- DOT struggles to secure bullish momentum and we explore why.

- Polkadot dominance slides to 12-month lows but fee-paying transactions underscore life signs.

Polkadot [DOT] has been in a downward spiral for the last five months. There were various bullish attempts along the way and signs that the bulls would take over, only for price to extend its downside.

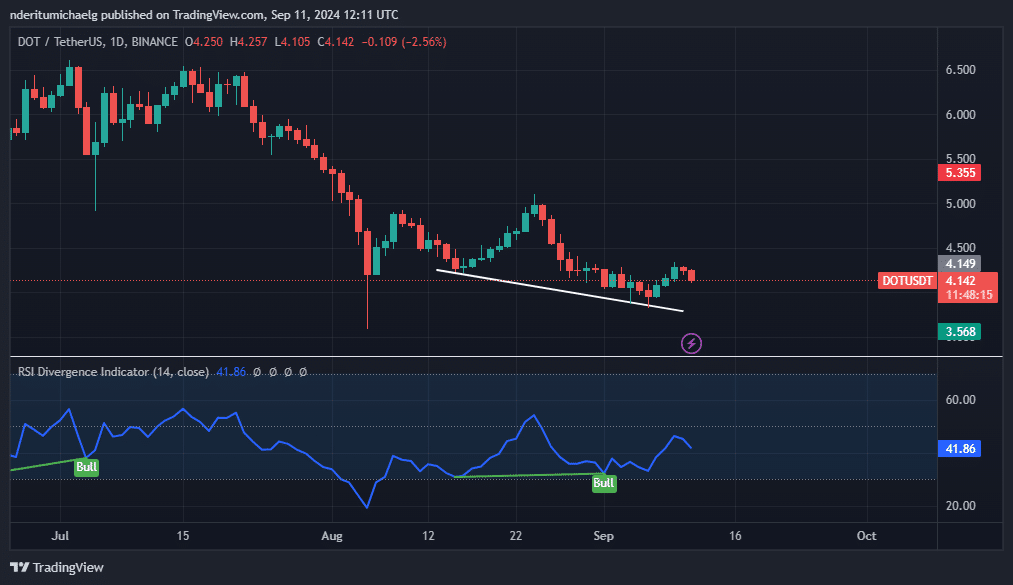

DOT traded at $4.14 at press time, which was roughly a 27% premium form its August highs. More importantly, the cryptocurrency kicked off this week with bullish expectations after flashing a bullish RSI divergence in the last few weeks.

Although it may still be too early to judge DOT’s recent attempted upside, the cryptocurrency appears to be experiencing the same problem this week. Demand for DOT has been quite low despite its recent upside, hence its struggle to bounce back.

Why DOT has been struggling to find a bullish footing

Most of the top performing cryptocurrencies are aligned with key narratives that have prevailed over the last few months. The Polkadot network failed to capitalize on this trend. As a consequence, liquidity has been flowing elsewhere.

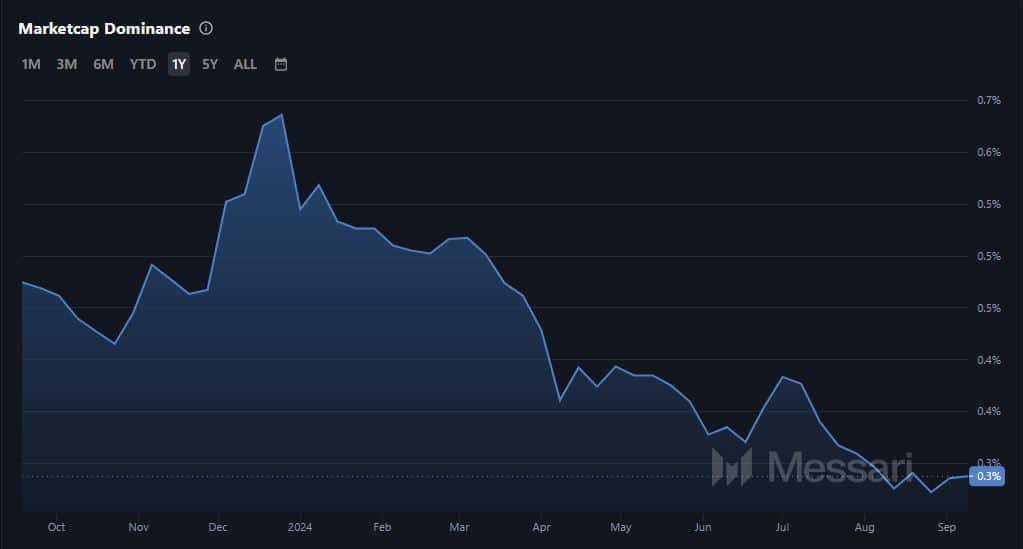

The above explanation coincides with Polkadot’s dominance performance. For example, the network demonstrated a surge in dominance between October and December last year.

This phase was characterized by a robust price rally. Polkadot dominance has since then been slashe from 0.63% to 0.%.

Polkadot’s dominance bottomed out at 0.27% towards the end of August. This reflects the downward trajectory observed in DOT’s price action. It was also evident in the network’s performance.

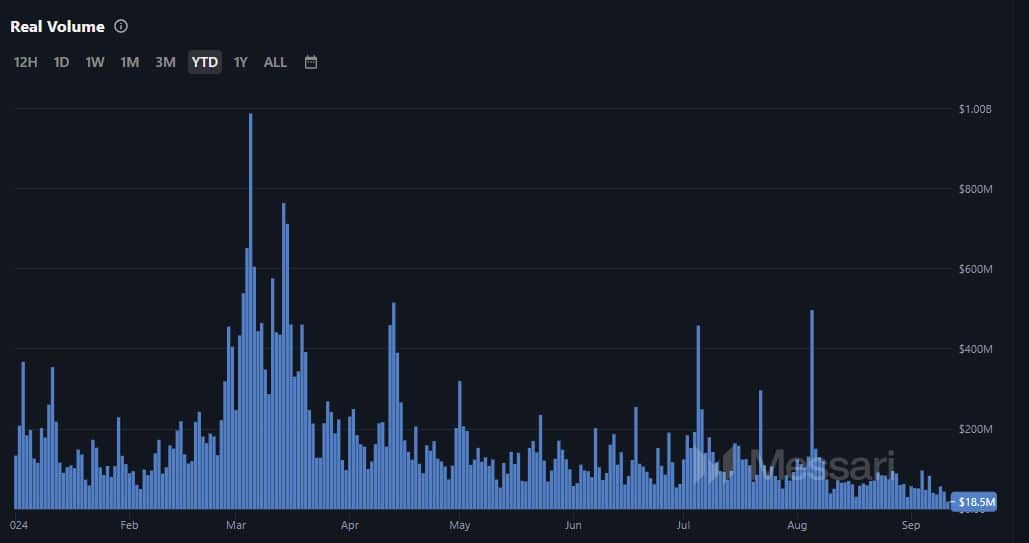

An environment characterized by declining liquidity and the inability to tap into narratives also influenced on-chain volumes.

Polkadot’s highest 12-month on-chain volume was observed in March this year. Real volume peaked at $988.1 million.

Polkadot’s daily real volume in the last few days was restricted below the $50 million level. This was further evidence of the extent of how the network’s utility slowed in the last few months, consequently affecting DOT.

Will there be redemption for Polkadot and DOT?

There is some good news despite all the doom and gloom. Polkadot’s ecosystem maintained decent activity so far this year. The network recently reported that the number of fee-paying transactions operating on Polkadot rollups doubled within the last 12 months.

Read Polkadot [DOT] Price Prediction 2024-2025

Meanwhile, DOT is close to its October 2023 lows. This is important because there was a strong demand resurgence near those levels, leading to healthy rally that peaked in March.

Investors may see this as an opportunity to jump in at discounted prices.