BEAM’s price jumped by 10.83%, pushing its market value to $921 million. The high trading activity indicates that investors are feeling positive about the cryptocurrency.

BEAM experienced a 10.83% price rise and a 217.05% increase in trading volume. With large holders controlling 85% of BEAM, this high concentration could affect market stability, reflecting significant control by a few entities.

BEAM Price and Market Activity Surge

Beam (BEAM) has shown a notable price increase, valued at $0.01863 at press time, reflecting a 10.83% rise in the last 24 hours, according to CoinMarketCap.

This surge in price has brought BEAM’s market capitalization to $921,524,187, a 10.90% increase, indicating growing interest and investment.

The 24-hour trading volume is $36,608,453, a 217.05% rise, suggesting heightened trading activity.

As of press time, the MACD was positive with a value of 0.00029, indicating increasing buying pressure. The RSI (14) was at 70.94, suggesting that BEAM was nearing overbought territory.

Additionally, the Klinger Oscillator showed a strong positive value of 22.516M, reinforcing the upward trend. The Awesome Oscillator (AO) also supported the bullish sentiment, with a value of 0.00138.

Source: TradingView

BEAM Holder Insights and Market Dynamics

Despite the recent price increase, only 23% of BEAM holders are in profit, while 68% are at a loss, according to IntoTheBlock data.

Source: IntoTheBlock

The concentration of large holders is high at 85%, indicating that a few entities control a significant portion of the token supply.

BEAM’s price correlation with Bitcoin (BTC) is strong at 0.91, implying that BEAM’s price movements closely follow those of Bitcoin.

This correlation is typical for many altcoins, which tend to mirror Bitcoin’s market behavior. As Bitcoin recovers its $62,500 support and market sentiment turns bullish, this sets the pace for BEAM’s rally to continue.

However, holder composition shows that 93% of holders have had their tokens for 1 to 12 months, with only 7% holding for less than a month and none for over a year. This reflects relatively short-term investment behavior.

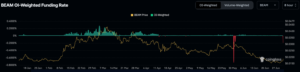

BEAM Open Interest and Funding Rate Analysis

The Open Interest (OI)-Weighted Funding Rate for BEAM, displayed alongside its price, showed fluctuations around zero.

Source: Coinglass

This rate indicates the cost of holding long or short positions in perpetual futures contracts, with positive values suggesting that long positions were paying short, and negative values indicating the opposite.

From early January to the end of June, BEAM’s price generally trended downwards, from around $0.0450 to approximately $0.0180. During this period, the OI-Weighted Funding Rate showed minor fluctuations, with a few spikes.

These spikes often corresponded with sharp price movements, reflecting the dynamic interplay between futures market sentiment and BEAM’s spot price.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News