The crypto market experienced a sudden and severe drop on August 5, leading to the liquidation of over $600 million in leveraged long positions.

Bitcoin’s price fell sharply, reaching as low as $52,500.This drop marked a 10% decrease from its previous level of $58,350, occurring in less than two hours. The sharp decline also impacted other major cryptocurrencies, including Ether, contributing to the broader market downturn.

Bitcoin and Ether Recover After $740M in Leverage Liquidations

Bitcoin (BTC), which dropped to $52,500 during the recent crash, has partially recovered and is now trading around $54,384, according to TradingView data. This rebound comes after Bitcoin last traded below $53,000 on February 26, before a rally triggered by the approval of spot Bitcoin exchange-traded funds (ETFs) in the U.S.

Price of Bitcoin tumbled sharply on Aug. 5, falling as low as $52,5_TradingView

Ether (ETH) also experienced a significant drop, falling 18% from $2,695 to as low as $2,118. It has since bounced back slightly and is currently trading at $2,358.

Ether (ETH) price current status_TradingView

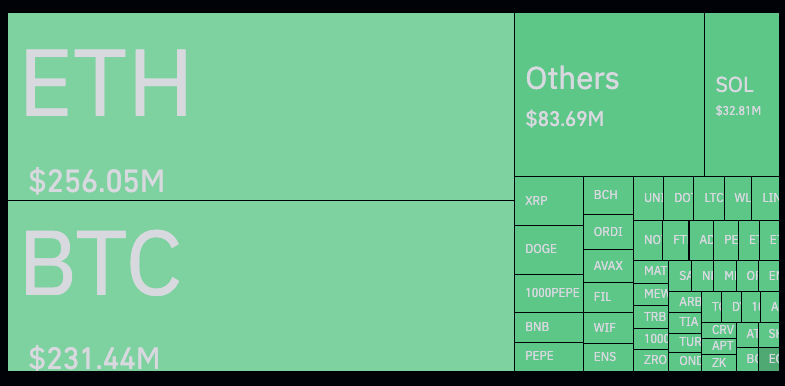

The recent market turbulence has led to the liquidation of over $740 million in leveraged positions across the crypto market in the past 24 hours. Of this, more than $644 million in leveraged longs have been wiped out. Traders with leveraged positions in Ether were particularly hard hit, with $256 million in ETH longs liquidated, while $231 million in Bitcoin longs were also closed.

last 24 hours status. Source: Coinglass

ETH Interest and Global Stock Decline Drive Market Turmoil

The open interest for Ethereum (ETH) has surged significantly in recent months, with many traders seeking exposure to the asset in anticipation of and following the approval of spot Ether ETFs in the US. However, this excitement was met with a severe downturn in crypto asset prices, triggered by a broader sell-off in the Japanese stock market.

The Nikkei 225 index dropped 7.1% during early trading hours, and Japanese bank stocks experienced their worst performance since 2008 on August 2. This decline was exacerbated by the Japanese central bank’s decision to raise interest rates.

The recent crypto market crash led to a dramatic $500 billion reduction in total market capitalization over the past three days, marking the largest 72-hour wipeout in over a year. Analysts attribute the turmoil to weak jobs data in the US, slow growth among major tech companies, and concerns over significant selling by crypto trading firm Jump Crypto.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News