Binance has increased the minimum staking requirements for popular cryptocurrencies including Solana (SOL), Polkadot (DOT), and Cosmos (ATOM) in their earning products.

Binance Earn products provide opportunities for crypto token holders to generate passive income from their assets. These offerings include Flexible Savings and Locked Savings. In Locked Savings, users can lock their tokens for a predetermined duration and then withdraw their staked coins along with the accumulated rewards.

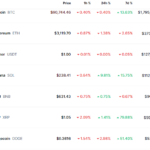

Binance has recently increased the minimum requirements for locking assets for 120 days on various cryptocurrencies. For instance, to lock ATOM for 120 days, users must now stake a minimum of 1,000 ATOM instead of 30 ATOM. Similarly, SOL stakers now need to lock at least 500 SOL instead of 30 SOL.

However, this adjustment has resulted in a reduction of 1-2 percent in the annual percentage rates (APRs) associated with these products.

Investors have different preferences when it comes to staking their crypto assets, with some favoring centralized exchanges (CEX) like Binance for its simplicity and convenience, while others opt for staking directly on proof-of-stake blockchains like Ethereum and Cardano.

However, the recent change in Binance’s lock-up period is significant as it could indicate market trends and potentially influence the decisions of individual investors.

Binance’s decision to raise the lock-up requirements can be viewed as an attempt to attract both current token holders and new investments. This move is seen as a positive signal, particularly when considering the increased cap for ATOM prior to the United States Securities and Exchange Commission (SEC) filing a lawsuit against Binance.

The SEC alleges that ATOM and SOL, among other coins, are unregistered securities that Binance facilitated illegal trading of by U.S. citizens.

Alternatively, some believe that the rise in individual quotas may be a response to the increasing adoption of self-custody solutions by individuals. This trend could have resulted in a decline in the customer base for centralized exchanges, leading Binance to retain liquidity and prevent further loss of market share. Opinions on this matter are divided within the community.

However, some view this development as a positive sign, interpreting it as Binance’s confidence in the enduring potential of cryptocurrencies, which they believe can withstand market fluctuations.

Others perceive this decision as a desperate attempt by centralized exchanges to maintain their influence and adapt to evolving market dynamics. They argue that the emergence of self-custody alternatives, which provide individuals with greater asset control, has prompted exchanges like Binance to make adjustments in order to stay competitive and stay connected with the changing preferences of users.

Important: This article is intended solely for informational purposes. It should not be considered or relied upon as legal, tax, investment, financial, or any other form of advice.

Follow Cryptos Headlines on Google News

Join Cryptos Headlines Community