Key Points

- Bitcoin ETFs continue their inflow streak with $136 million on September 24.

- BTC price trades near $64,000.

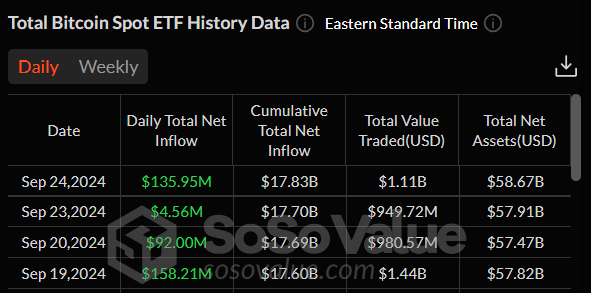

On September 24, the US-based Bitcoin ETFs recorded their 4th consecutive day of inflows at almost $136 million.

Bitcoin ETF Inflows on September 24

According to SoSoValue data, the BTC ETFs that recorded inflows yesterday are the following:

- BlackRock’s Bitcoin ETF, IBIT, recorded almost $99 million in inflows.

- Fidelity’s Bitcoin ETF, FBTC, recorded nearly $17 million in inflows.

- Bitwise’s Bitcoin ETF, BITB, recorded over $17 million in influxes.

- Grayscale’s Bitcoin ETF, BTC, recorded almost $3 million in inflows.

The other Bitcoin ETFs did not see any inflows or outflows the other day.

This was the fourth consecutive inflow day that the Bitcoin ETFs saw with the most significant one of this streak being on September 19 when the crypto products saw over $158 million in inflows.

According to the same data from SoSoValue, the total net assets locked in Bitcoin ETFs as of September 24 were $58.6 billion. Since their debut back in January, the crypto products recorded a cumulative total net inflow of almost $18 billion.

Amidst the positive inflows in these crypto products this week, Bitcoin also continues its ascendant trajectory.

Bitcoin Trades Near $64,000

At the moment of writing this article, BTC is trading near $64,000, up by 1% in the past 24 hours.

Earlier today, the price of BTC surpassed $64,000 and reached levels close to $64,800.

BTC started a price rally during the past week ahead of the important FOMC meeting in the US and continued to see a surge in price following the US Fed to cut rates by 50 bps on September 18.

A Potential New ATH for BTC by the End of 2024

If Bitcoin manages to close the month in the green, the odds will be higher for a strong performance in October, November, and December.

According to data from CoinGlass, in 2015, 2016, and 2023 when BTC closed September in the green, the last months of these years also brought in significant returns.

Despite the historical data showing that September is a weaker month for Bitcoin, its price trajectory this month breaks the bearish pattern and places the digital asset on its way to a potential new ATH by the end of 2024.