Cryptocurrency analytics firm Alphractal reports that Bitcoin miners are experiencing what could be the first capitulation of 2024, with more potential challenges ahead.

The company’s analysis, based on Hash Ribbons, Difficulty Ribbons, and its proprietary capitulation identifier, highlights two types of miner capitulation: Moderate and Aggressive.

Moderate Capitulation

Moderate Capitulation, bazı madencilerin genellikle stratejik bir Bitcoin satışını veya iş modellerinde yapılan ayarlamaları takiben operasyonlarını küçültmesi veya kapatması durumunda ortaya çıkabilir. Bu tür bir kapitülasyon tipik olarak düşen kârlar veya operasyonel verimsizlikler tarafından tetiklenir ancak Aggressive Capitulation kadar şiddetli değildir.

Aggressive Capitulation

Aggressive Capitulation daha uç bir olaydır ve genellikle Bitcoin fiyatındaki keskin düşüşler veya ani dış şoklar nedeniyle önemli sayıda madencinin faaliyetlerini durdurmasıyla işaretlenen nadir bir durumdur. Kayda değer bir örnek, birçok madenciyi aniden faaliyetlerini durdurmaya zorlayan Çin’deki 2021 madencilik yasağıydı. Tarihsel olarak, Aggressive Capitulation Bitcoin fiyat diplerine denk gelir ve 2011, 2018 ve 2021’de olduğu gibi boğa piyasaları sırasında yüksek madenci geliri dönemlerinden sonra ortaya çıkar.

Alphractal’a göre, Aggressive Capitulation tipik olarak Bitcoin ağının hash oranı ile zorluk ayarlaması arasında büyük bir eşitsizlikle tetiklenir ve bu süreç yaklaşık 14 gün sürer. Kapitülasyon olayları genellikle iki haftadan fazla sürmediği için bu kısa pencere genellikle çok önemlidir.

What is the 2024 Bitcoin Miner Capitulation Like, According to the Analysis Firm?

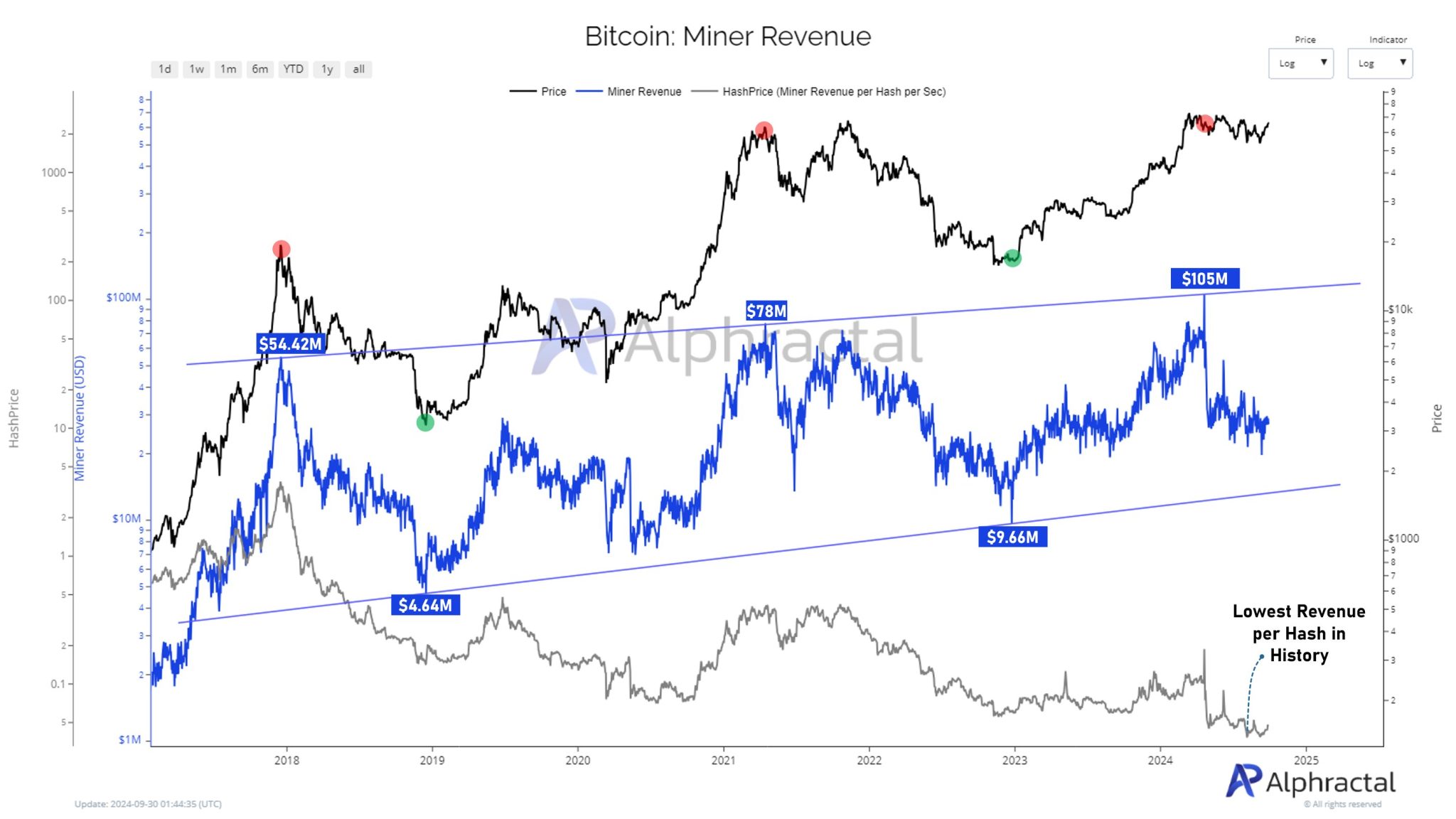

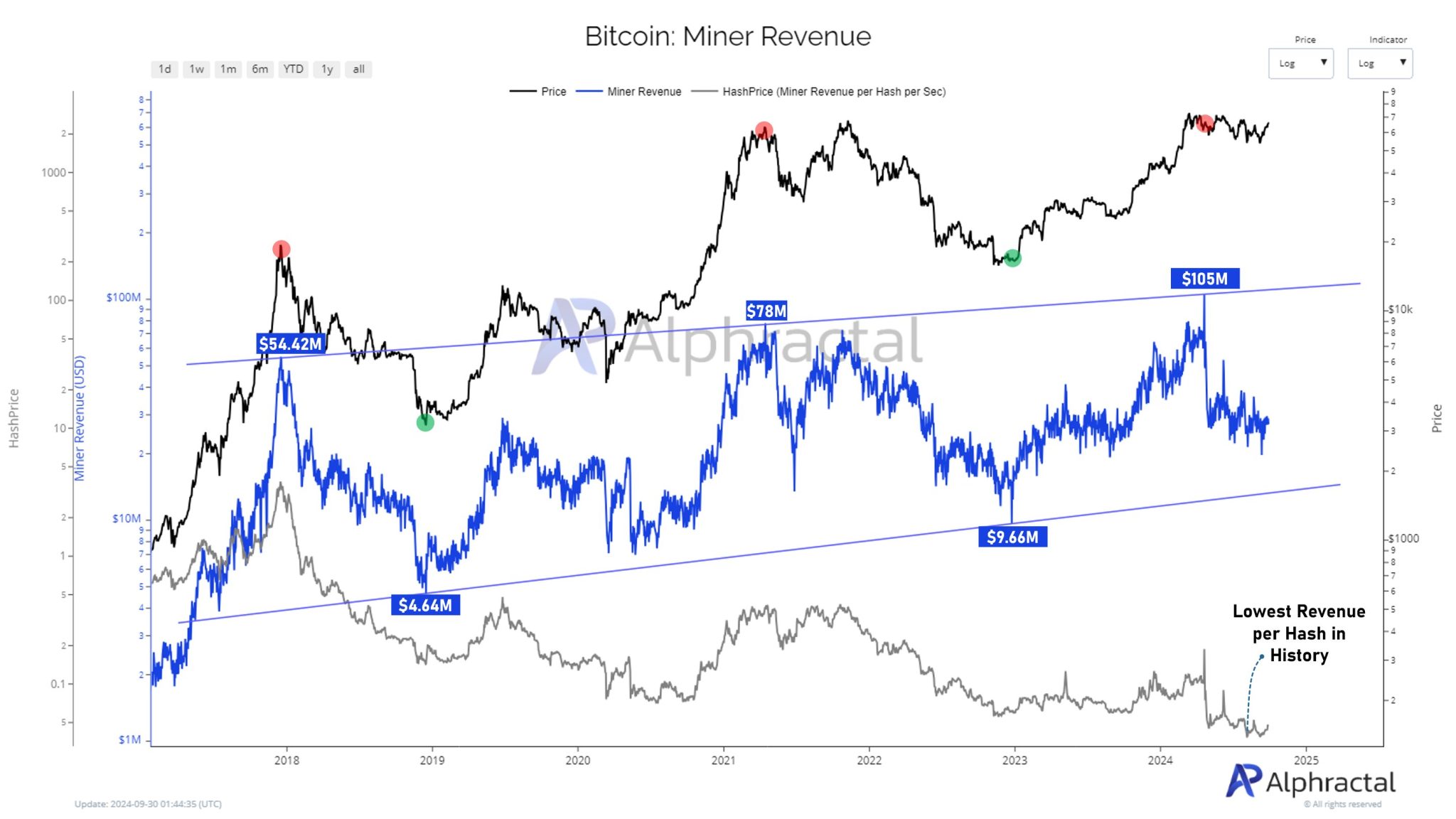

In June 2024, Bitcoin miners experienced a moderate capitulation event, with daily revenue per hash falling to its lowest point in history. This led many miners to re-evaluate their operational strategies. While total mining revenue in USD terms peaked at $105 million this year, post-hash revenue did not return as it did in previous cycles, indicating a shift in market dynamics.

One of the most significant changes noted by Alphractal is the increasing presence of large mining companies, which has changed fundamental on-chain metrics. The performance of these companies’ stocks is now more closely tied to on-chain data, reflecting a more centralized and competitive environment. This centralization creates new risks as smaller miners struggle to compete with larger companies that can invest in new equipment and optimize their operations.

Alphractal warns that if a major mining company shuts down, it could lead to a sharp drop in the Bitcoin network’s hash rate, potentially triggering a new round of miner capitulations. With these risks on the horizon, the future of Bitcoin mining in 2024 looks more uncertain than in previous cycles.

*This is not investment advice.