- Bitcoin’s current downturn was “normal,” per Michael van de Poppe.

- The broader market remained positive for the king coin.

The crypto markets in 2024 have been turbulent, leading many to question if a significant crash is looming. Some fear a major Bitcoin[BTC] downturn, but analyst Michael van de Poppe firmly disagrees.

Despite Bitcoin’s 36% correction, bringing its price to around $54K, he argued that this was a normal retracement in the current market.

The fears surrounding a “big crash” were overblown, and a deeper analysis suggested there were promising signs for a potential recovery, especially comparing September 2023 to September 2024.

Retail traders may be pessimistic, but Bitcoin seems to be setting up for a bounce in the fourth quarter of 2024, as it did in previous years.

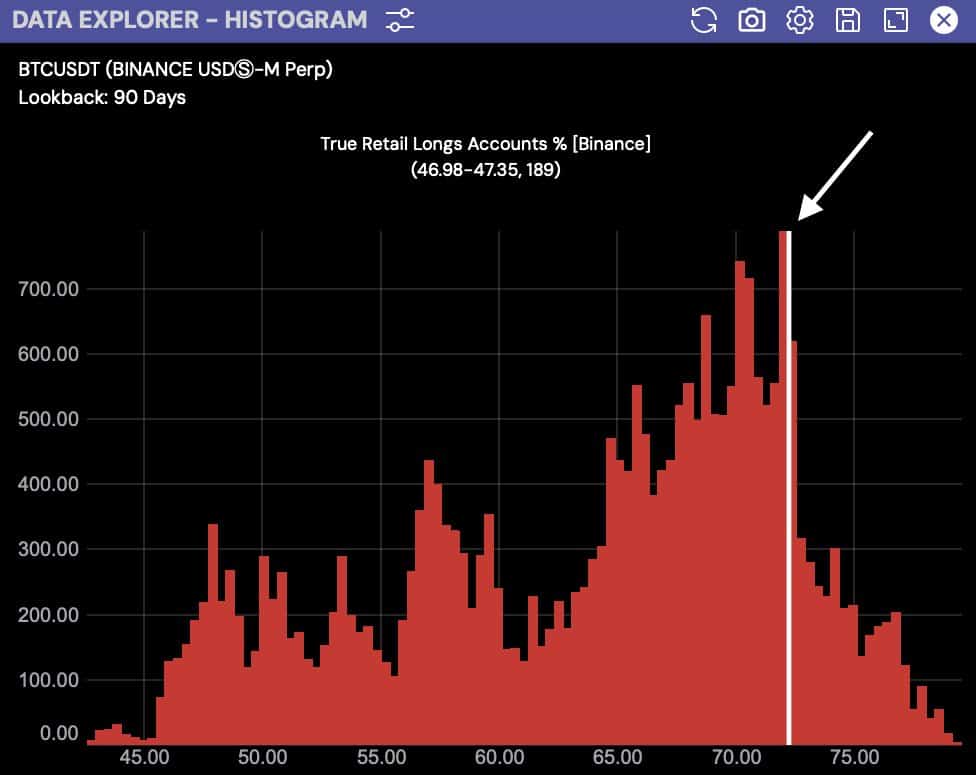

True retail longs accounts

Analyzing the behavior of retail traders further supports this outlook. Data showed that 72% of retail long positions on Bitcoin remained intact, which indicated bullish sentiment despite the recent price consolidation.

This trend contradicted the idea of an imminent crash, as retail traders held onto their long positions, suggesting confidence in Bitcoin’s future price recovery.

Michael Poppe’s analysis emphasized that these factors reinforce the view that a crash is unlikely.

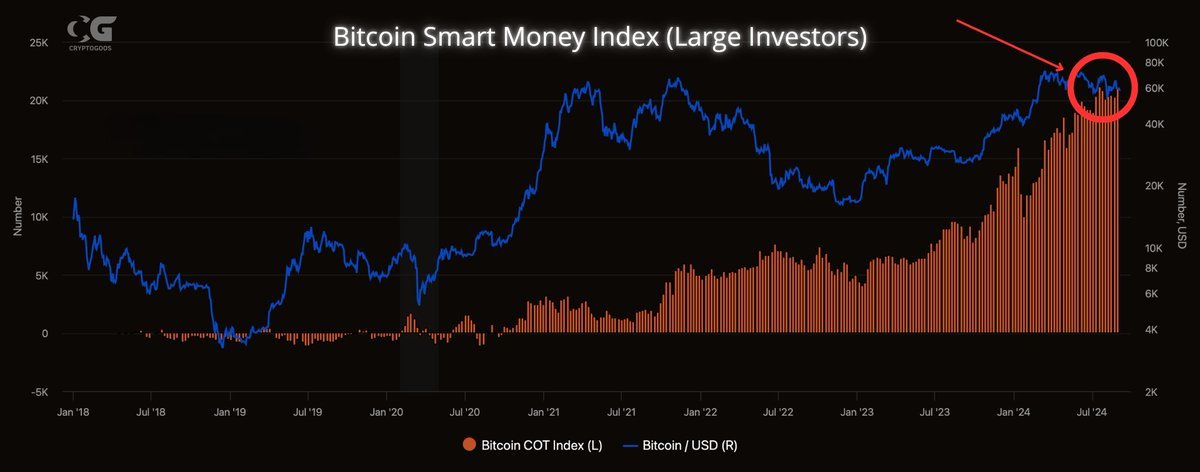

Smart money index

The Smart Money Index also painted a positive picture for Bitcoin. While the broader market sentiment was filled with fear, large investors were taking advantage of this pessimism to accumulate more Bitcoin.

This behavior further negated the possibility of a major crash, as institutions and large holders continued to support the cryptocurrency.

Their activity, combined with the current price consolidation, pointed toward Bitcoin’s potential to rebound rather than plummet.

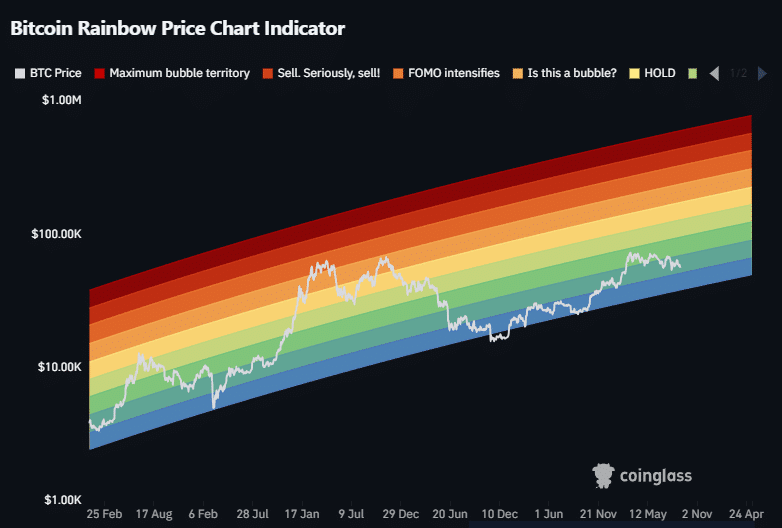

Bitcoin rainbow chart

Moreover, the Bitcoin Rainbow Chart offered additional evidence of stability. Bitcoin was trading within the dark green zone at press time, indicating that it was nearing a solid accumulation phase.

Historically, this area has proven to be a valuable buying opportunity on higher timeframes.

If Bitcoin maintains its current trajectory and respects this indicator, the chances of a market collapse remain minimal.

A drop below $51K could move BTC into a stronger accumulation phase, but this still supports long-term upward movement.

Bitcoin Funding Rate

Lastly, examining Bitcoin’s Funding Rate revealed another bullish signal. The rate was starting to turn positive, indicating that long traders were beginning to pay short traders.

This shift suggested that more investors were becoming confident in Bitcoin’s upward momentum and were positioning themselves for potential price gains.

As shorts continue to close their positions, it creates further buying opportunities, pushing Bitcoin’s price higher.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Despite recent market volatility and widespread bearish sentiment, the evidence suggests Bitcoin is not headed for a significant crash.

Instead, key indicators point toward a potential recovery and higher price movements as we enter the final quarter of 2024.