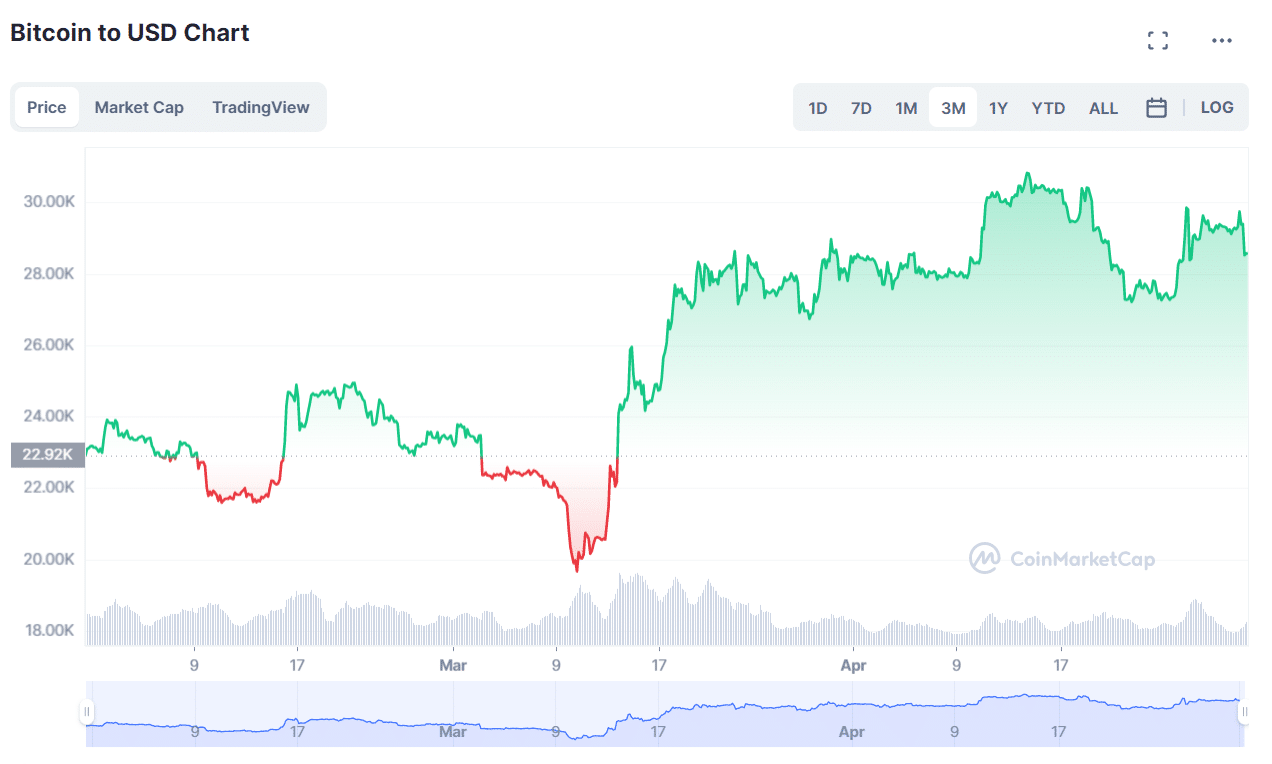

Bitcoin has had a good month again, which means April is the fourth month in a row with gains, as per Coinglass data.

Bitcoin’s positive performance in the last four months has continued despite a banking crisis. This shows that the closure of Silvergate and Silicon Valley did not have any impact on Bitcoin.

Bitcoin’s current bull market compares to a recovery in 2019

Bitcoin has experienced four consecutive months of gains as of April 28, according to Coinglass data. This is the first time since 2019 that Bitcoin has achieved such a positive growth streak, which occurred during the recovery from the worst bear market.

Bitcoin has been showing a positive trend for the past four months since the beginning of this year, which means that its price has been consistently increasing during this period.

Retail and institutional investors have been interested in Bitcoin due to its quick price changes, which caused it to rise above $30,000 for the first time since June 2022.

Bitcoin has become a topic of serious discussion among cryptocurrency experts, celebrities, and even some traditional financial analysts, who have made optimistic price predictions for BTC, driving its value to exceed $30,000 for the first time since June 2022.

Jeff Kendrick, who is the head of Standard Chartered’s digital asset research, has predicted that Bitcoin’s price will hit $100,000 by the year 2024, according to a report from Reuters.

Robert Kiyosaki, a famous author known for his book Rich Dad, Poor Dad, has predicted that the price of bitcoin will reach $100,000.

Bitcoin’s growth was not impacted by the closure of Silvergate and Signature Bank.

CNBC reported that as there was a banking crisis globally, investors found Bitcoin to be an attractive alternative to the traditional banking system. Bitcoin performed well throughout March after a slow February.

Despite the closure of two of the most crypto-friendly institutions, Silvergate and Signature Bank, bitcoin prices continued to rise, as reported by CNBC. Investors found bitcoin to be an alternative to traditional banking systems during a global banking crisis, resulting in its popularity and growth in March after a flat February.

Although Bitcoin prices continued to increase after Silvergate and Signature Bank closed, these banks provided important connections between traditional money and digital currencies. With their absence, there could be a decrease in the amount of money flowing into cryptocurrencies until other similar institutions take their place.