After a strong start in 2024 with the approval of spot Bitcoin ETFs, Bitcoin surged to a new all-time high of $74,000. However, its performance has been disappointing in Q2 following the bitcoin halving event.

One of the main reasons for Bitcoin’s struggle is strong miner capitulation, which has prevented its price from surpassing the resistance level of $69,000-$70,000. Currently, Bitcoin has dropped by 1.26% to just under $66,000. Analysts in the crypto market predict another three months of underperformance for Bitcoin before it resumes its upward trend.

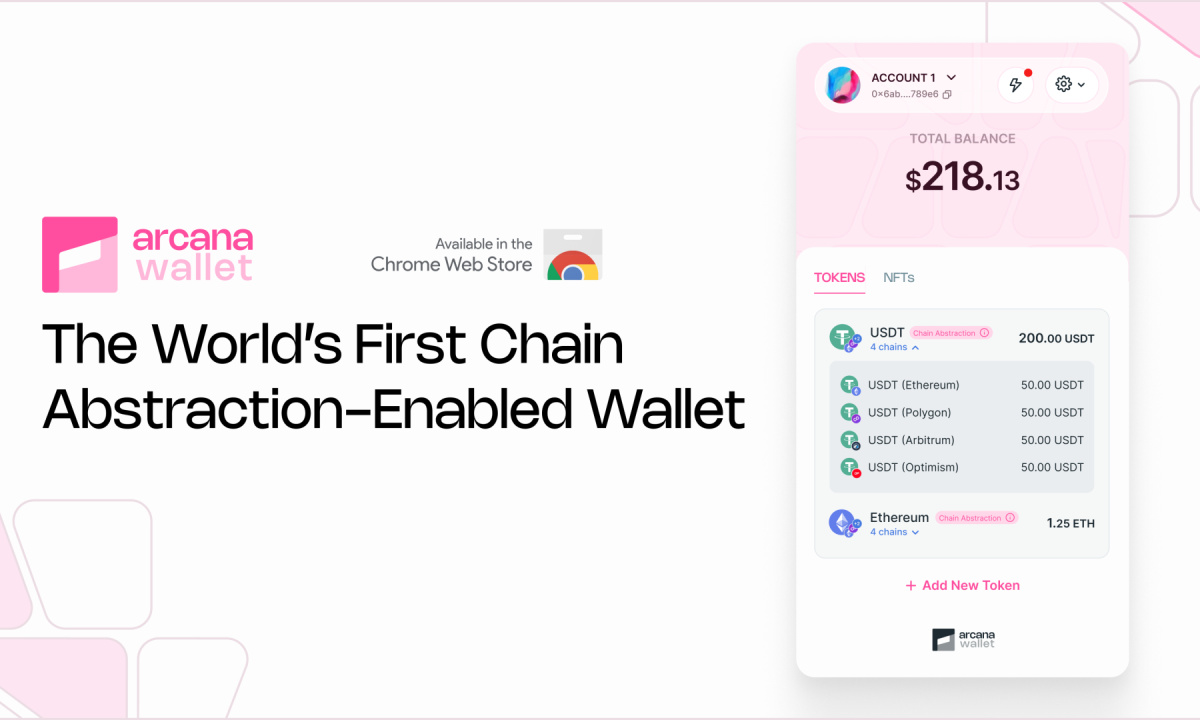

Market Dynamics: Bitcoin vs. Traditional Assets

During the second quarter, stocks and bonds outperformed Bitcoin, dominating the major crypto market boom. According to the Bloomberg indicator, commodities, bonds, and global stocks all surpassed Bitcoin in returns during Q2. While traditional asset classes saw positive returns, Bitcoin experienced a 5% decline during this period.

Courtesy: Bloomberg

The Bloomberg report highlighted that Bitcoin initially benefited from investor enthusiasm following the launch of spot Bitcoin ETFs and expectations of interest rate cuts. However, this enthusiasm appears to be diminishing as time progresses.

In contrast, JPMorgan, a banking giant, anticipates net flows into crypto, including ETFs and venture capital fundraising, to reach approximately $12 billion. Despite this optimistic outlook, it remains lower than the $45 billion inflows seen during the crypto bull run of 2021 and the $40 billion inflows during the crypto winter of 2022.

BTC Price Consolidation and Long-Term Outlook

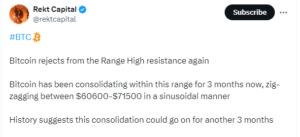

Popular crypto analyst Rekt Capital noted that Bitcoin (BTC) has been encountering resistance around the high of $70,000. Over the past three months, the world’s largest cryptocurrency has been consolidating within a range, fluctuating between $60,600 and $71,500. Based on historical chart patterns, it is highly likely that Bitcoin’s price could continue to consolidate for another three months.

Source: X

Courtesy: Rekt Capital

In a separate analysis, Rekt Capital suggested that this extended consolidation period could be beneficial for investors. Such phases often pave the way for a sustained bull run in the long term, according to the analyst’s insights.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News