In its latest weekly report, CoinShares has revealed an incredible change in the flow of funds into crypto exchange-traded products, with Bitcoin (BTC) seeing a massive $436 million in ETF inflows last week. This surge came after a period marked by $1.2 billion in outflows over the previous 10 days.

As analyst James Butterfill explains, the major rebound in inflows is mostly due to a change in how the market thinks about the chance of an interest rate cut by 50 basis points on Sept. 18.

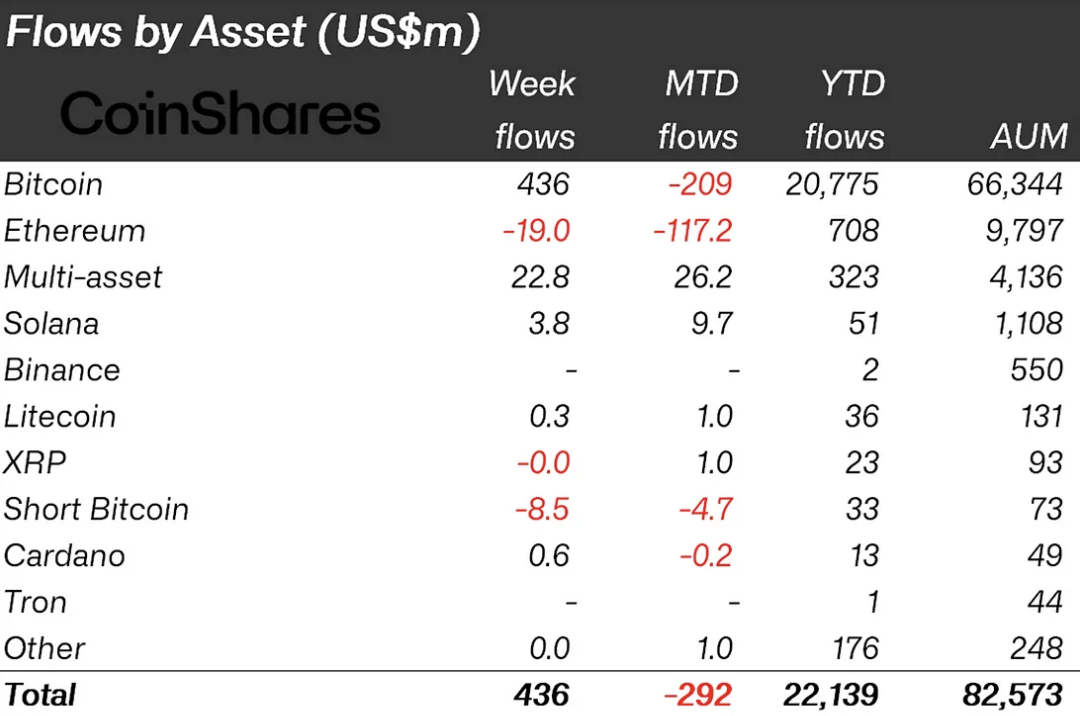

Despite the recent positive turn, Bitcoin’s month-to-date figures show $209 million in outflows, which is a pretty stark contrast to its year-to-date inflows, which have reached an impressive $20.775 billion.

What’s more?

Meanwhile, it is worth noting that short-Bitcoin vehicles saw an outflow of $8.5 million, after three weeks of inflows. Ethereum is facing its own set of challenges and saw $19 million in outflows, with still $708 million year-to-date inflows.

On the other hand, Solana showed some staying power, amounting to $3.8 million with its fourth straight week of inflows.

Vehicles oriented around blockchain technologies also have seen a positive shift, with $105 million in inflows thanks to the seeding and launch of several new ETFs on the U.S. market.

Matt Hougan, the CIO of Bitwise, recently said that he is interested in launching ETFs centered on meme cryptocurrencies. This means that assets like Shiba Inu (SHIB) or Dogecoin (DOGE) might soon be available for investment, which will give investors more options.