Key Points

- Bitcoin hit a new ATH above $97,000, amidst huge optimism triggered by Trump’s crypto support.

- The prospect of Strategic Bitcoin Reserves in the US and beyond contributes to the rally.

Earlier, Bitcoin hit a new ATH above $97,000, fueled by huge optimism in the crypto industry stemming from Trump’s crypto policies and increasing interest in the digital asset and related products, including BTC ETFs, and the newly launched BTC ETF options.

At the moment of writing this article, BTC is trading above $97,000, up by 5% in the last 24 hours.

The digital asset’s latest price rally kicked off strongly yesterday and is sustained by multiple factors.

Trump Pushes for a New White House Crypto Post

According to the latest reports revealed by Bloomberg, the newly-elected US President, Donald Trump, is currently pushing for a new White House post dedicated to crypto policies.

Trump’s team is reportedly discussing whether to create such a role for the first time. The industry is reportedly pitching in for the position to have direct access to Trump who has shown massive crypto support during 2024 and made important promises for the industry.

As the US SEC Chair, Gary Gensler is leaving his post at the agency, a friendlier name is expected to step in and show more supportive policies towards crypto, which also brings optimism for the industry.

Texas, On Its Way to Create A Strategic Bitcoin Reserve

After the bill for creating a Strategic Bitcoin Reserve was introduced in Pennsylvania, now other states are reportedly following the same steps.

Satoshi Act Fund’s CEO Dennis Porter shared recent messages via X, saying that a Texas lawmaker declared that he wants the state to have a Strategic Bitcoin Reserve first.

Porter highlighted that Texas has a $2.6 trillion economy and it’s the 8th largest economy in the world. If the state creates a BTC reserve, this would send shockwaves across the globe and increase the FOMO around the idea of a National Strategic Bitcoin Reserve.

Porter said that they established a majority pro-Bitcoin Congress with the digital asset at $60,000, and the impact when BTC hits $250,000 or $1 million will be mind-blowing.

If the US creates a Bitcoin treasury, more countries will step in and do the same.

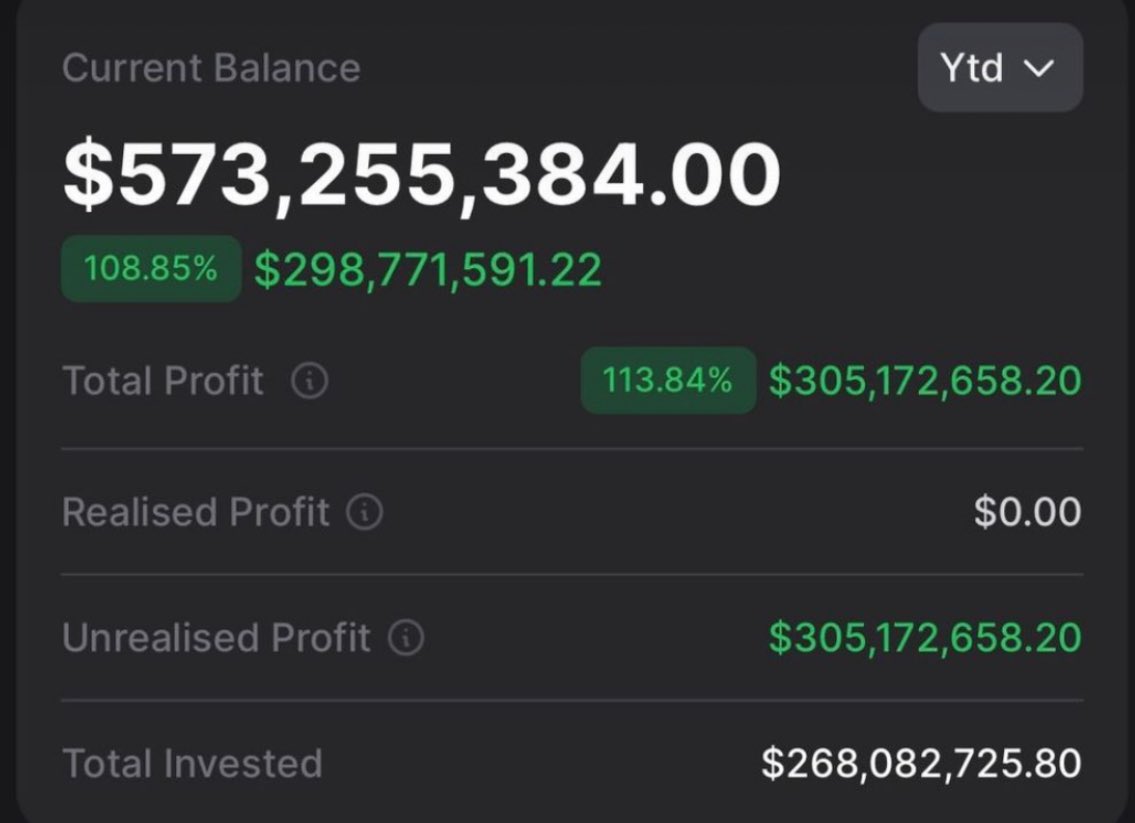

El Salvador already has one, and the country has been buying BTC on a daily basis, regardless of the market volatility. The nation already has more than half a billion dollars in BTC.

Recently, a Polish Presidential candidate expressed his interest in creating a BTC reserve. More countries will follow, for sure.

BTC ETFs and Successful Options Launch

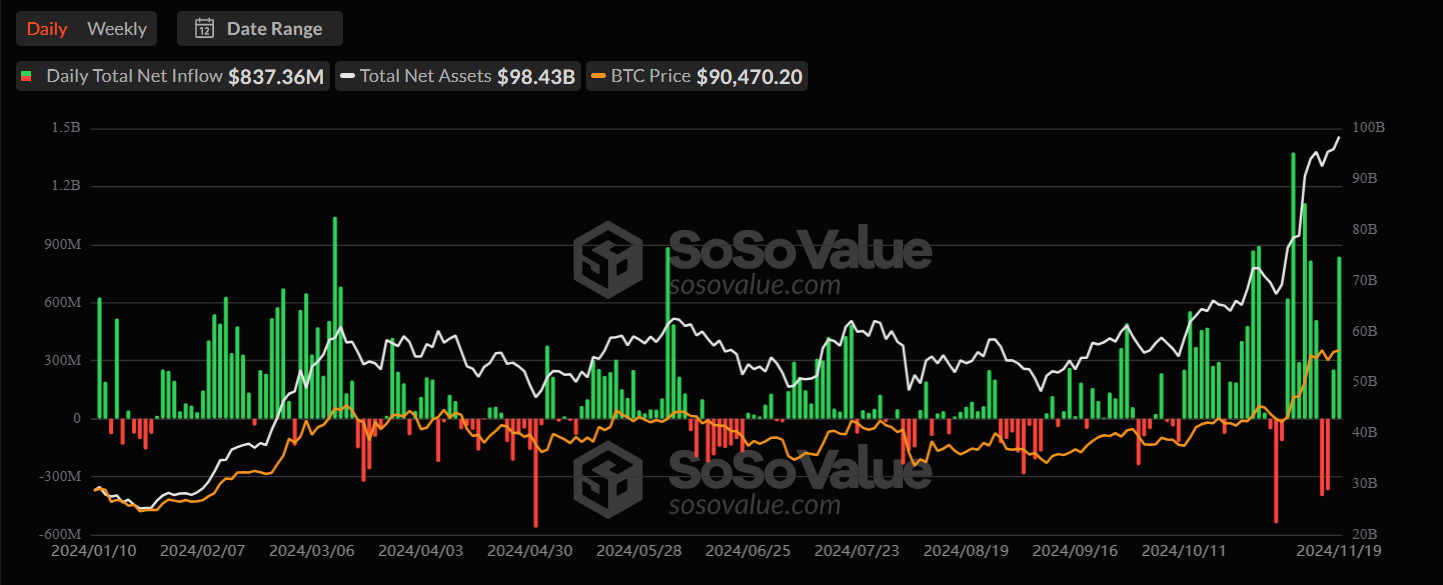

The institutional interest in Bitcoin and related products continues to rise, as BTC ETFs recorded a continued streak of inflows this week.

Yesterday, the crypto products saw over $773 million in inflows, pushing the week’s flows close to $2 billion, according to data from SoSoValue.

The total net assets locked in the crypto products as of November 20 surpassed $100 billion, and the cumulative flows in BTC ETFs are over $29 billion, the same data shows.

This week also marked the launch of BTC ETF options, which also recorded huge success since day 1 of trading, mirroring increased interest from institutional players.

Other bullish news includes MicroStrategy’s recent upsizing of its note offering, as the company will use almost $2.6 billion to buy more BTC.

Bitcoin Nears $100,000

Recently, BTC surpassed Visa, Mastercard, and JPMorgan combined, in market cap.

For now, BTC is sitting on the 7th spot in the list of Top Assets by Market Cap in the world, getting ready to overtake Amazon. BTC currently has a market cap of $1.93 trillion, while Amazon’s is $2.13 trillion.

All signs point to Bitcoin’s rally to continue and the digital asset to hit $100,000 in the next few days.

The industry is already celebrating and the best example comes from CryptoQuant’s CEO message via X.

Ki Young Ju shared a post quoting CZ, and celebrating the upcoming massive milestone for BTC and the entire crypto industry.

Polymarket data shows that there’s a chance of 71% of Bitcoin hitting $100,000 in November. We believe the odds are higher.