Crypto’s largest exchange, Binance, lost market share during Red September while competitors captured more user trading volume.

According to an Oct. 3 CCData report, Binance spot and derivatives trading volumes declined 23% and 21% each as centralized crypto exchange activity generally dwindled last month. CCData researchers said CEX volumes dropped 17% in September, a historically tough month for digital assets.

The platform founded by crypto dynamo Changpeng Zhao represented 27% market share in the spot sector and 40% of the derivatives market volume following the decline. Binance last held this spot and derivative market share four years ago, in 2020.

The exchange, now led by CZ’s successor, Richard Teng, has weathered U.S. regulatory hurricanes since a June 2023 Securities and Exchange lawsuit.

SEC prosecutors criticized the firm’s listing modus operandi in proposed amended filings. According to the federal watchdog, Binance broke securities law by running an unregistered brokerage and offering illegal securities trading.

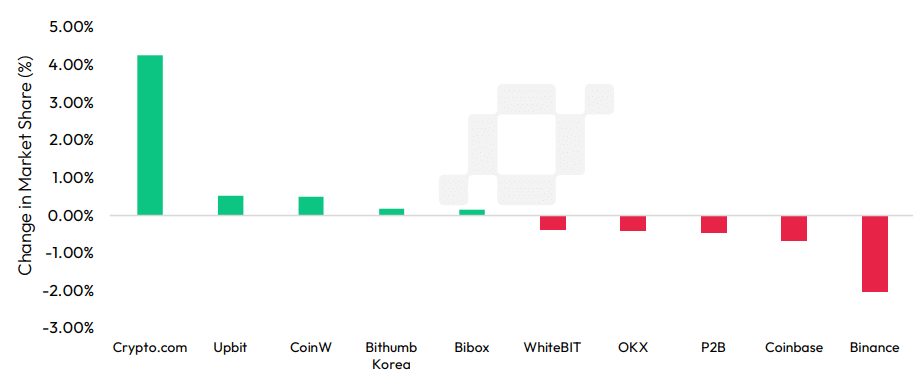

Meanwhile, rival exchanges have benefited from the titan’s diminishing dominance. CCData noted that Crypto.com achieved a 40% surge across spot and derivatives markets last month.

Year-to-date, Crypto.com has made the largest gains in the spot markets, increasing its market share by 8.08% to 10.5%. Bybit and Bitget also made strong progress this year, seeing their market share rise by 3.48% and 1.59% to 9.60% and 3.34%.

Binance, Upbit and OKX have lost the most market share, declining by 5.34%, 4.60% and 4.04% to 27.0%, 2.50% and 3.91% respectively.

CCData report

Experts expect a boost in asset prices and liquidity during Q4, with further Federal Reserve rate cuts in sight and an outcome in the U.S. presidential election. Crypto markets traded downward due to global economic uncertainty stemming from conflicts in the Middle East.