- Despite the price drop, bearish sentiment around AVAX increased.

- In case of a continued bull run, AVAX might reclaim $32 soon.

While the market condition remained sluggish, Avalanche [AVAX] showcased promising performance. In fact, AVAX was the top performer in terms of price gains in the last 24 hours among the top 20 cryptos by market capitalization.

Let’s have a closer look at AVAX’s state to see where it might reach if the bull trend continues.

Avalanche beats Bitcoin, Ethereum

CoinMarketCap’s data revealed that while typo coins like Bitcoin and Ethereum witnessed slight upticks, AVAX bulls pushed the token’s price up by more than 6% in the last 24 hours.

At the time of writing, Avalanche was trading at $23.03 with a market capitalization of over $9.33 billion, making it the 12th largest crypto.

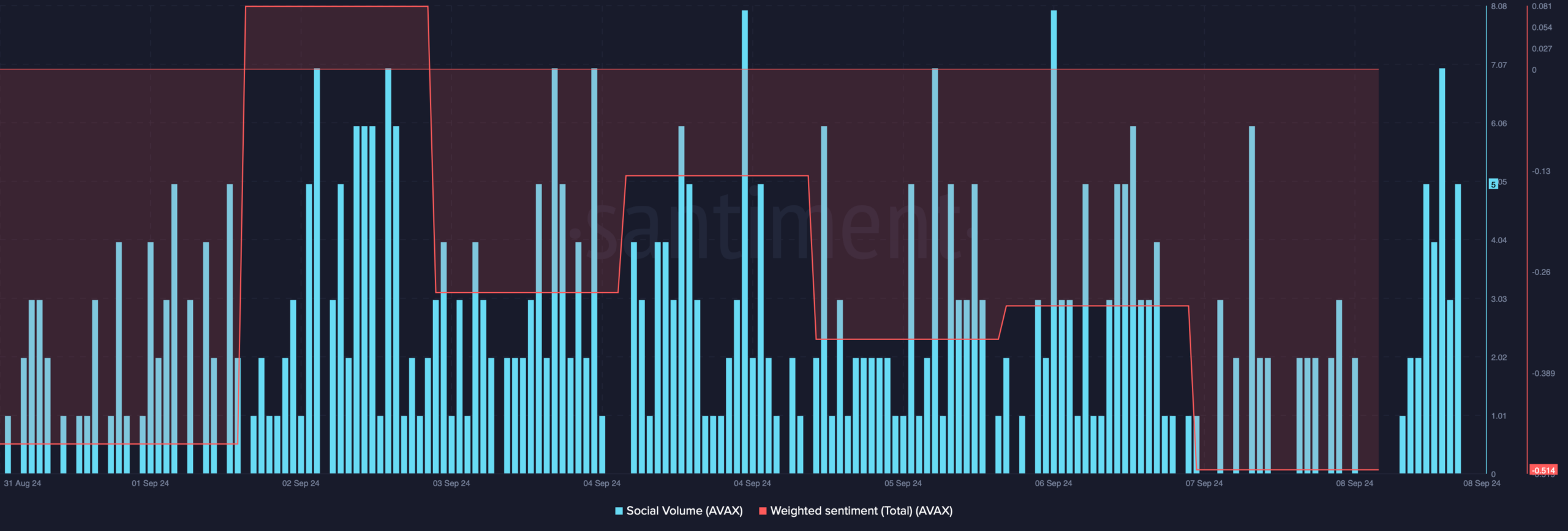

However, it was surprising to note that the price uptick failed to stir up bullish sentiment in the market. AMBCrypto’s analysis of Santiment’s data revealed that AVAX’s weighted sentiment dropped.

This indicated that bearish sentiment around the token increased. But its social volume remained high, reflecting the token’s popularity in the crypto space.

Nonetheless, long-term investors’ confidence in AVAX did increase over the last few weeks.

As per IntoTheBlock’s data, the number of AVAX holders (addresses holding an asset for more than 1 year) exceeded the number of AVAX cruisers (addresses holding an asset for 1-12 months).

This indicated that long-term holders were expecting the token’s price to rise further in the coming weeks or months.

Will AVAX maintain its bullish momentum?

AMBCrypto then planned to assess Avalanche’s on-chain metrics to see whether they hint at a continued price increase.

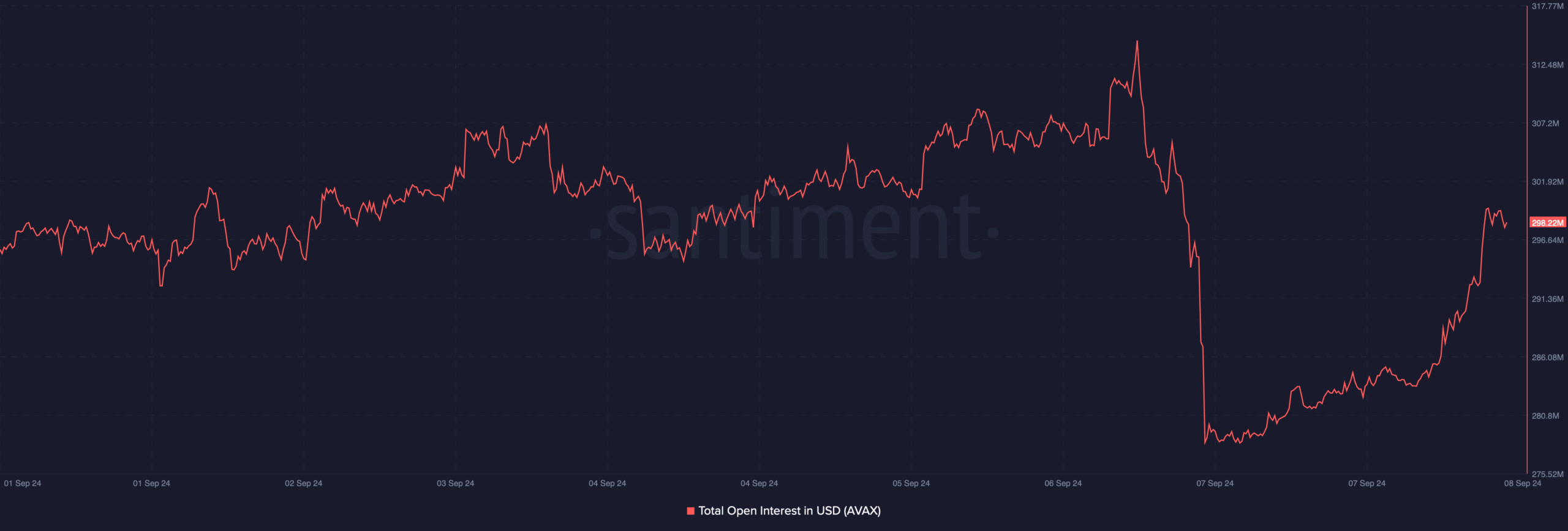

As per our analysis, after a decline, AVAX’s open interest started to increase along with its price. This suggested that the chances of the bull rally continuing were high.

Apart from that, we also found that selling pressure on the token declined. According to our look at DeFiLlama’s data, AVAX’s netflows dropped to -$2.47 million on the 7th of September.

For starters, a negative newflow indicates a rise in buying pressure, which can be considered a bullish signal.

However, the whales weren’t much active in the past few hours when AVAX’s price increased. A look at Hyblock Capital’s data revealed that Avalanche’s whale vs retail delta dropped from more than 60 to 44.

A decline in the metric meant that retail investors were having more exposure in the market than whales.

Is your portfolio green? Check the Avalanche Profit Calculator

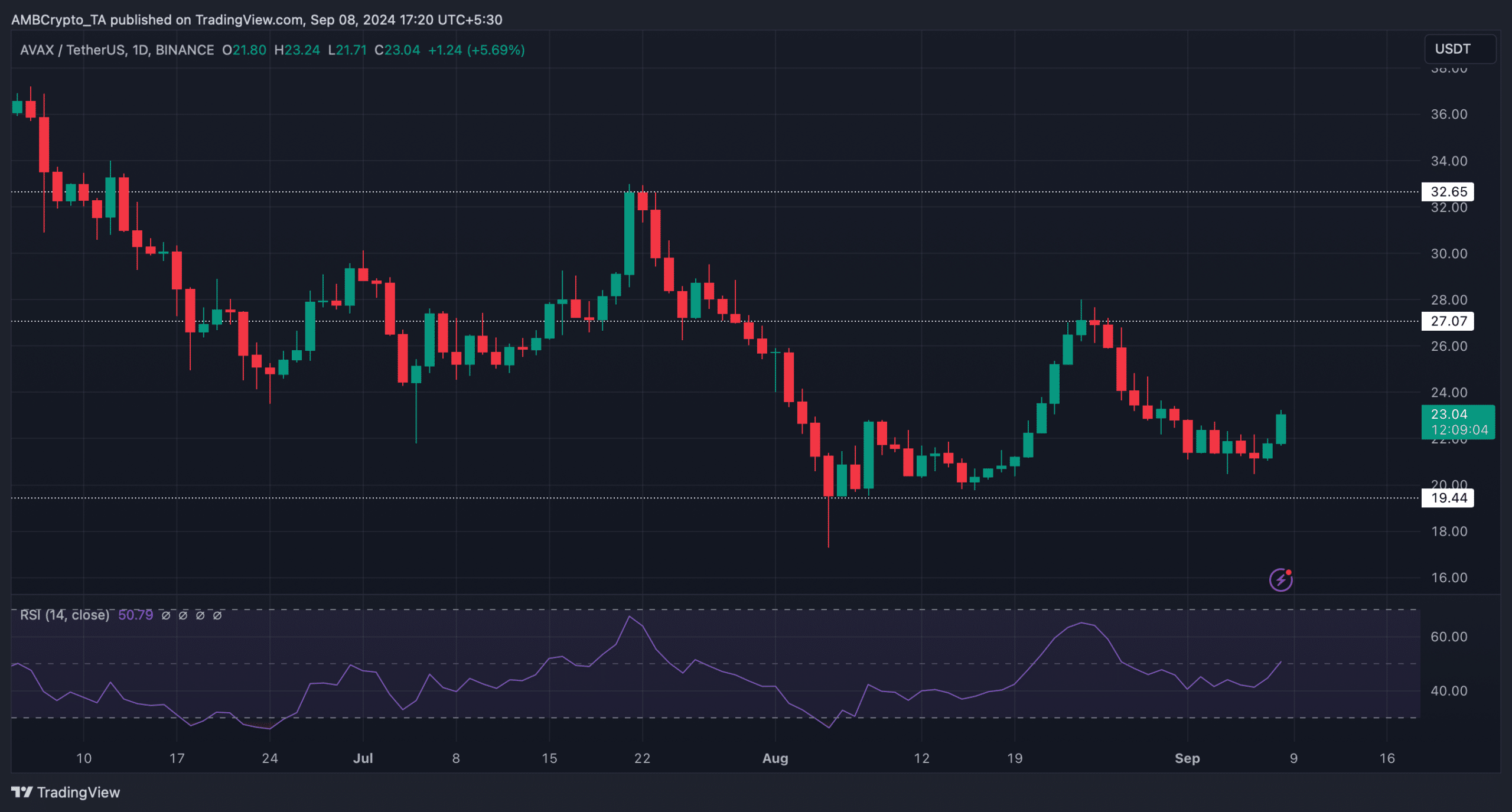

Nonetheless, the technical indicator Relative Strength Index (RSI) registered a rise. This indicated that AVAX bulls might be able to sustain the upward momentum and push the token’s price further up.

If that happens, then AVAX might first target $27 before it eyes $32. But in the event of a bearish trend reversal, AVAX might drop to $19.4.