Binance, the world’s largest cryptocurrency exchange, and stablecoin issuer Circle Internet Financial have partnered to help more people use USD Coin (USDC).

This partnership shows how important stablecoins are in today’s fast-growing crypto economy. It also highlights the efforts of these two companies to promote innovation and build trust in the cryptocurrency industry.

Binance and Circle Deal for USDC

According to a blog post, Binance will integrate USDC into its products and services. This will allow its 240 million users worldwide to access USDC easily, making it more useful for trading, saving, and payments.

Binance aims to offer its users a smooth and efficient stablecoin experience, strengthening its role in the crypto market.

Notably, Binance will use USDC for its corporate treasury operations. This decision shows the growing use of stablecoins as a reliable way to manage company funds.

USDC offers stability and helps individuals and companies handle their money efficiently. With its clear and regulated framework, Binance uses USDC to improve liquidity and lower operational risks.

– Advertisement –

Meanwhile, Circle will help Binance provide advanced technology, liquidity solutions, and tools.

These resources are designed to build user trust and spark innovation. Likewise, Circle’s technology will allow Binance to improve its services, ensuring users’ access to a safe and scalable stablecoin solution.

Furthermore, this partnership shows a growing trend of cooperation between major players in the crypto and financial sectors. Ultimately, the aim is to connect traditional finance with digital finance.

Their shared vision meets the needs of individuals, businesses, and institutions looking for efficient and financial solutions in the digital world.

Stablecoin Dominance On the Rise

Last month, the Aptos Foundation partnered with Circle and Stripe to merge traditional and decentralized finance.

The integration of Circle’s USDC and Cross-Chain Transfer Protocol (CCTP) boosts blockchain interoperability.

Meanwhile, Stripe, a leader in payment processing, employed the token to streamline fiat transactions.

Stripe’s ongoing collaborations highlight its strong focus on crypto innovation. This includes an earlier June partnership with Circle to promote USDC adoption.

By enabling transactions with USDC, the integration will allow merchants and creators to bypass traditional finance systems. This makes cross-border payments faster and cheaper.

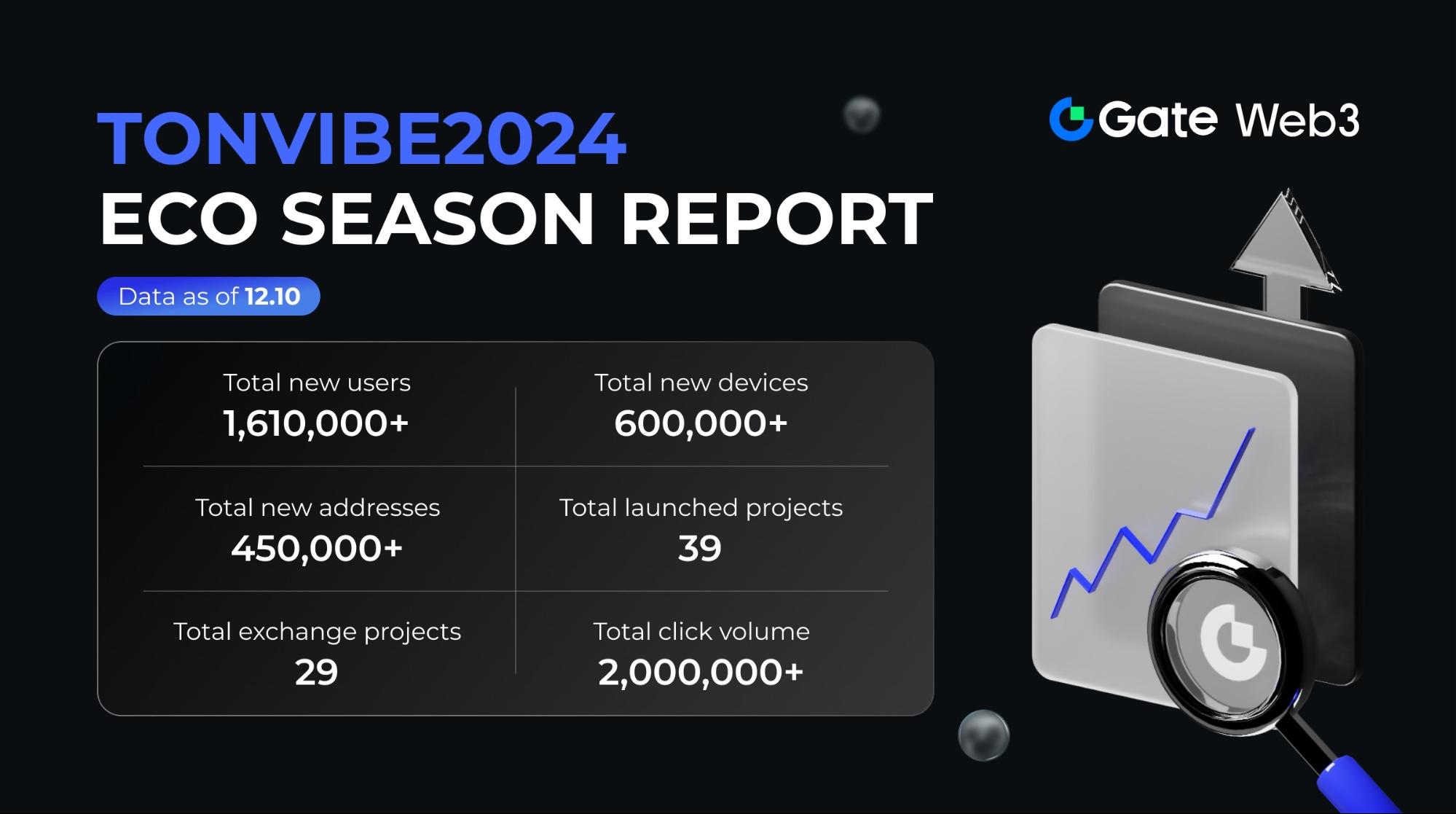

Beyond Circle, Tether is also driving the evolution of stablecoin. The price of TON recently surged after Tether announced its plans to launch a Dirham-pegged stablecoin on the network.

The Dirham-pegged stablecoin aims to help investors in the UAE and nearby regions who want to use AED for crypto transactions. It creates a stable connection between traditional and digital finance.

Tether also promised to maintain an auditable reserve for each Dirham-pegged USDT in its reserve.

Circle and its IPO Push

Recall that CEO Jeremy Allaire declared that Circle is still pushing its dream of launching an Initial Public Offering (IPO). Allaire said the firm has built a strong business it is working to sustain pending the listing.

Circle initiated its first listing attempt two years ago via a partnership with Special Purpose Acquisition Company (SPAC) Concord.

The deal, however, failed at the time, taking Circle to the drawing board. The issuer filed a draft statement to pursue the IPO in January.

More than 11 months later, the firm is still awaiting approvals from the US Securities and Exchange Commission (SEC).

Intriguingly, Circle’s decision to go public could help the firm to secure additional funding. There is currently no scheduled timeline for the IPO launch.

However, many believe the public listing milestone might come in early 2025.