- Aptos broke out of a downtrend with bullish indicators like RSI and MACD suggesting momentum.

- Whale accumulation, rising TVL, and increased open interest confirm Aptos’s potential for further gains.

Aptos [APT] has successfully broken out of its descending channel and is now poised for a significant move upward.

With analysts predicting a potential 3x gain from current levels, all eyes are on Aptos as it tests resistance around the $7.8 mark. Can it solidify its breakout and trigger a long-term rally?

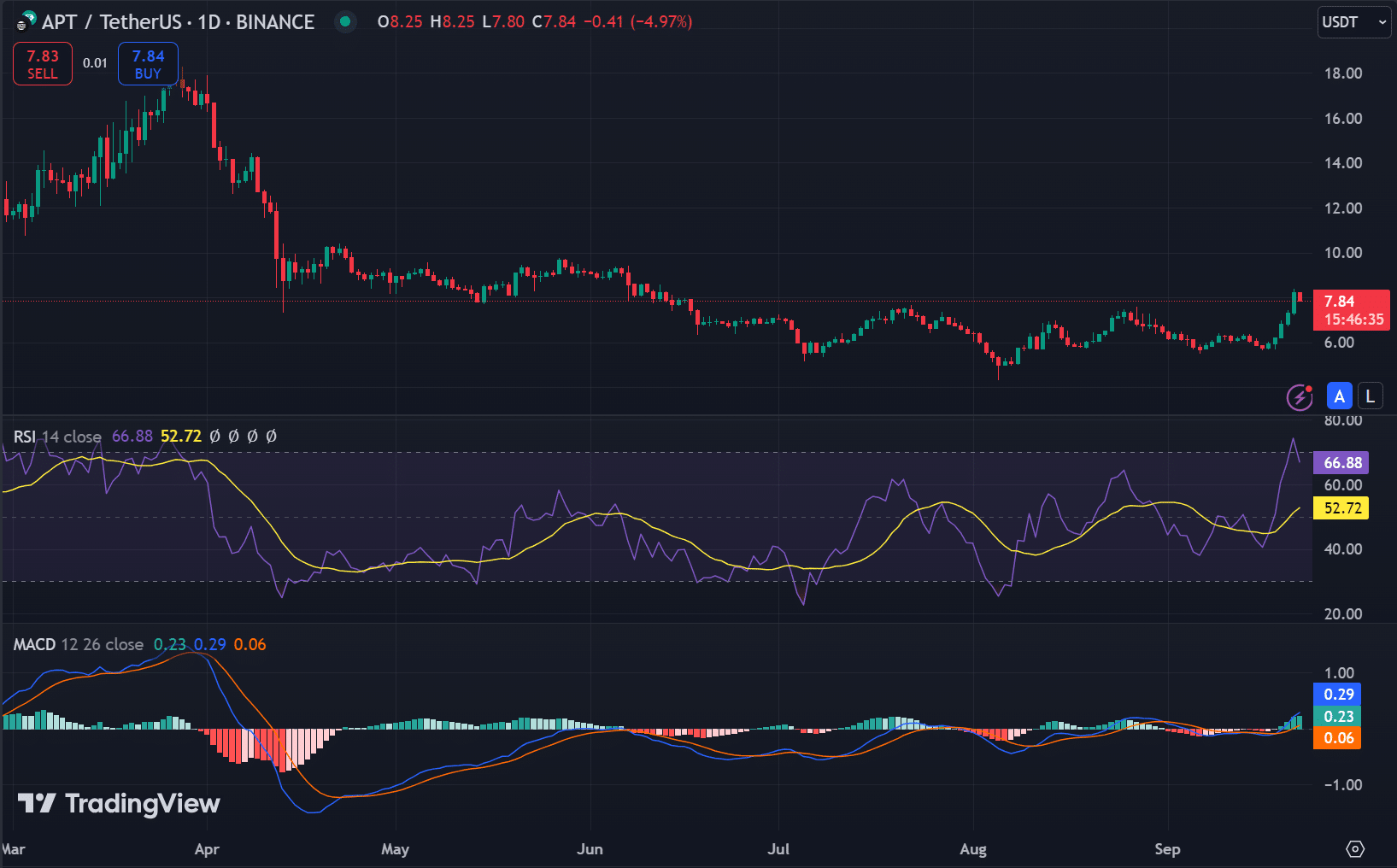

Is Aptos primed for a rally? Analyzing price action

Aptos shows signs of a bullish reversal after breaking out of a prolonged downtrend. The price has reached $7.84, with a key resistance at $7.83.

Technical indicators such as the Relative Strength Index (RSI) suggest bullish momentum, sitting at 66.88 at press time—just below overbought territory, reflecting increased buying pressure.

Additionally, the MACD also displays positive divergence, signaling potential further upward movement if momentum holds.

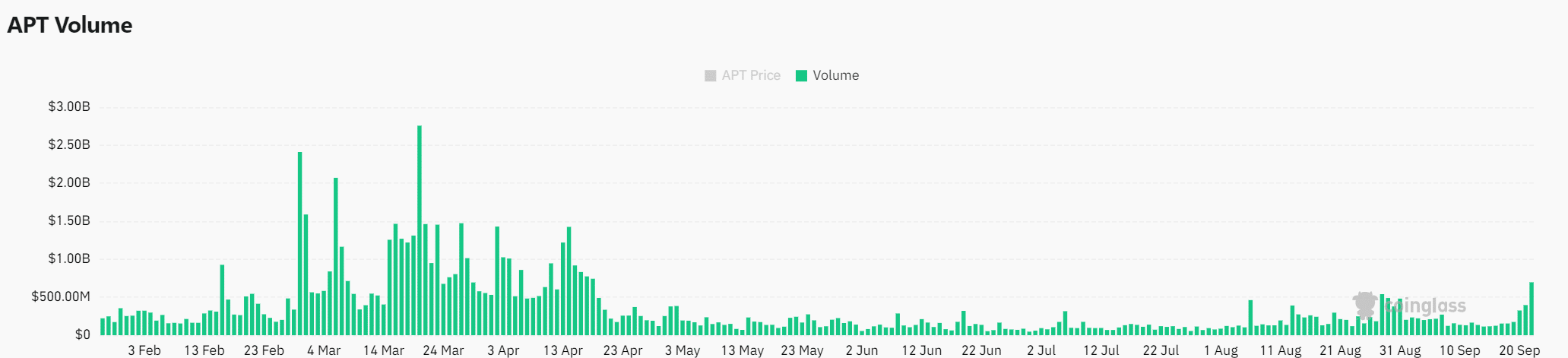

Volume surge signals strong market interest

Volume is a crucial indicator of price action validity, and Aptos has seen a remarkable increase in trading activity. Over the last 24 hours, trading volume has surged by 93.71%, reaching $726.99 million.

This massive influx of trading signals growing investor interest in APT, aligning with the price breakout and indicating that the market could sustain its momentum.

Is rising TVL pointing to increased adoption?

Total Value Locked (TVL) offers key insights into how much liquidity and trust the market places in a blockchain. For Aptos, TVL has risen sharply, increasing from $916.85 million to $935.86 million in the last 24 hours.

This significant growth highlights the increasing adoption of the Aptos network and signals bullish fundamentals that could support further price appreciation.

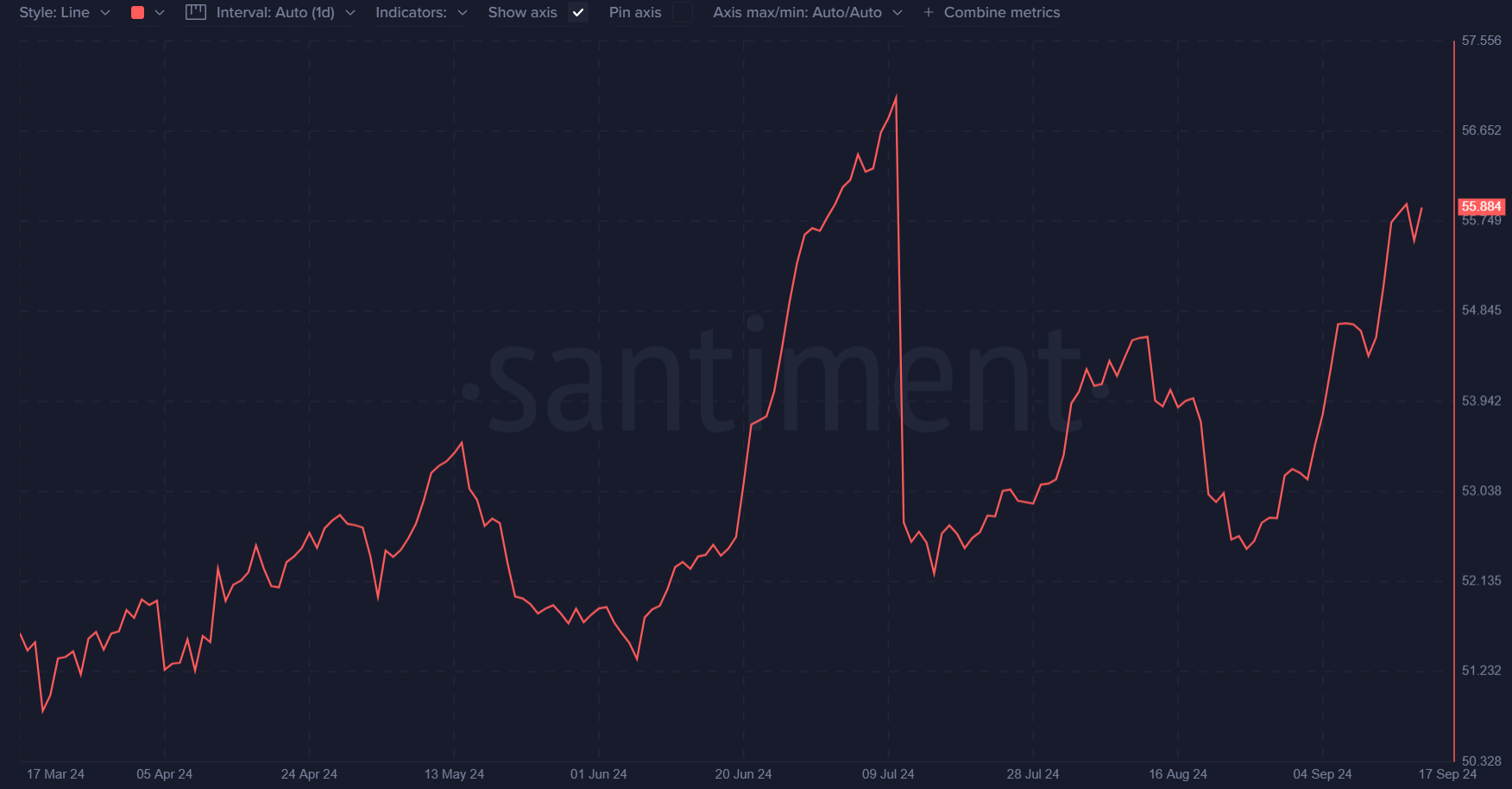

Are whales accumulating APT?

The percentage of stablecoins held by whales, over $5 million, has also surged, standing at 55.88%. Whale accumulation is often a precursor to a price rally, as larger holders tend to move markets.

This trend suggests that major players are taking positions in APT, anticipating future gains.

Growing open interest confirms market momentum

According to Coinglass data, open interest in Aptos futures has increased by 12.87%, reaching $148.45 million at press time. Rising open interest alongside increasing price action strongly indicates that the market believes in continuing Aptos’s bullish trend.

With rising interest from both futures traders and spot buyers, APT is positioned to make significant gains in the coming weeks.

Read Aptos’ [APT] Price Prediction 2024-25

Can Aptos maintain the momentum?

With growing interest from whales, a sharp rise in TVL, and strong volume backing its recent breakout, Aptos appears poised for a significant long-term rally.

However, sustained momentum is critical. If Aptos can maintain this level of market interest, the 3x target may indeed be within reach.