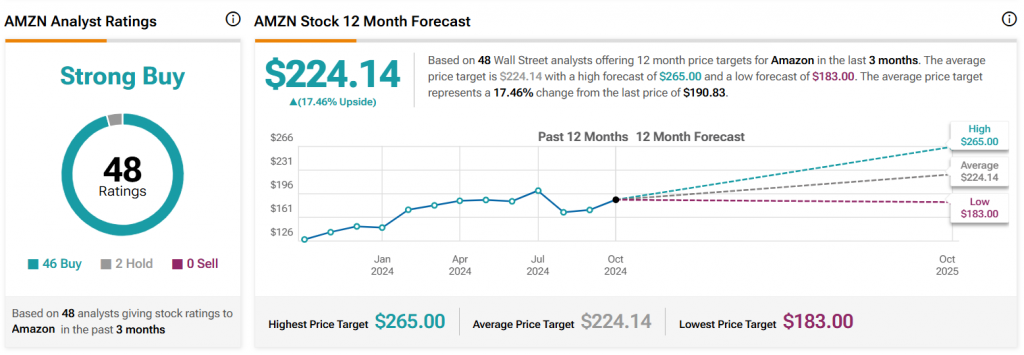

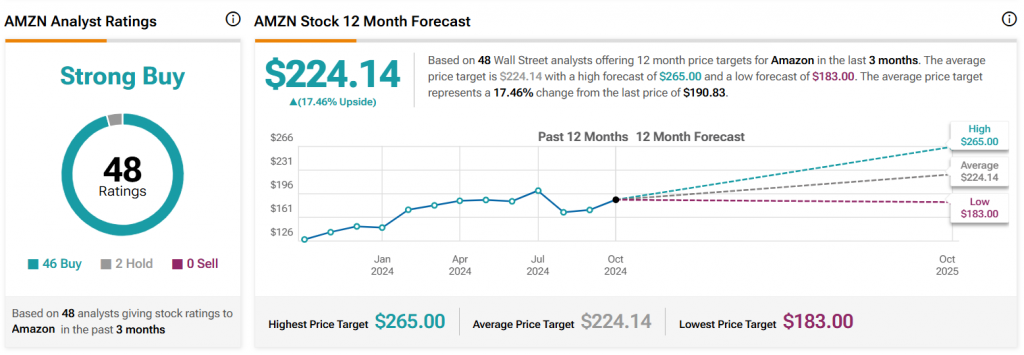

According to TipRanks, Amazon’s immediate price target is stable at $224, with a high of $265 that the firm can claim within the next 12 months.

“The average price target for Amazon is $224.14. This is based on 48 Wall Street Analysts’ 12-month price targets issued in the past 3 months. The highest analyst price target is $265.00; the lowest forecast is $183.00. The average price target represents a 17.46% increase from the current price of $190.83. Amazon’s analyst rating consensus is a strong buy. This is based on the ratings of 48 Wall Street analysts.”

Also Read: Top 3 Cryptocurrencies That You Should Watch In Q4 2024