Bit Global Digital, the global controller and issuer of Wrapped BTC (WBTC) filed a complaint against Coinbase, Inc. The lawsuit seeks damages from the delisting of WBTC from the exchange.

Bit Global Digital estimated damages of up to $1B after the delisting of Wrapped BTC (WBTC) from Coinbase. In a December 13 filing with the US District Court, Northern District of California, Bit Global pointed out the extensive potential direct and reputational losses from the lawsuit.

Bit Global claimed Coinbase noticed the utility of WBTC, the most widely used form of wrapped Bitcoin. In 2024, Coinbase introduced its new asset, cbBTC, which already launched on Ethereum, Base, and Solana.

Both WBTC and the new cbBTC traded on Coinbase, until on November 19 the exchange announced the upcoming delisting. The newly filed lawsuit noted the action curbed free competition and damaged the reputation of the longest-running wrapped token. The launch of cbBTC arrived in September, immediately spreading concern across all users, especially in DeFi lending.

The lawsuit filing claims the launch of cbBTC and the subsequent delisting of WBTC could lead to reputational and market losses valued at up to $1B. The filing does not explicitly seek those damages, as the exact size of the claim will be determined during the trial.

Coinbase makes a relatively small market for WBTC, carrying only 0.71% of the total spot volumes. WBTC is most active on Binance, as well as on its Uniswap V3 decentralized pair.

Spot trading uses a relatively small share of the WBTC supply, at around 5.1%. Most WBTC is involved as collateral in lending. Around 20% of the token are used for interoperability and smart contracts. Over 32% of the supply is acquired for holding, in the form of an ERC-20 token.

WBTC delisting follows controversy with the wrapped token’s controlling entity

The shift to cbBTC also follows a controversy regarding control over WBTC. Formerly issued by BitGo, WBTC is now controlled by Bit Global and its subsidiary. The issue with the new arrangement is the potential for issuing WBTC on other networks, especially TRON. There were also concerns about Justin Sun’s control over the supply and collateral of WBTC.

Currently, WBTC is one of the most transparent wrapped tokens, with a public list of addresses holding the collateral. There are concerns over issuing WBTC on TRON without a transparent collateral, or for exploits against the actual BTC collateral. Currently, TRON only carries around 99 WBTC, an early-stage test run.

Coinbase’s wrapped token has already expanded to 21,605 cbBTC, with just 652 tokens on Solana and 4,229 tokens on Base. The asset still has to catch up with the supply of 135,843.65 WBTC.

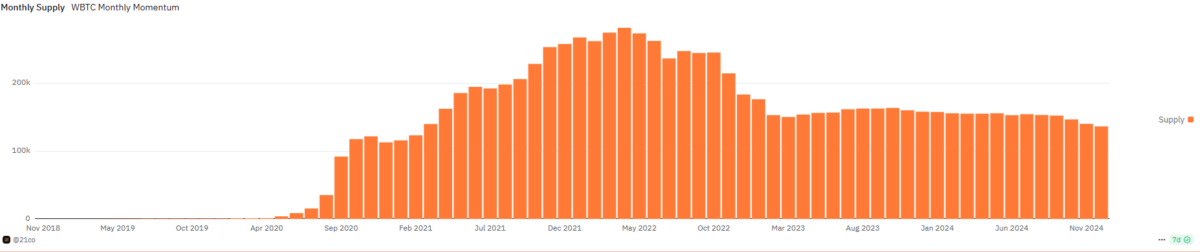

The issuer and controller controversy led to a predominance of WBTC burns over the past few months. The current supply of WBTC is the lowest since 2021, diminishing from over 152K tokens in the summer of 2024. At the current price of BTC above $101,000, the diminished supply may become one of the points in determining the damages for Bit Global Digital.

In addition to Coinbase phasing out WBTC, the asset may also be abandoned by the Sky Ecosystem, formerly Maker DAO. The DeFi protocol still retains two pools with WBTC collateral but raised the issue of liquidating them and also switching to cbBTC.

At the same time, other major DeFi protocols are holding a significant share of the WBTC supply. Aave V3 is the single biggest wallet, with inflows of 24.92% of all WBTC. The asset has also spread to Compound, Morpho, as well as Wormhole, and other bridges.

The market maker Wintermute is one of the main users of WBTC, engaged in regular mints and burns. The usage of WBTC has not damaged the reputation or activity of all DeFi entities, and WBTC is still essential in multiple trading pairs, bridges, and lending collateral pools.

The main advantage of WBTC is its traceability and transparency, with constantly updated proof of assets. Coinbase has claimed all cbBTC is backed by actual BTC but has not given a publicly known wallet with the actual BTC holdings.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.