Bitcoin (BTC) is again at a critical juncture. The top cryptocurrency has broken above its August highs and is now challenging a long-term resistance zone.

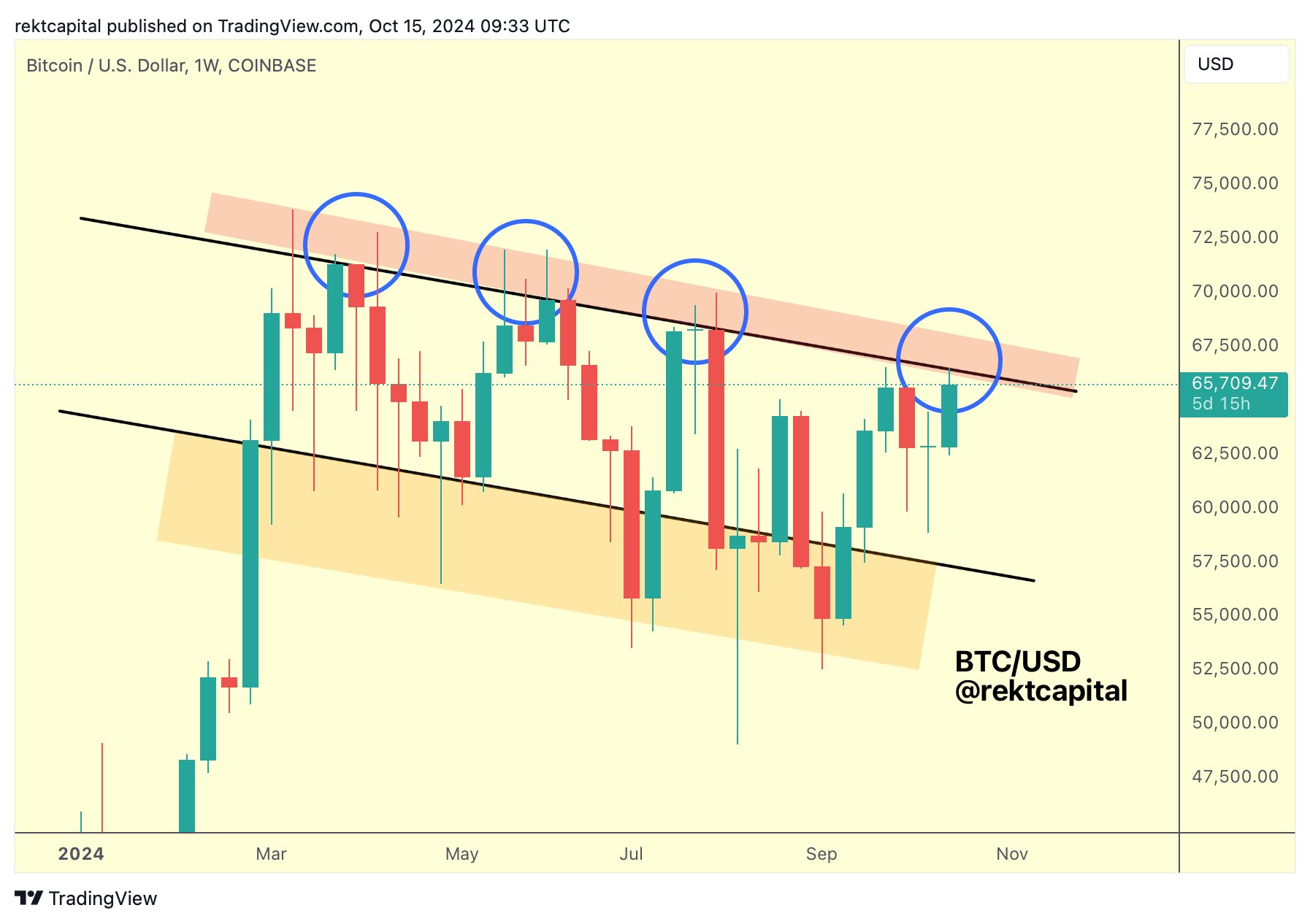

According to analyst Rekt Capital, Bitcoin’s successful attempt to overcome the August peak positions it to face more substantial resistance located at the top of a downward channel. In an earlier analysis, the analyst noted that this level has historically been a problematic barrier for Bitcoin, as it is where past bullish rallies were rejected.

Highlighting the significance of this milestone, Rekt Capital pointed out that the August peak resistance had led to a price crash of up to 18%.

With this point now cleared amid Bitcoin’s rally above $66K on Monday, Rekt Capital said a weekly close above this red resistance zone (as seen in the chart below) could signal a full-scale breakout, potentially reversing the current downtrend pattern.

Bitcoin Attempting to Reverse Current Downtrend Pattern

Remarkably, Bitcoin re-entered the $67K price range on Tuesday for the first time in three months. It continues to defend this threshold as it trades at $67,877, making an attempt at the $68K level.

Rekt Capital highlighted this latest move in the latest update. He shared an updated chart showing that Bitcoin is just a few steps away from breaking above the red box as of Tuesday evening, describing it as a “moment of truth.” This anticipated outcome could indicate that Bitcoin has overcome the downtrend that commenced after the all-time high in March.

Notably, after initially entering the $67K channel yesterday, Bitcoin experienced an abrupt price drop, sending it to the $66K level within an hour. However, it quickly recovered from this dramatic drop and has maintained a price in the upper end of the $67K range.

Rekt Capital acknowledged this occurrence in the follow-up update, stressing that a weekly close inside the red resistance zone is all Bitcoin needs to avoid massive price rejections, as seen previously. Notably, closing above the zone would require Bitcoin to surpass and hold above the $68K level.

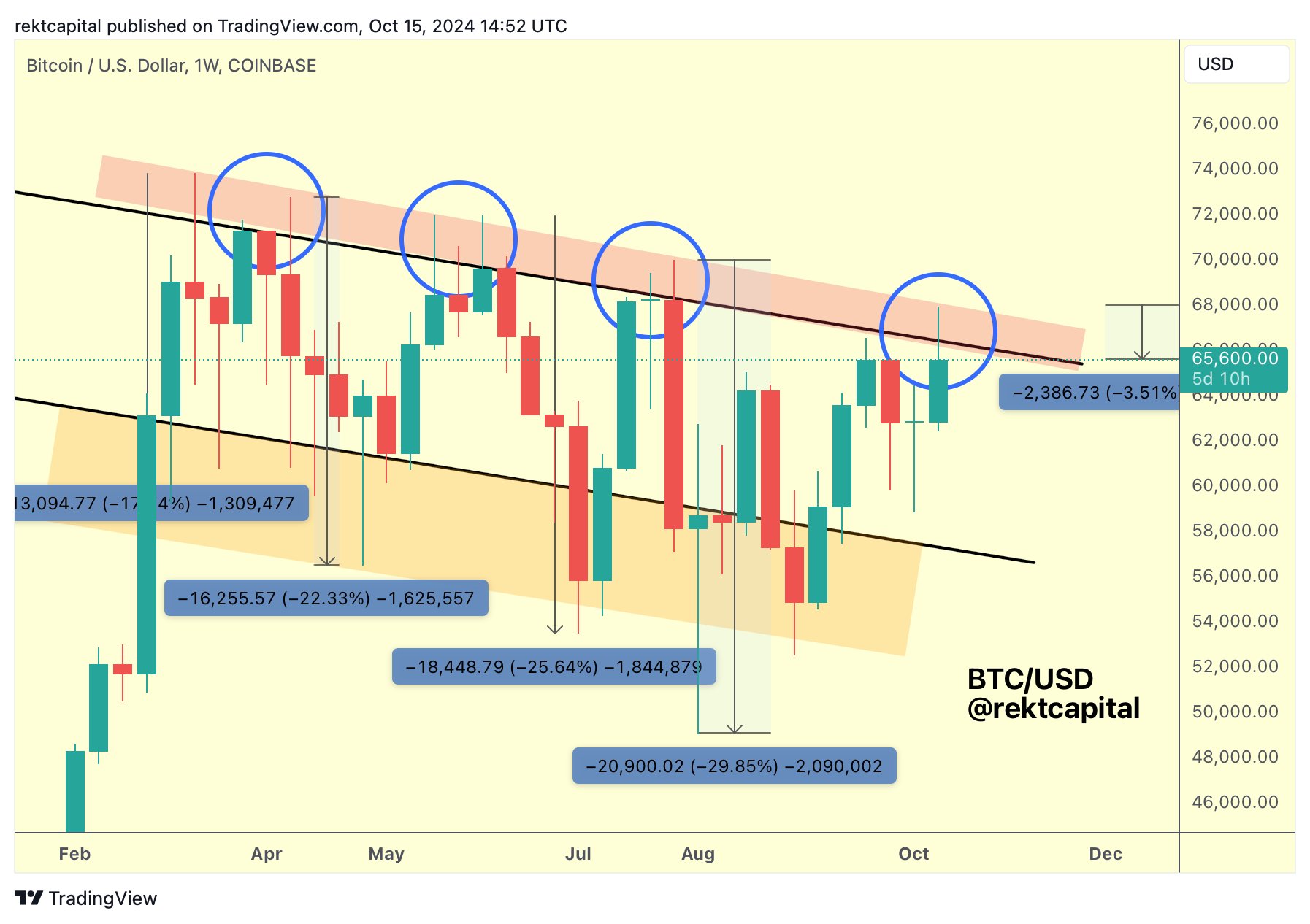

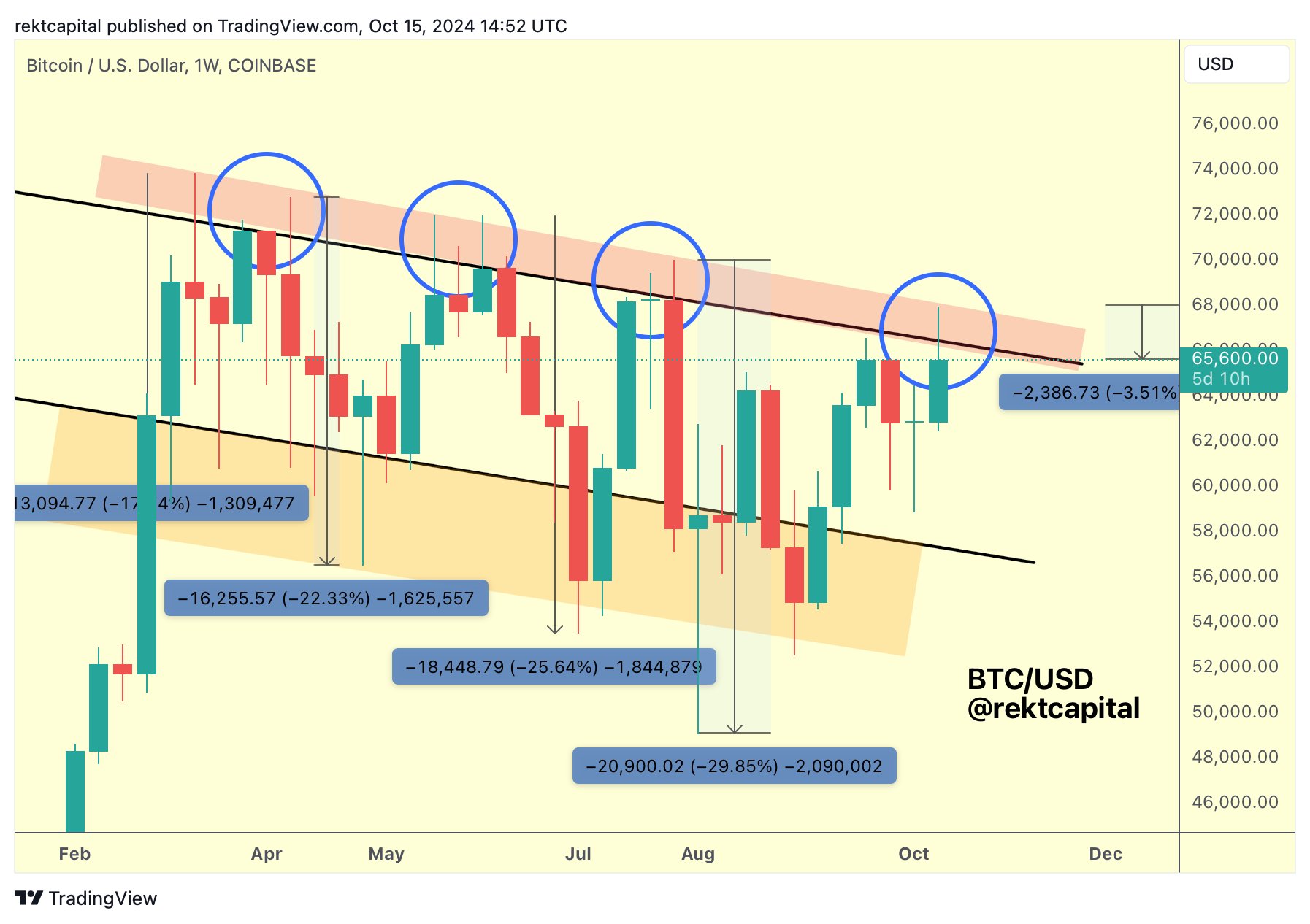

Bitcoin Risks a 30% Drop to $47K

According to the analyst, Bitcoin faces a potential 30% price correction if it fails to close above the required level. He noted that the rejections have led to progressively deeper pullbacks since March: from an initial 17% drop to a 22% fall, then a 26% crash, and most recently a 29% collapse.

If this pattern continues, investors could be looking at a likely drop of over 30%, which would drag Bitcoin down to at least $47K.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.