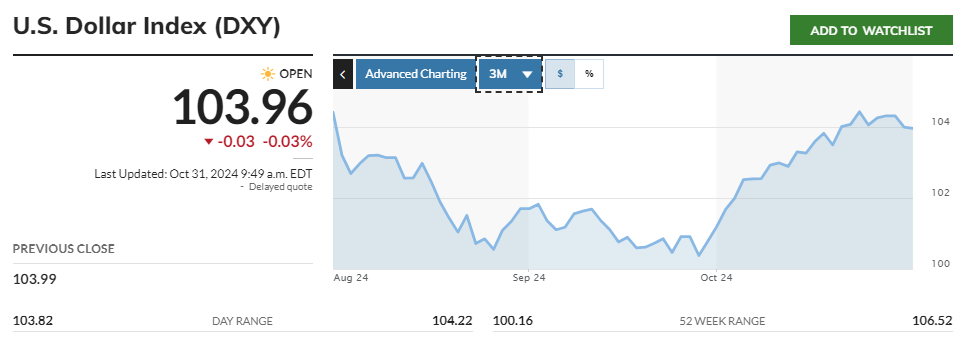

The latest Bitcoin (BTC) rally near an all-time high coincided with a recovery of the US dollar against other currencies. In the past 60 days, the correlation of BTC to the direction of the US dollar was negative, but that trend may shift after the Presidential elections.

Bitcoin (BTC) may be seeking direction based on global economic and financial indicators. For the last 60 days, the BTC correlation to the US dollar is negative. The USD recovered against the basket of six currencies, which makes up the DXY index.

The DXYindex is one of the clearest switches for risk on and risk off assets, which can affect BTC behavior. During the 2024 bull cycle, BTC dominates and is considered less risky than in previous years. However, the DXY effect may be felt in the coming months as the pressures on the US dollar shift.

In October, BTC is on track to lock more than 14% in total gains. During the same month, the US dollar index against a basket of six major currencies also rose, meaning BTC did not replace fiat so fast. Last month’s rally happened on a strong US dollar price, boosted by a mix of external economic indicators and crypto-specific factors like whale buying.

Based on Kaiko Research data, the BTC/DXY ratio has remained negative in the past 60 days, but may shift its direction in the case of a bigger BTC rally. Historically, BTC had its biggest rallies during periods of relatively weak US dollar, while corrections happened during US dollar rallies. The price also depends on crypto-specific factors, as in the case of the 2022 market crash and the 2023 bear market.

#Bitcoin's 60-day correlation with the USD has stayed mostly negative in 2024, averaging -0.2, despite a brief positive flip in August.

This could change after next week’s election. #BTC #DXY #Crypto pic.twitter.com/2MWMdUPWnB

— Kaiko (@KaikoData) October 31, 2024

BTC has always been more volatile than traditional markets, easily outpacing stocks, gold and fiat currencies in the short term. In the longer term, BTC has been tied to overall positive indicators of economic activity. A strong dollar and US economy may actually be positive for BTC, as its nominal price works as a store of value.

On a larger scale, the BTC/DXY correlation is mostly negative, showing an inverse reaction of the crypto market to a rising dollar.

The crypto market may absorb a strong dollar more easily than in previous years. The market is heavily dollarized through stablecoins, and long-term traders already de facto hold dollar positions. The biggest driver of the BTC/DXY ratio would be the performance of BTC.

However, some of the expectations for the coming months involve a dollar peak against other currencies, and a nominal breakout for BTC. A falling DXY index is expected to repeat previous rallies for BTC and crypto.

Volatility expected after US Presidential elections

The price of BTC is heading for the final days before the Presidential election, with relatively low volatility. The expectations are that BTC may deliver bigger price swings or a correction after the election, leading to higher instability.

BTC hovered above $71,300 after sliding in the past few days. Despite liquidity inflows and overall positive trends, BTC keeps sliding during US market hours, still unable to post a new all-time high.

The outcome of the elections is seen as the major factor to affect the movements of both the US dollar and BTC. The odds of a BTC rally may be tied to the election winner outcome, with volatility both on the upside and on the downside.

The DXY index is expected to peak at 106-107 points at the end of 2024, then decline in the first months of the new year. Overall, the index is expected to remain between 101 and 107 for the duration of 2025, outperforming the basket of major currencies.

For most of Bitcoin’s history, the DXY index has hovered between 90 and 100. During those periods, dollar weakness was one of the rationales for picking BTC. Based on previous cycles, a rising index may actually coincide with corrections.

However, the leading crypto coin may benefit from mainstream inflows in case of US economic optimism. US traders remain one of the most active, both for centralized crypto exchanges and for ETF. Economic optimism may boost crypto investments, especially mainstream adoption of BTC, acting more irrationally than during previous US dollar cycles.