- APT has a strongly bullish outlook in the coming weeks.

- The short-term bias was also bullish but BTC volatility could damage it.

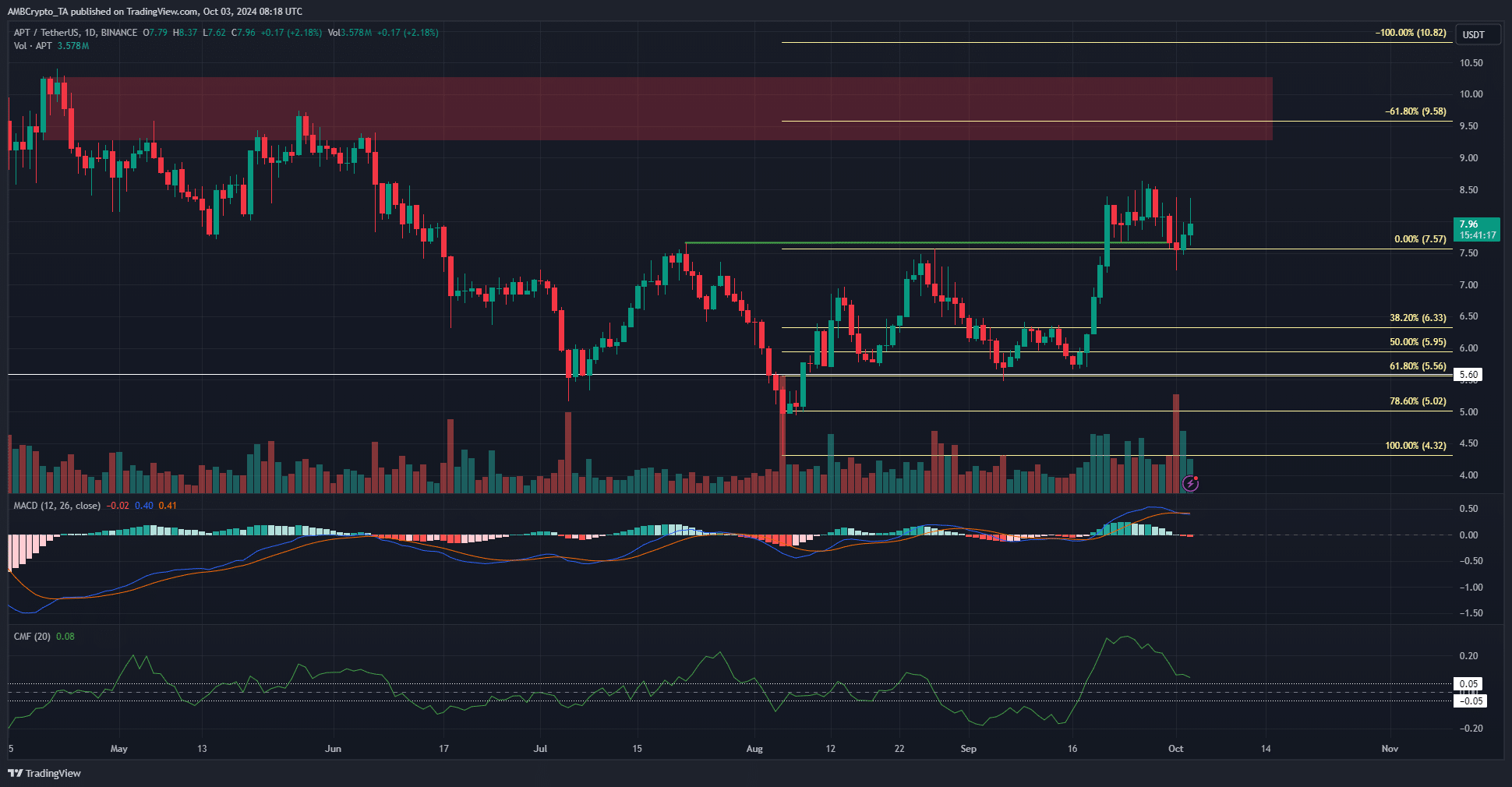

Aptos [APT] has a bullish structure on the weekly chart and maintained its upward trajectory despite the volatility and fear in the market in the past week. The breakout past $7.5 saw a pullback alongside the rest of the market.

Yet, the higher timeframes did not signal a bearish trend was in progress. A drop below $7.23 would be the first sign of a bearish scenario. This drop did not seem likely based on the evidence at hand.

Aptos crypto retests August high as support

The volatility on Tuesday, the 1st of October, saw Aptos lose 1.56% for the day, but intraday trading was highly volatile. The trading volume rivaled that of the 5th of August’s panic.

Despite this fearful setting, the price did not fall below $7.57. This level was the high in August that was used to plot the Fibonacci retracement and extension levels. The 61.8% extension at $9.58 lined up well with a weekly bearish order block around $10.

The 100% extension level was at $10.82, a resistance zone from December 2023. Swing traders will be targeting these levels in the coming months.

The trend on both the daily and the weekly charts was bullish, although the MACD formed a bearish crossover to show some bearish short-term momentum. The CMF also dropped significantly but was still above +0.05 to indicate notable buying pressure.

Shift in the Open Interest trends

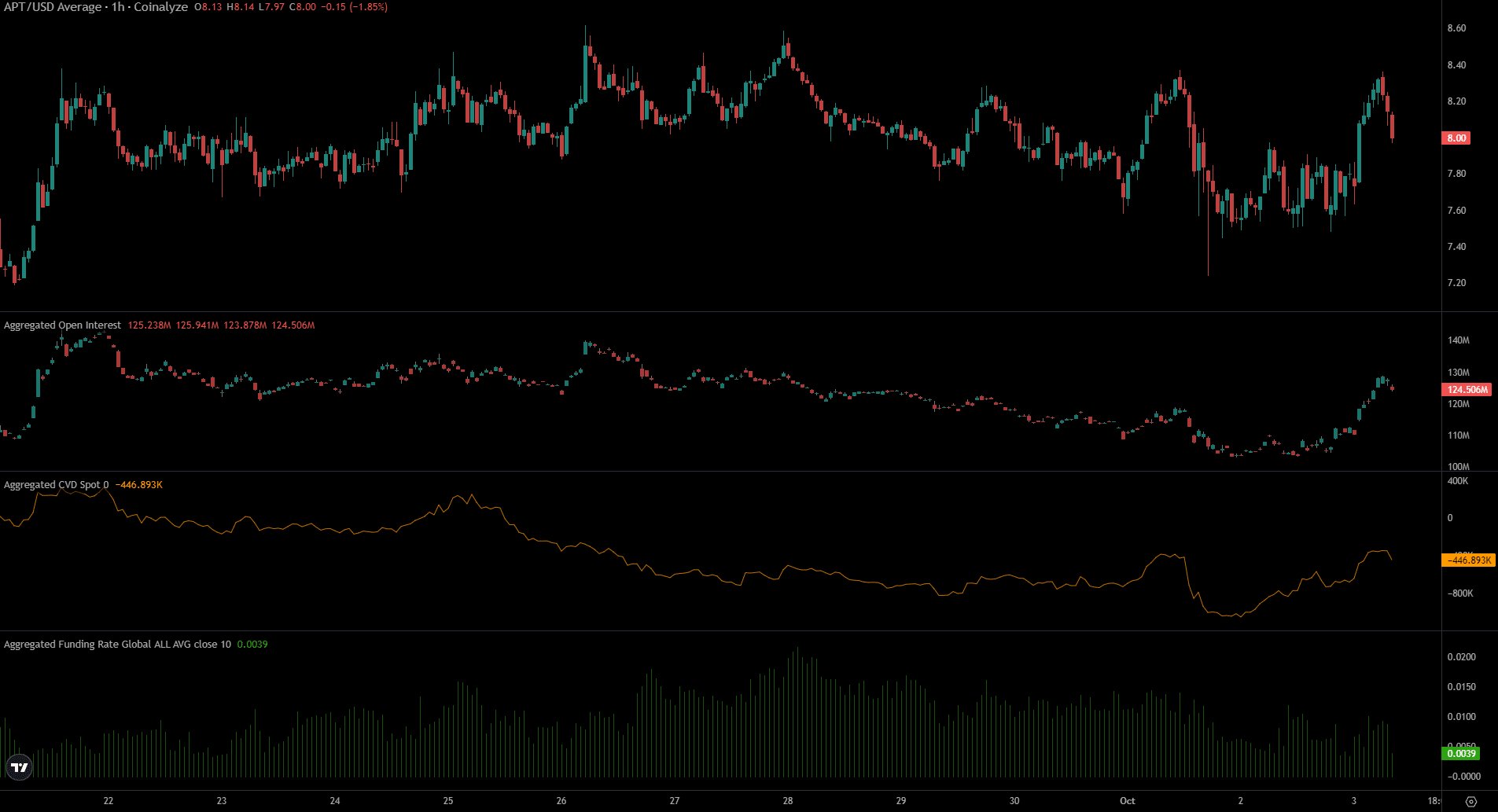

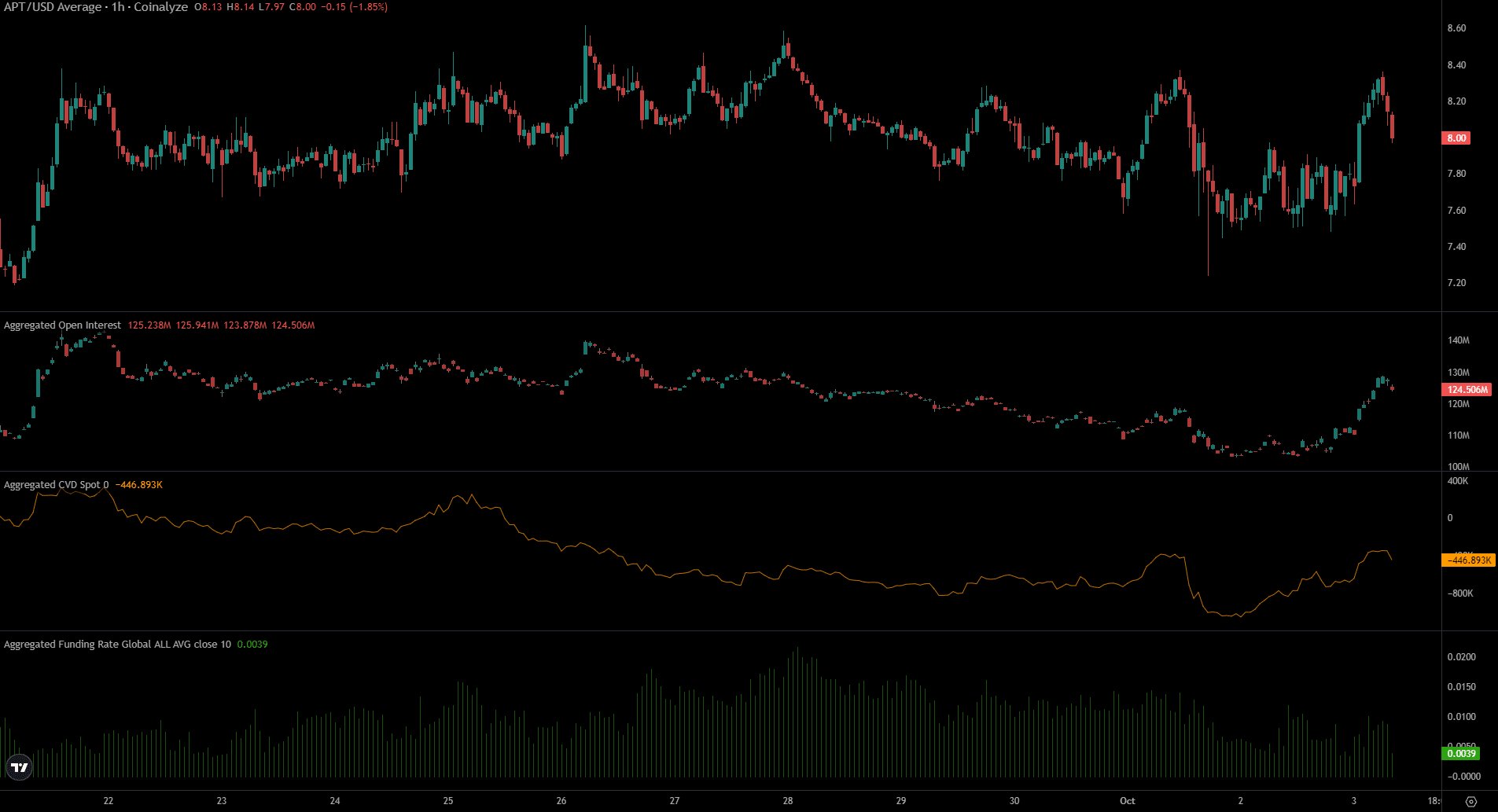

Source: Coinalyze

The Open Interest had been in a downtrend in the past week but this changed markedly in the past 24 hours. The OI rose from $104 million to stand at $124 million while APT bounced by 7.2%.

Is your portfolio green? Check the Aptos Profit Calculator

The spot CVD also saw a steady increase in recent days. Together they showed that the short-term market sentiment was bullish and participants expected more gains.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion