Notable shifts in market dynamics have catalyzed the recent recovery push from Bitcoin.

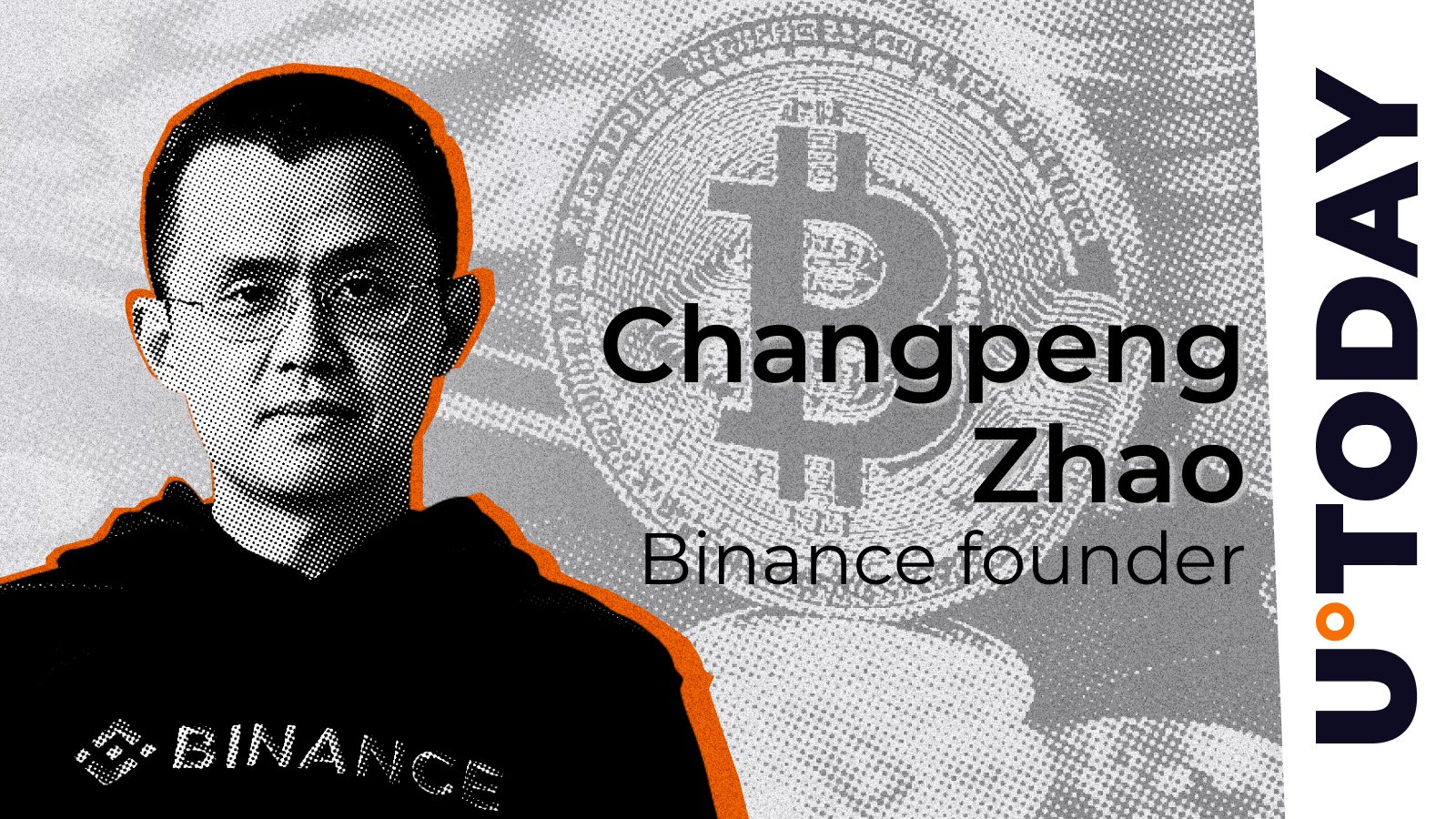

Indicators such as the Coinbase Premium Index highlight increased demand, particularly in the U.S. market. Recent data from CryptoQuant reveals that despite a negative Coinbase Premium, Bitcoin’s price remains stable, suggesting strong buying pressure on Binance rather than U.S.-based exchanges.

Negative Coinbase Premium Signals Strong Buying Pressure on Binance

“During the current upward trend, the fact that the Coinbase Premium is negative while #Bitcoin’s price isn’t falling suggests that there is strong buying pressure occurring on Binance.” – By @avocado_onchain… pic.twitter.com/ipZ09cA1JK

— CryptoQuant.com (@cryptoquant_com) September 20, 2024

Buying Pressure on Binance

The Coinbase Premium Index measures the price difference of Bitcoin between Coinbase and Binance, reflecting shifts in demand between these exchanges. Currently, the index shows a significant negative value, indicating that Bitcoin is trading lower on Coinbase compared to Binance.

This situation suggests that buying activity is stronger on Binance. Notably, the presence of strong buying pressure on Binance amid Bitcoin’s upward trend indicates that investors are driving the market outside the U.S., potentially setting the stage for further price increases.

Per CryptoQuant, for Bitcoin’s price to see sustained growth, buying pressure needs to spread globally, driven by FOMO (Fear of Missing Out) across markets outside the U.S.

MicroStrategy’s Aggressive Bitcoin Purchases

Supporting this surge in demand, MicroStrategy recently bolstered its Bitcoin holdings, acquiring 7,420 BTC for approximately $458.2 million at an average price of $61,750 per Bitcoin. This addition pushes MicroStrategy’s total Bitcoin holdings to 252,220 BTC, acquired at an average price of $39,266 per Bitcoin, totaling around $9.9 billion.

Earlier, on September 13, MicroStrategy Chairman Michael Saylor revealed a previous acquisition, where the company injected fresh capital of $1.11 billion into the Bitcoin market.

This aggressive acquisition strategy comes after the firm announced plans to raise $2 billion from its shares, partly for purchasing Bitcoin. Such large-scale purchases by institutional investors contribute to the ongoing demand and stability in the market, further supporting the upward trajectory of Bitcoin’s price.

Movement in Bitcoin Miner Wallets

In related news, miner wallets that have been inactive for over 15.5 years have recorded movement, suggesting potential profit-taking by early Bitcoin adopters. Five such wallets transferred a total of 250 BTC, valued at approximately $15.9 million.

These wallets, which originally received 50 BTC each as mining rewards back in 2009, had seen the value of their holdings appreciate substantially due to market price changes.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.