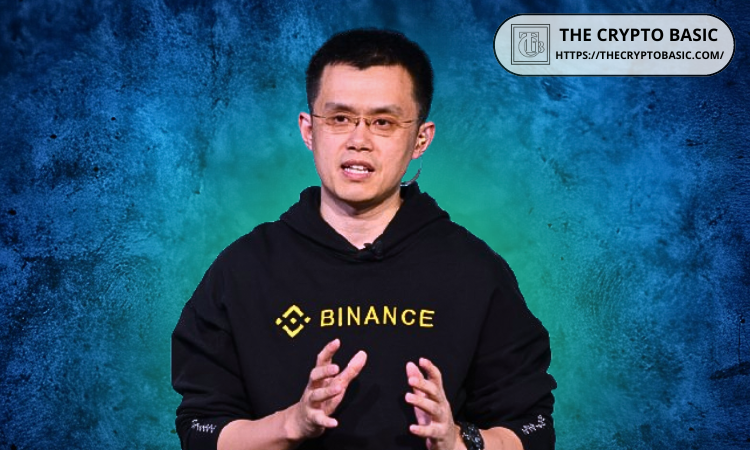

Another ambitious Bitcoin price prediction emerges after Binance co-founder Changpeng Zhao asserted that the asset could skyrocket by more than 8x.

Notably, Bitcoin’s growing traction has come with higher price expectations as several industry leaders have thrown in their thoughts on the asset’s short-term and long-term performance. The former Binance CEO recently predicted Bitcoin’s future outlook, insisting it would trump the market cap of gold.

Bitcoin to $850,000: CZ

In his session at the Bitcoin MENA 2024 conference in Abu Dhabi, Zhao insinuated that Bitcoin would surge past $850,000. He drew the price assertion from the theory that Bitcoin would surpass gold’s $16 trillion market cap.

The former CEO stated that the Bitcoin growth trajectory would trounce that of gold, as the former is a new technology and the latter an old financial tool. He insisted that comparing Bitcoin to gold does not add up, as the digital asset has several advantages and “could do more” than the precious metal.

As a result, he maintains that Bitcoin would birth an industry larger than gold’s empire. Notably, if it attains the market cap of gold, which is currently $18.25 trillion, Bitcoin will trade at $921,976 per coin.

CZ Emphasizes the Superiority of Bitcoin to Gold

The Binance co-founder emphasized the superiority of Bitcoin to gold, stating the premier crypto asset is a limitedly capped asset. He also noted that Bitcoin is easier to spend and store, making it a better currency.

Furthermore, CZ buttressed the transactional acumen of Bitcoin, stating that holders can use the asset to transfer wealth seamlessly compared to gold. With this analogy, the co-founder inferred that Bitcoin would outperform gold in the near term.

Notably, Zhao is not the only enthusiast who has predicted that Bitcoin will outgrow gold. Anthony Scaramucci and Howard Lutnick earlier talked up the comparison, insisting that Bitcoin is a superior asset to gold.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.