- The strong recent gains could herald a vertical move.

- The Funding Rate suggested that sentiment was not as bullish as it seemed.

Baby Doge [BabyDoge] has rallied close to 200% since the 12th of September, almost a month ago. At press time, it was up by 237% from the lowest price it reached this year, which was in the first week of August.

The rally in September started when the meme coin was listed on Binance. A listing on top exchanges tends to drive hype and divert attention to the token, and BABYDOGE bulls were surfing the waves higher.

Baby Doge coin breaks September highs

Measured from the lows on the 6th of September, BABYDOGE rose by 217% in three weeks but saw a deep retracement to test $0.0018 (numbers reduced by a factor of 10^6 for legibility).

This 33% retracement was quickly overcome in the first week of October.

Even though Bitcoin [BTC] was struggling to climb past the $63k resistance zone, Baby Doge coin managed to soar by 64%. Such quick, massive bullish gains raised eyebrows online and attracted more buyers eager for further gains.

The moving averages showed bullish momentum, and the breakout past the local highs showed firm bullish intent. The A/D indicator bounced higher in October and showed that demand was strong.

Assessing the speculative sentiment

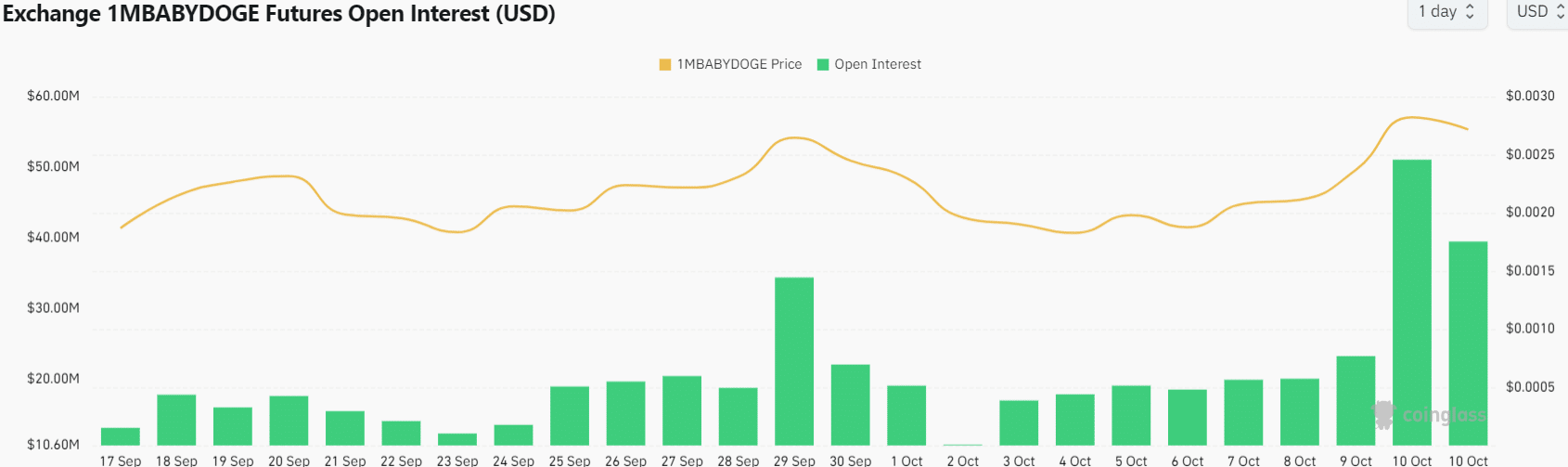

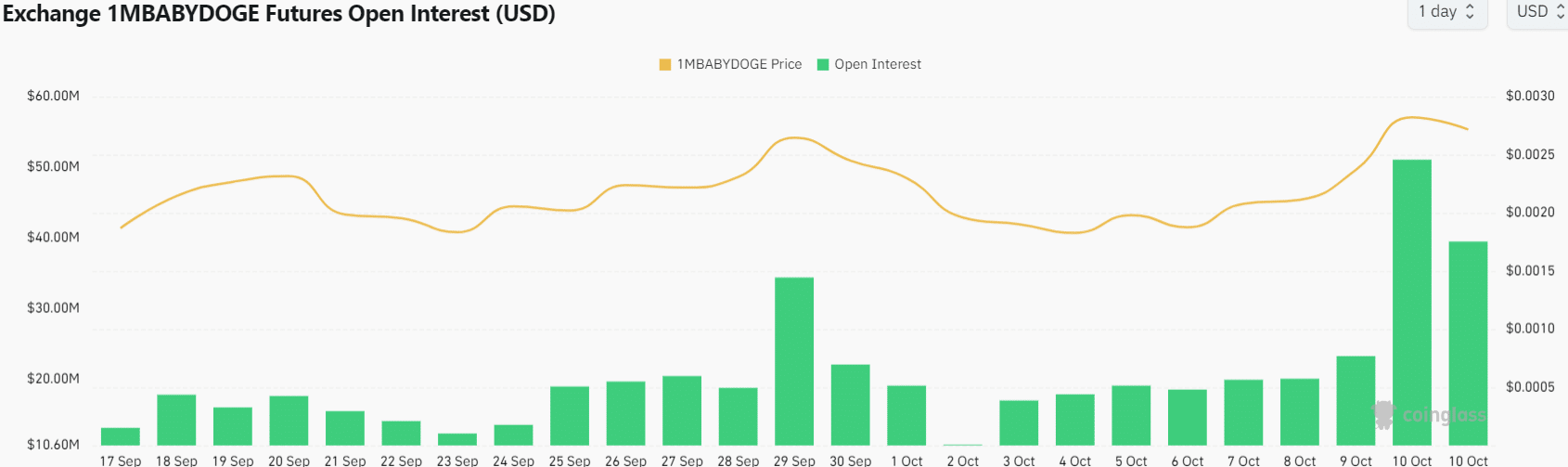

Source: Coinglass

In the past three days, the Open Interest leaped from $18.5 million to $39.5 million. The OI doubling alongside a strong price rally showed sentiment was bullish.

The nearly 10% dip of the past 24 hours was accompanied by an OI drop.

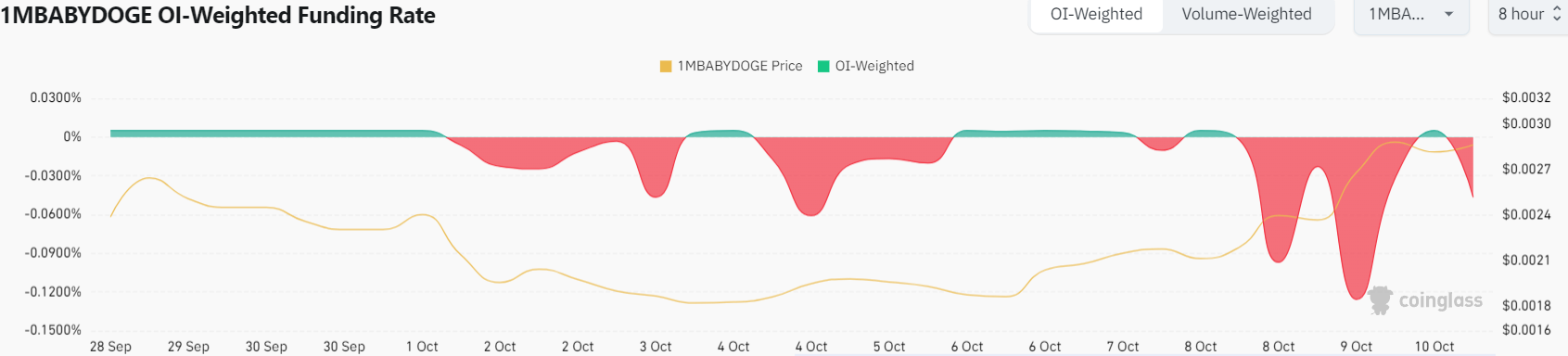

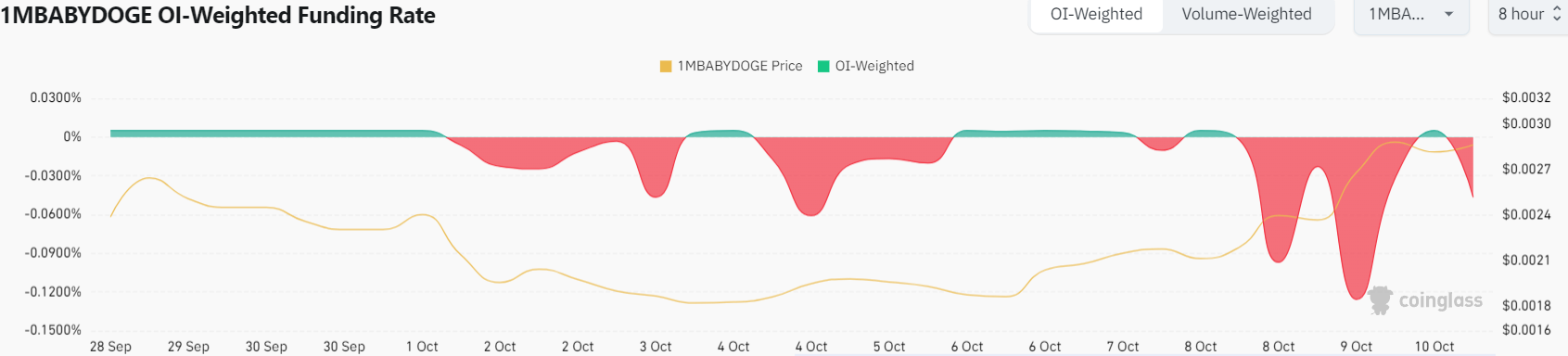

Source: Coinglass

While the short-term sentiment appeared in favor of the bulls, the Funding Rate has been predominantly negative over the past week. This showed that short sellers were paying funding to the long position holders.

Realistic or not, here’s BABYDOGE’s market cap in BTC’s terms

It also pointed toward bearish sentiment, going against the findings on the Open Interest chart.

These mixed signs in the Futures market could make traders’ decisions harder, but the bullish argument has more merit due to the recent price action.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion