The price of Bitcoin (BTC) has gone down, making some people worried. But Bitcoin miners are still confident in the network.

The current Bitcoin price is around $26,046.

Even though the Bitcoin price is going down, the basic things that make the network work, like difficulty and hash rate, are getting stronger. This means that the network is doing well despite the lower price.

Bitcoin Mining Difficulty Recovers

Even though the Bitcoin price went down by 10% last week, the people who mine Bitcoin don’t seem too worried.

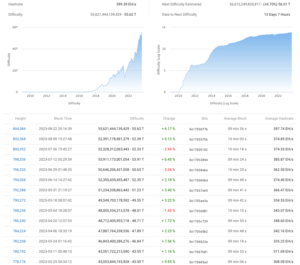

On August 22, something called “difficulty” increased by 6.17%. This happens every two weeks automatically. This increase made the difficulty go to its highest level ever. It’s also the sixth biggest increase this year, according to BTC.com.

Difficulty shows how hard it is for miners to get Bitcoin and how secure the Bitcoin network is. Because difficulty is going up, it seems like miners are still making enough money and the network is safe.

The next automatic change will make difficulty go over 56 trillion for the first time.

Bitcoin network fundamentals overview (screenshot). Source: BTC.com

High BTC Hash Rate Reflects Strong Confidence

The story about hash rate is similar. Hash rate is a measure of how much power miners use on the Bitcoin network.

While the exact number can’t be figured out, hash rate is getting close to its highest point ever, which is more than 400 exahashes per second (EH/s).

MAC_D, a person who helps with CryptoQuant, a place where people study the blockchain, talked about this data. They said that because the hash rate is high, people who use Bitcoin and Ether networks feel sure that they are safe. This is true even though the prices of BTC and ETH went down by 10%. The Ethereum staking rate also shows that more people are using ETH, even though the price went down.

This means that people believe that Bitcoin and Ethereum networks are safe and reliable. Even though the prices went down, the networks are doing well, and this might be a good time to buy more of these assets.

Bitcoin estimated hash rate chart. Source: Glassnode

Information from Glassnode, a company that studies the blockchain, shows that there hasn’t been much change in the amount of Bitcoin held by miners.

On August 22, miners had a little more than 1.83 million BTC. This went up by a small 0.08% since the beginning of the month.

Bitcoin miner BTC balance chart. Source: Glassnode

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News