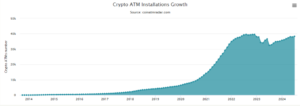

The cryptocurrency world is becoming more accessible, thanks in large part to the rise in Bitcoin ATMs. Since October 2020, their numbers have skyrocketed from 10,000 to over 38,000 worldwide.

This growth isn’t just a passing trend; experts believe it will continue due to the convenience, profitability, and strategic expansion driving the increase.

Bitcoin ATMs: Bridging Gaps and Enhancing Accessibility

For many, traditional financial institutions present a barrier to entering the crypto world. Bitcoin ATMs help bridge this gap by allowing users to buy cryptocurrency with cash, eliminating the need for bank accounts or dealing with complex online exchanges. This promotes financial inclusion, especially for the unbanked and those who prefer using physical cash.

Source: Coin ATM Radar

The advantages go beyond just accessibility. Bitcoin ATM transactions often provide more privacy compared to online exchanges, where users may need to share extensive personal information. Moreover, these ATMs offer immediate transactions—cash is inserted, and cryptocurrency is sent directly to the user’s digital wallet—bypassing the delays typically associated with bank transfers on online platforms.

Bitcoin ATMs: Lucrative Growth and Expanding Market

The expansion of Bitcoin ATMs is driven not only by user demand but also by their profitability for operators. These machines offer a lucrative business model through transaction fees added to the spot price of Bitcoin, providing a healthy profit margin.

With a bullish cryptocurrency market in 2024, entrepreneurs are increasingly attracted to this space. As of the latest count, there are 38,279 Bitcoin ATMs deployed worldwide, according to Coin ATM Radar. Over the past 11 months, approximately 6,000 new crypto ATMs have been installed by 43 different companies across 72 countries.

Bitcoin continues to dominate crypto ATM transactions, with Bitcoin Cash and Ether also being popular. While more than 80% of crypto ATMs are located in the US, countries like Canada, El Salvador, Germany, Hong Kong, and Spain are emerging markets.

Additionally, regulatory environments are becoming more favorable for cryptocurrencies. Governments are creating frameworks that support the industry’s responsible growth, fostering trust and encouraging further investment in Bitcoin ATMs. This evolving regulatory landscape helps expand the reach of Bitcoin ATMs and strengthens their position in the financial sector.

Challenges Facing the Bitcoin ATM Industry

Despite the positive outlook for Bitcoin ATMs, the industry faces several challenges. Some operators struggle with a lack of experience or financial resources, which can lead to security vulnerabilities and diminish user confidence. Furthermore, regulatory uncertainties in certain regions contribute to a cautious approach from potential investors.

To address these issues, industry leaders are taking proactive steps. Educational initiatives are being launched to help users understand the benefits and risks of cryptocurrency transactions. In addition, robust customer support systems are being established to enhance the user experience. Building trust and ensuring security are critical for encouraging broader adoption of Bitcoin ATMs.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News