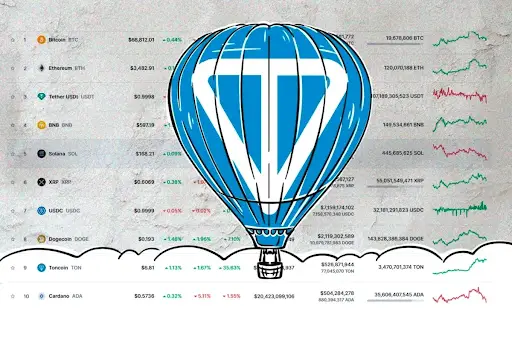

In the cryptocurrency market, Bitcoin exhibited considerable volatility yesterday, retreating to the $57,000 mark. It then made an attempt to rise towards $61,000 but couldn’t breach the resistance, slipping back below $59,000. This turbulent movement correlated with significant outflows in spot Bitcoin ETFs. Let’s delve into the details.

Spot Bitcoin ETFs Experience Outflows

On Thursday, spot Bitcoin exchange-traded funds (ETFs) in the US recorded a net outflow of $71.73 million, marking the continuation of a three-day outflow trend. Notably, BlackRock’s largest spot Bitcoin ETF, IBIT, experienced a negative flow for the first time since May 1, with an outflow of $13.51 million. Access NEWSLINKER to get the latest technology news.

Similarly, Grayscale’s GBTC faced an outflow of $22.68 million. Fidelity’s FBTC saw outflows reaching $31.11 million. Bitwise’s BITB fund experienced an outflow of $8.09 million, and Valkyrie’s BRRR ETF had an outflow of $1.68 million.

Current Status of Spot Ethereum ETFs

Spot Ethereum ETFs also witnessed minor outflows. US spot Ethereum ETFs reported a net outflow of $1.77 million on Thursday after experiencing positive flows the previous day. Grayscale Ethereum Trust (ETHE) saw a notable outflow of $5.35 million, whereas Grayscale Ethereum Mini Trust (ETH) recorded a net inflow of $3.57 million.

The remaining seven spot Ethereum funds ended the day without any inflows or outflows. The total trading volume for these ETFs dropped to $95.91 million, compared to the previous day’s figure of $151.57 million. Bitcoin was trading at around $58,984 with a 0.3% decline in the past 24 hours, while Ethereum decreased by 0.29% to $2,516.

Key Takeaways

- The spot Bitcoin ETFs experienced a net outflow of $71.73 million, continuing a three-day trend.

- BlackRock’s IBIT saw its first negative flow since May 1, with outflows of $13.51 million.

- Grayscale’s GBTC and Fidelity’s FBTC faced substantial outflows of $22.68 million and $31.11 million, respectively.

- Spot Ethereum ETFs had a net outflow of $1.77 million, with Grayscale Ethereum Trust seeing a notable outflow of $5.35 million.

- Total trading volumes for both Bitcoin and Ethereum ETFs saw a significant decrease.

These data points highlight the current investor sentiment and market dynamics in cryptocurrency ETFs, reflecting broader market volatility and investor behavior.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.