- ARB holders anticipated a breakout, with a potential 182.72% price surge from current levels.

- Despite declining activity, ARB’s $2.47 billion TVL suggested strong DeFi performance amid price uncertainty.

Arbitrum [ARB] was trading at a crucial level at press time, with analysts suggesting a potential breakout could lead to a significant price surge.

The token has been trading in a descending channel for an extended period, consistently hitting resistance at the top of the channel and finding support at the bottom.

At the time of writing, ARB’s price hovered around the upper boundary of this channel, hinting at a possible bullish reversal if it breaks above this critical level.

According to a recent analysis, the price of ARB could rise to approximately $1.50 if a breakout occurs. This projection marked a potential 182.72% increase from its current value of $0.5082.

As the token continued to test the resistance level, traders are closely monitoring its next move to see if it will trigger a significant rally.

Decline in ARB price and trading activity

Despite a potential breakout, ARB’s recent price action has been less favorable. ARB has seen a -5.07% decline in the last 24 hours and a -1.11% decline over the past seven days.

With a circulating supply of 3.5 billion ARB tokens, its press time market cap stood at $1.77 billion.

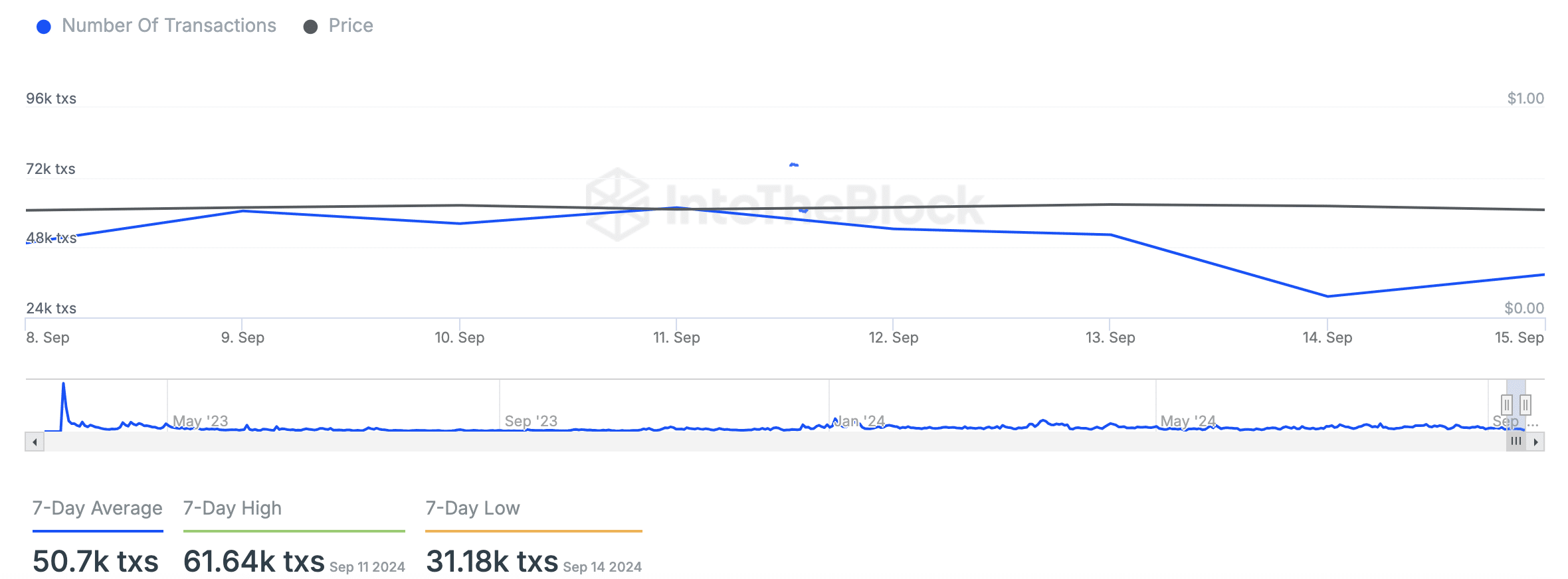

Alongside the price drop, on-chain activity has also decreased. Data shows that ARB’s transaction volume has been trending downward, with a 7-day average of 50.7k transactions.

The highest transaction volume in this period was 61.64k on September 11, while the lowest, 31.18k, was recorded on the 14th of September.

Moreover, large transactions have also seen a decline, with only 51 recorded in the last 24 hours, a drop from a peak of 110 on the 10th of September.

Despite this reduced activity, the price has remained stable around $0.50, raising questions about the potential for a breakout.

On-chain metrics show mixed signals

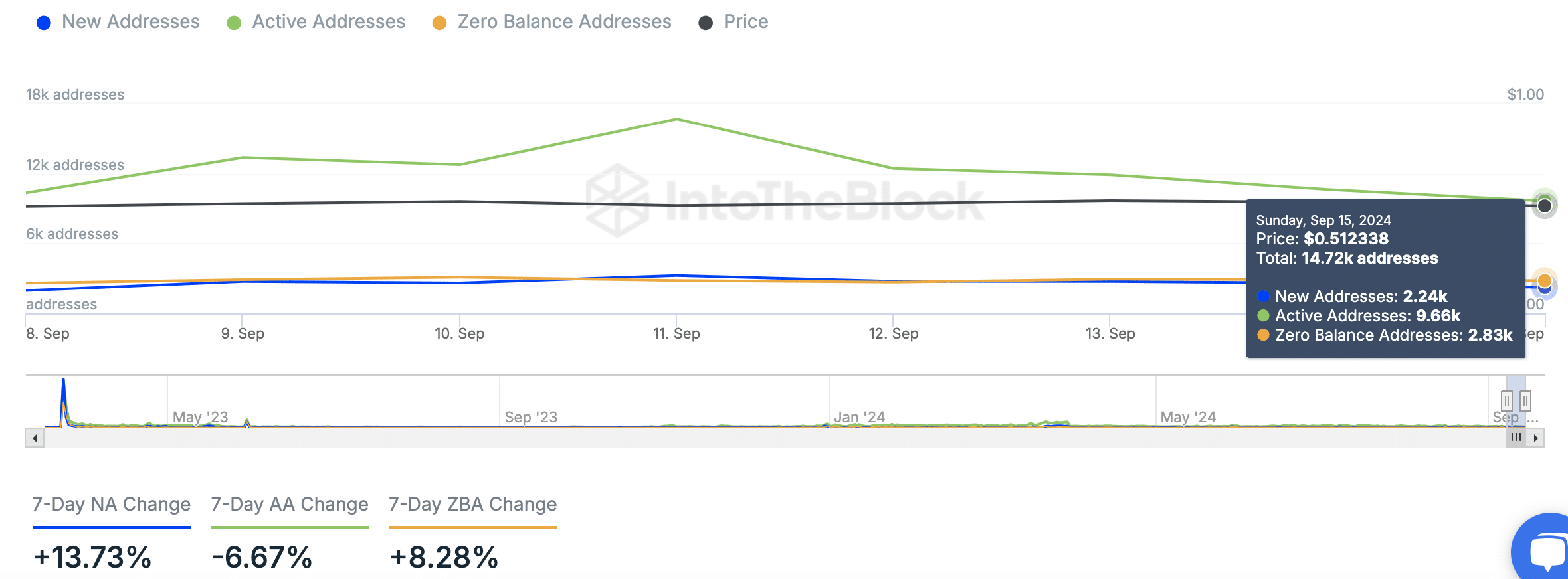

Recent data from IntoTheBlock highlighted both positive and negative trends in ARB’s on-chain metrics. The number of new addresses has increased by 13.73% over the past week, reaching 2.24k.

However, the number of active addresses has dropped by 6.67%, down to 9.66k. In contrast, zero balance addresses have risen by 8.28%, indicating a higher number of dormant accounts.

Despite these metrics, ARB’s total value locked (TVL) remained robust, sitting at $2.47 billion at press time, per DefiLlama.

Stablecoin market capitalization on the platform stood at $4.701 billion, with $11,118 in fees and $9,417 in revenue over the last 24 hours.

This strong performance in the DeFi space has yet to translate into a price recovery for ARB, though the possibility of a breakout may change that.

A recent report from AMBCrypto suggests that nearly 100% of ARB holders are currently holding at a loss.

Read Arbitrum’s [ARB] Price Prediction 2024–2025

This is reflective of the token’s prolonged downtrend in recent months, even as the platform itself continues to perform well in terms of TVL and market share in the DeFi space.

The token’s decline has raised concerns among holders, especially as on-chain activity has slowed.