- Binance has announced that it will delist MATIC and list POL.

- Polygon’s native token is set for trend reversal, on-chain activities show.

On the 28th of August, the Binance [BNB] exchange confirmed that it will delist Polygon’s MATIC and list its new POL token, announcing,

“Binance will delist all existing MATIC spot trading pairs (i.e., MATIC/BNB, MATIC/BRL, MATIC/BTC, MATIC/ETH, MATIC/EUR, MATIC/FDUSD, MATIC/JPY, MATIC/TRY, MATIC/USDC, and MATIC/USDT) and cancel all pending MATIC spot trading orders.”

After delisting, all trading orders will be canceled, with all bots services suspended. Trading for the new POL token will start on the 13th of September.

To ensure a smooth transition, all MATIC deposits and withdrawals will be suspended on Binance from the 10th of September.

Price charts not favoring MATIC?

However, the market has not shown a strong reaction to the news. MATIC experienced a sharp decline until press time, settling in to trade at $0.433 after marking a 2.84% decline over the past 24 hours.

Additionally, over the past seven days, MATIC dropped by 16.74%.

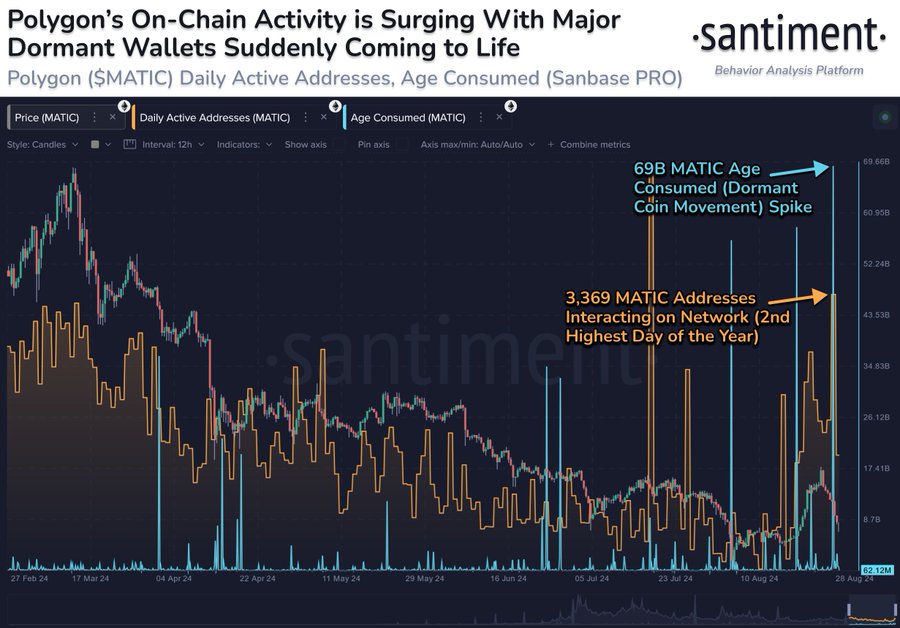

Zooming out, MATIC had been slumping for quite some time, ever since the wider crypto market had experienced a retrace in March, according to Santiment.

However, now, the altcoin seemed well-poised for a reversal. Citing the current growing on-chain activity, Santiment noted that the rise in active addresses and dormant coins showed an imminent reversal.

Despite the price declines, the overall market sentiment remained positive. For starters, Chaikin Money Flow (CMF) was positive at 0.07 at the time of writing, suggesting increased buying activity.

Thus, there was increased buying pressure, indicates that the lower prices have presented a buying opportunity, which will support a trend reversal.

Read Polygon’s [MATIC] Price Prediction 2024–2025

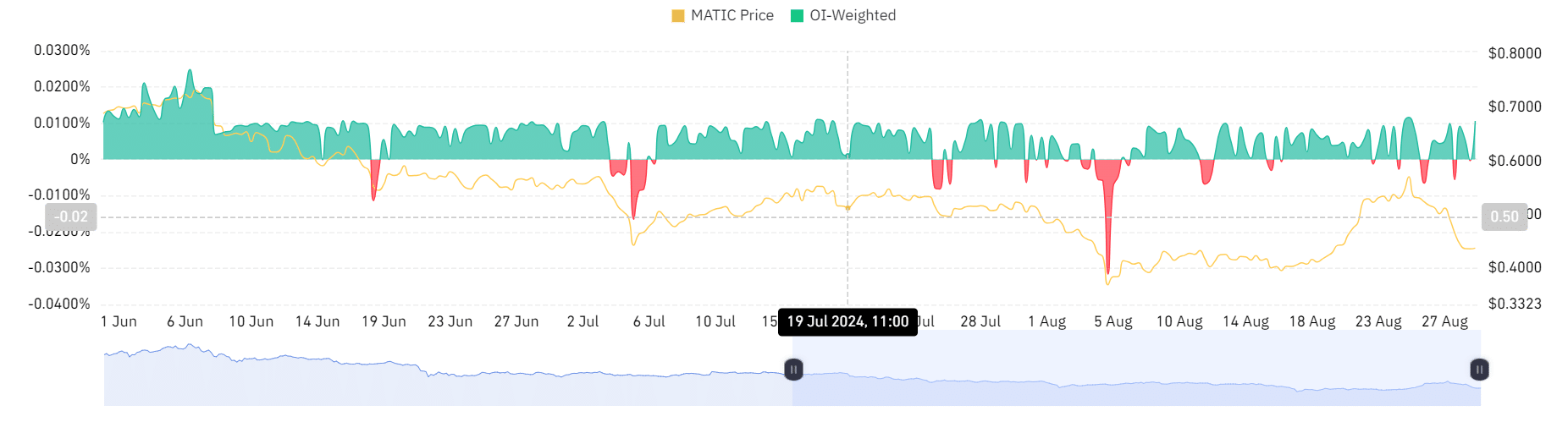

This notion was further supported by a positive Open Interest Weighted Funding rate. Over the past 24 hours, many investors have started to bet on increasing prices, thus increasing demand for long positions.

With investors going long, this is a bullish market sentiment.