Key Points

- An Ethereum whale from the ICO stage has reportedly started selling large amounts of ETH again.

- This could potentially lead to increased sell pressure and affect Ethereum’s price action.

Ethereum Whale Begins Large-Scale Selling

A whale who participated in the initial coin offering (ICO) of Ethereum has reportedly started to offload large amounts of ETH. This was recently observed and could lead to significant implications.

The whale, according to Lookonchain, has just sold 3,000 ETH. Interestingly, this same whale address sold 7,000 ETH at the beginning of July. This could suggest a correlation with Ethereum’s price action.

Potential Market Impact

After the July sale, Ethereum’s price dipped by 15%. This indicates that news of such a large sale could potentially trigger a sell event. The market might react with an increase in sell pressure.

At the time of writing, Ethereum was already experiencing significant sell pressure, with its price dropping to $2,526. This was after an 8% pullback from its weekly high. It also retested a short-term ascending support line in the last 24 hours.

Lookonchain’s analysis suggests that more sell pressure might be on the horizon. This contradicts the possibility of Ethereum bouncing from the aforementioned ascending support.

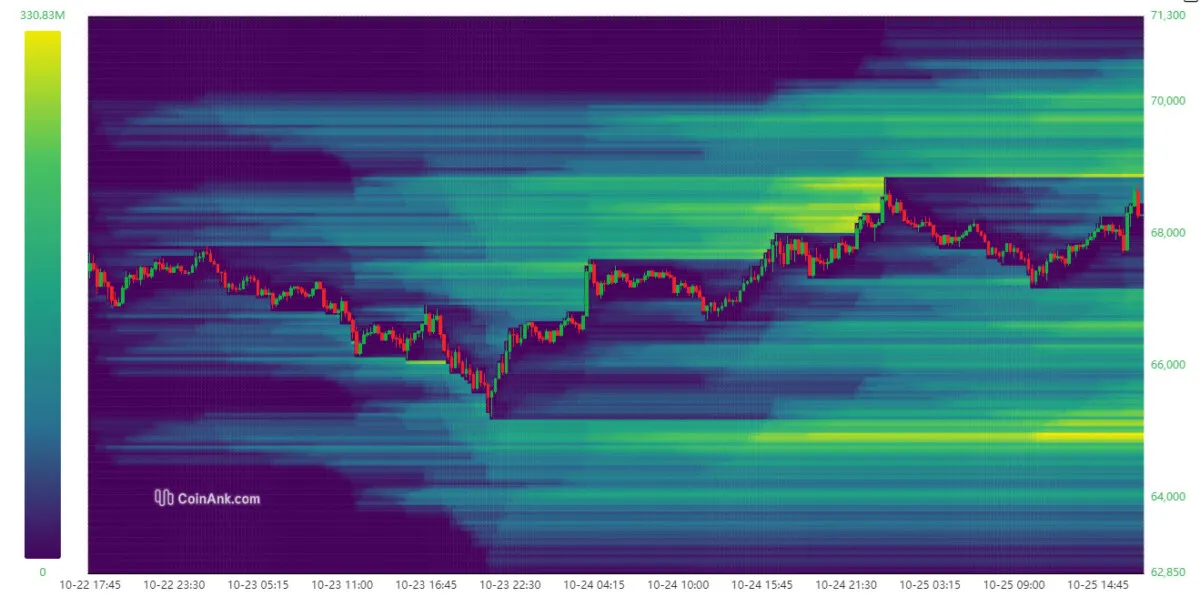

Exchange Flow Data and Volatility

Ethereum’s exchange flow data showed that both exchange inflows and outflows have dropped. This could lead to a pivot in the next few days, potentially resulting in increased volatility.

Exchange inflow data was higher over the last 24 hours at 144,830 ETH, while outflow data was lower at 140,614 ETH. This indicates higher sell pressure than buy pressure. However, the price appeared to have bottomed out at the support level, possibly due to whale activity.

Data from IntoTheBlock revealed that the amount of Ethereum flowing into large holder addresses was higher at 360,320 ETH. Meanwhile, outflows from large holder addresses were down to 248,590 coins. This confirms that whales have been accumulating at recent lows.

Despite this accumulation, the lack of a significant price uptick in the last 24 hours indicates a high degree of uncertainty. This could potentially lead to weak demand in the near future.