Key Points

- Binance Labs announced an investment in Lombard, developer, and distributor of LBTC.

- Lombard aims to bridge the gap between Bitcoin’s value and security and DeFi’s opportunities.

Binance Labs, the leading venture capital and incubator committed to empowering new projects and boosting the Web 3 ecosystem, announced a new investment in Lombard, the developer and distributor of LBTC.

LBTC is a security-first Bitcoin liquid staked token (LST) that allows individual holders and institutions to earn yield on their BTC, while, at the same time, leveraging their assets in DeFi.

Bridging the Gap Between Bitcoin and DeFi’s Opportunities

As noted by Binance in its official announcement, Lombard collaborates with staking startup Babylon, with the main target of bridging the gap between the economic value and security of Bitcoin and the opportunities offered by DeFi.

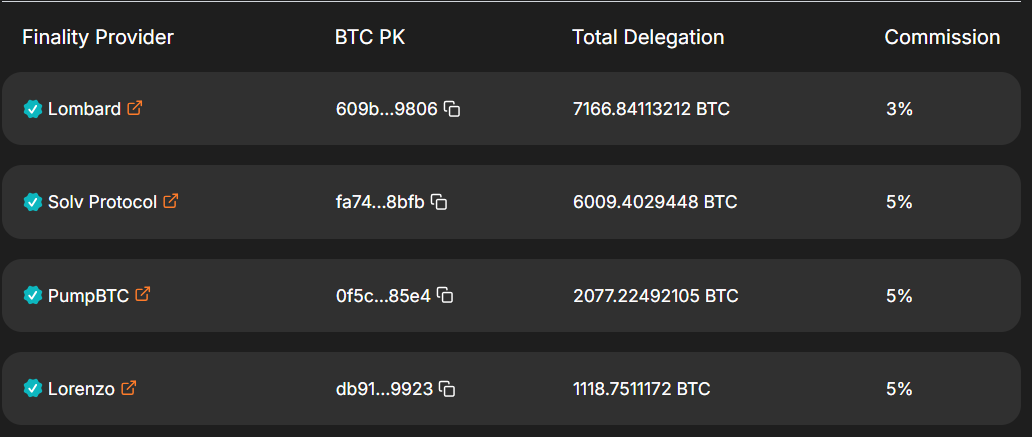

Lombard is now the largest contributor on the Babylon platform, with more than 7,166 BTC delegated to it. Besides Lombard, other Babylon providers include Solv Protocol, PumpBTC, Lorenzo, and more.

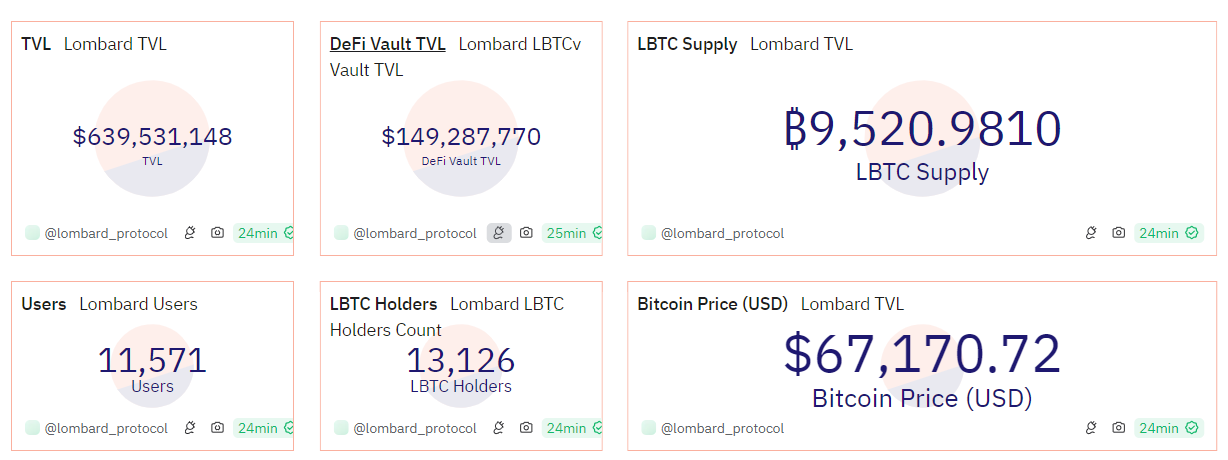

Lombard was launched in August and it now holds 40% of the Bitcoin LST market, with a TVL (Total Value Locked) of more than $639 million, the equivalent of around 9,520 BTC from over 11,500 users, according to Binance, citing data from Dune.

Lombard connects Bitcoin to DeFi, unlocking over $1.5 trillion in idle BTC liquidity.

LBTC – Lombard’s Flagship Product

Lombard’s flagship product is LBTC which allows Bitcoin holders to take part in DeFi, offering access to:

- Staking

- Yield generation

- Lending

- Borrowing

- Trading

Over 60% of the total LBTC powers the following:

- Yield strategies on Pendle

- Institutional borrowing with Maple Finance

- Lending on platforms like Morpho and ZeroLend

Other LBTC key features:

- Robust security

- Liquidity

- Seamless cross-chain functionality

- Decentralization via a decentralized validator network, the Security Consortium, that validates transactions on the protocol

What’s Next for Lombard?

Lombard leads the way in bringing the first Bitcoin Liquid Restaked Tokento market through its partnership with Ether.fi, the non-custodial liquid staking protocol that allows users to stake their ETH without giving up control or custody of their funds.

Binance revealed that Lombard is currently in Phase 2 of its roadmap, focusing on integrating LBTC with top Ethereum DeFi protocols.

Phase 3 will make LBTC available on multiple L2 chains and L1 networks, along with a deeper integration with Babylon’s Bitcoin Staking Protocol.

With the help of Binance Labs’ funding, Lombard will expand access to its flagship product, allowing users to stake BTC and mint LBTC.

Also, Lombard employs the following:

- Multiple audits

- An active bug bounty program

- 24/7 threat monitoring

Andy Chang, Investment Director at Binance Labs, said that the team at Binance is excited to support Lombard’s vision of scaling LBTC across DeFi.

He also said they’re committed to supporting innovative, early-stage projects, that have potential for a meaningful, sustainable impact on the Web3 ecosystem. He highlighted Lombard’s approach to integrating BTC with DeFi and LBTC’s fast growth that shows increased user interest to unlock more utility for Bitcoin.

Jacob Philips, co-founder and Head of Strategy at Lombard, also expressed his gratitude to Binance, as they continue to expand LBTC as a new core primitive.

He said that Binance‘s support is crucial in helping them connect with a global Bitcoin audience, as they look forward to accelerating their growth and delivering the mission to unlock new opportunities for Bitcoin holders across the DeFi space.